GARLAND, TEXAS — Palladium USA is nearing completion of Embree Eastside, a 107-unit mixed-income housing community in Garland, a northeastern suburb of Dallas. About a quarter of the units will be rented at market rates, while the remainder will be reserved for renters earning between 30 and 60 percent of the area median income (AMI). Amenities will include a pool, dog park, walking trails, fitness center, conference room, computer lab and a kids’ playroom. HEDK is the project architect. General contractor Brownstone Construction is teaming up with Garland Housing Finance Corp. on construction. PNC Bank provided both equity ($13.7 million) and debt ($11.2 million) for the project. The first units are scheduled to come on line in the first quarter of next year.

Multifamily

ALEXANDRIA, VA. — Bell Partners has purchased The Thornton, a 439-unit apartment community located in historic Old Town Alexandria, a neighborhood in metropolitan Washington, D.C. Built in 2018 along the Potomac River, the property features studio, one- and two-bedroom apartments. Amenities include a dog grooming spa, 24-hour fitness center, clubroom, game room and a courtyard with a bocce ball court, fireplace and grilling area. Bell Partners purchased the community via its Value Add Fund VIII and will rebrand it as Bell Old Town. With this acquisition, the Greensboro, N.C.-based buyer now owns and/or manages 22 apartment communities containing more than 7,300 apartment homes in the Mid-Atlantic region. The seller and sales price were not disclosed, but Triad Business Journal reports that the City of Alexandria appraised the property at $161.1 million in January. The news outlet also reported that Starwood Capital Group purchased the community in 2019 for $180.2 million.

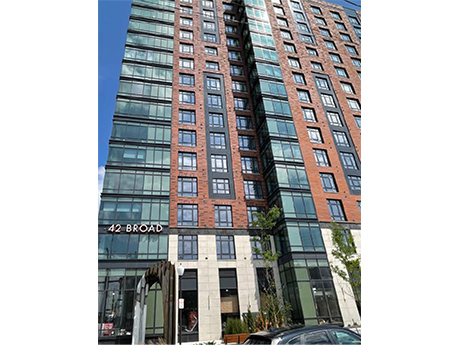

MOUNT VERNON, N.Y. — Canadian institutional investment firm Otera Capital has provided a $93 million loan for the refinancing of a 249-unit multifamily property in Mount Vernon, about 20 miles north of Manhattan. The 16-story building at 42 W. Broad St. houses studio, one-, two- and three-bedroom units. Amenities include a pool, fitness center, game room, entertainment kitchen, outdoor dining areas, coworking spaces, library and a courtyard garden. Kellogg Gaines and Geoff Goldstein of JLL arranged the financing. The borrower is a joint venture between two New York City-based firms, Alexander Development Group and The Bluestone Organization, and institutional investors advised by JP Morgan Asset Management.

ATLANTA — Cushman & Wakefield has brokered the sale of Alexan Summerhill, a new 315-unit apartment community located at 720 Hank Aaron Drive SE in Atlanta’s Summerhill submarket. Weinstein Properties purchased the property from the developers, Trammell Crow Residential and PGIM Real Estate. The sales price was not disclosed, but Atlanta Business Chronicle reported the property traded for $94 million. Robert Stickel, Alex Brown, Ashlyn Warren, Michael Kay and Sim Patrick of Cushman & Wakefield represented the sellers in the transaction. Situated near Georgia State University’s Center Parc Stadium and Convocation Center, as well as a new Publix grocery store, Alexan Summerhill features studio, one- and two-bedroom apartments. Amenities include a clubhouse, fitness center, swimming pool with a tanning ledge and poolside lounge, gaming lounge, event room, indoor/outdoor work from home spaces, podcasting studios, makers space, computer lab with wireless printing, grilling stations, bike storage and repair, EV charging stations, dog park and a pet spa.

