WAXAHACHIE, TEXAS — St. Louis-based developer Mia Rose Holdings has broken ground on The Emory at North Grove, a 98-unit multifamily project in Waxahachie, about 30 miles south of Dallas. The mid-rise building will feature one- and two-bedroom units, retail space and such amenities as a resort-style saltwater pool and a fitness center. Bradbury Construction is the general contractor for the project, completion of which is slated for late summer 2026.

Multifamily

NEW YORK CITY — JLL has brokered the $58.8 million sale of a multifamily development site in the Gowanus area of Brooklyn. The 38,500-square-foot site at 563 Sackett St. lies within a Qualified Opportunity Zone and can support approximately 258,600 buildable square feet. A 12-story, 350-unit development with other commercial uses is planned for the site. Michael Mazzara, Ethan Stanton and Brendan Maddigan of JLL represented the seller, the Mazzei Family, in the transaction and procured the buyer, Brooklyn developer Fulltime Management.

NEW YORK CITY — Locally based brokerage and advisory firm GFI Realty Services has arranged a $40 million acquisition loan for 1501 Voorhies Avenue, a multifamily building in Brooklyn’s Sheepshead Bay area. The loan is collateralized by the rental portion of the building, spanning floors two through 19, as well as a 105-space parking garage. Floors 20 through 28 house condos. Daniel Lerer of GFI Realty arranged the loan through OceanFirst Bank. The undisclosed borrower has rebranded the building as Aqualina New York.

Eagle Partners Buys 350-Unit Multifamily Property in Hacienda Heights, California for $107M

by Amy Works

HACIENDA HEIGHTS, CALIF. — Eagle Partners has acquired Hills at Hacienda Heights, an apartment property located in Hacienda Heights, for $107 million, or $305,714 per unit. Kevin Green, Joseph Grabiec and Gregory Harris of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the undisclosed seller and procured the buyer in the deal. Built in 1970 on more than 10 acres and renovated in 2015, the gated Hills at Hacienda Heights features 350 apartments, three swimming pools, a spa, fitness center, coworking lounge and covered parking. Apartments feature 8-foot ceilings, washers/dryers, stainless steel appliances, and quartz or granite countertops. Brian Eisendrath, Cameron Chalfant, Jake Vitta and Tyler Johnson of IPA Capital Markets arranged $71 million in acquisition financing for the buyer.

Northmarq Secures $66.1M Construction Loan for Palm & Hollister Apartments in San Diego

by Amy Works

SAN DIEGO — Northmarq has arranged a $66.1 million construction loan on behalf of Ambient Communities for the development of Palm & Hollister Apartments in San Diego. Located at 555 Hollister St., the proposed community will feature 198 apartments. Aaron Beck, Bryce Quezada, Conor Freeman and Wyatt Campbell of Northmarq arranged the financing through Genesis Capital. The loan includes a three-year initial term and the option to roll into a mini perm upon completion of construction.

WHITEHALL, OHIO — Merchants Capital has secured $152.3 million in total financing for The Aries Lofts, a 315-unit affordable housing community in Whitehall developed by LDG Development LLC. Merchants Capital secured a $42.7 million Freddie Mac Forward TEL permanent loan, a $60 million tax-exempt construction loan and an $8 million equity bridge loan provided by Merchants Bank. As the syndicator, Merchants Capital provided $41.6 million in 4 percent low-income housing tax credit equity. LDG Development received Brownfield Remediation Funds from the Ohio Department of Development for environmental remediation of the project site, formerly the Wirthman Brothers Junkyard. The City of Whitehall awarded a 15-year payment in lieu of taxes agreement, granting a Community Reinvestment Area tax exemption. The Franklin County Economic Development & Planning Department also awarded a grant. Additional project financing included a bridge loan from The Affordable Housing Trust for Columbus and Franklin County as well as a partnership through a capital lease with the Columbus-Franklin County Finance Authority. Upon completion, The Aries Lofts will set aside 66 units for families earning 50 percent of the area median income (AMI), 183 units at 60 percent AMI and 66 units at 70 percent AMI. The project will feature one-, …

OAK PARK, ILL. — Draper and Kramer Inc. has acquired Eleven33 in Oak Park, about 10 miles west of downtown Chicago. The luxury apartment community rises 12 stories with 263 units. Draper and Kramer will also assume management of the property, which is located at 1133 South Blvd. across from the CTA’s Harlem/Lake Green Line station as well as Metra’s Oak Park station on the Union Pacific West Line. Completed in 2019, Eleven33 is currently 95 percent leased and has averaged 94.4 percent occupancy since January 2024. Floor plans come in studio, one-, two- and three-bedroom layouts ranging from 512 to 1,500 square feet. Monthly rents start at $1,945. Amenities include a fitness center, parlor area with billiards table, two conference rooms, a clubroom, bike storage, sun deck, pet washing stations, indoor dog run and parking garage. Newmark represented the undisclosed seller. Draper and Kramer did not have broker representation.

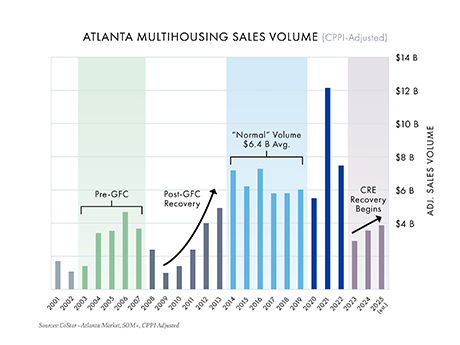

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

AUSTIN, TEXAS — Locally based multifamily and student housing developer LV Collective, formerly known as Lincoln Ventures, has completed Paseo, a 48-story apartment tower located at 80 Rainey St. in downtown Austin. Paseo offers 557 units in studio, one-, two- and three-bedroom floor plans, as well as four penthouses and a pool, deck and bar on the 12th floor with views of Lady Bird Lake. Residents also have access to a ground-level café and bar, a fitness center with a yoga studio, cold plunge and saunas and two floors of coworking space with private pods and conference rooms. Construction began in early 2023. Leasing launched in August, at which point monthly rents started in the $1,900s for a studio apartment.

LUBBOCK AND MIDLAND, TEXAS — Lone Star Funds has sold three unnamed multifamily properties totaling 606 units in West Texas. Two of the properties totaling 392 units are in Lubbock and were completed in 2004. The third property, which was built in 2013 and totals 214 units, is located in Midland. Lone Star acquired the assets in 2022 and implemented capital improvements during its ownership period. The properties sold to three separate buyers that requested anonymity.