Thrive Living to Transform Industrial Site in Los Angeles into 376-Unit Mixed-Income Apartment Community

by Jeff Shaw

LOS ANGELES — Thrive Living, with the financial support of JPMorgan Chase, has announced plans to redevelop a former industrial storage facility into an affordable and workforce housing community at 1457 N. Main St. north of downtown Los Angeles. Completion is slated for December 2024. The six-story multifamily complex will feature 376 apartments for low- and moderate-income residents earning up to 80 percent of the area median income and individuals utilizing the Housing Choice Voucher program. On-site community amenities will include a landscaped roof deck, barbecue and dining area with seating, a gym, recreation room, package delivery room and business center. The property is located near public transportation and will offer parking below the building with electric vehicle charging stations. JPMorgan Chase, through its Workforce Housing Solutions group (formerly Capital Solutions), is providing a $68.5 million construction loan to Thrive Living for the project. This is JPMorgan Chase’s first construction loan to a 100 percent rent- and income-restricted multifamily community. Thrive already secured entitlements for the site. The project aligns with Thrive’s mission to acquire and redevelop strategically located sites in urban markets that are experiencing significant housing affordability gaps. Like other Thrive communities, the project is privately financed without the …

By J. Byron Brazier Equitable development is a knotty concept. In theory, development equity sounds easy and essential. In practice, it’s not clearly defined and not easily sustainable — economically, socially or politically. Equitable development is generally seen as an approach that revitalizes and empowers disinvested communities by meeting residents’ wants and needs, diminishing disparities and spurring economic growth, ensuring residents benefit from such growth and creating conditions for people to live healthy and happy lives. That definition is accurate but incomplete. Equitable development has multiple meanings, some less intuitive than others. Chicago lawyer Danielle Meltzer Cassel says there are three ways to define development equity. The first is the one above, which is the direct model of equitable development. This model rectifies inequality through what development directly produces, such as affordable housing in areas where there’s little or no such housing, good jobs for people who are unemployed or underemployed, greater access to quality healthcare and education, and other resources that allow communities to thrive. There are two other definitions, the indirect model and what Cassel calls the procedural model of equitable development. The indirect model involves real estate developments that do not directly benefit disinvested communities, such as …

KATY, TEXAS — A partnership between two developers, Austin-based Wayfinder Real Estate and Houston-based Read King Commercial Real Estate, has broken ground on The Oak at Katy Park, a 348-unit multifamily project in the western Houston suburb of Katy. The site is located within the 54-acre Market at Katy Park master-planned development. Units will come in one-, two- and three-bedroom floor plans, and amenities will include a pool, fitness center, coworking space, pickleball court and outdoor grilling and dining stations. Meeks Architects is designing the project, and OHT Construction is serving as the general contractor. Completion is slated for early 2025.

NEW YORK CITY — Dwight Mortgage Trust, the affiliate REIT of locally based lender Dwight Capital, has provided $100 million in bridge financing for a 168-unit apartment building located at 224 W. 124th St. in West Harlem. The 19-story building was completed earlier this year and offers one-, two- and three-bedroom units, as well as townhomes and penthouse suites. Roughly 30 percent (51) of the residences are reserved as affordable housing. Amenities include a fitness center, children’s playroom, business lounge and a rooftop deck. The borrower and developer, Carthage Real Estate Advisors, will use the proceeds to refinance existing construction debt and fund lease-up of the property and other capital expenditures.

JERSEY CITY, N.J. — JLL has arranged an $18.6 million loan for the refinancing of an 83-unit apartment complex in the Journal Square area of Jersey City. The six-story building at 39 High St. was delivered earlier this year and houses a mix of studio, one-, two- and three-bedroom units. Amenities include a fitness center, tenant lounge, children’s playroom and a rooftop terrace. Matthew Pizzolato, Max Custer and John Cumming of JLL arranged the fixed-rate loan through an undisclosed life insurance company. The borrower was a partnership between Spitzer Enterprises and Titanium Realty Group.

BRADENTON, FLA. — Ryan Cos. has begun leasing Renata at Lakewood Ranch, a 502-unit apartment development located in Bradenton, a suburb of Tampa. The property is part of the 33,000-acre Lakewood Ranch development. Renata’s first buildings and clubhouse are set to open this month. Ryan Cos., along with development partners PGIM Real Estate and ParkSprings Development, expect to fully open the property by July 2024. Renata will include one-, two- and three-bedroom apartments ranging in size from 740 to 1,285 square feet, as well as a resort-style pool, fitness facilities and a private lakeside beach. Monthly rental rates will range from $2,145 to $2,790, according to Apartments.com.