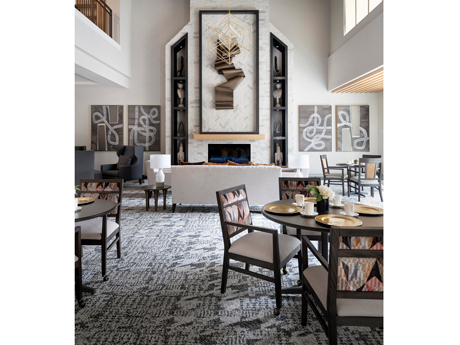

SCOTTSDALE, ARIZ. — Cogir Senior Living and Ryan Cos. US Inc. have opened ACOYA Shea, an independent living, assisted living and memory care community in the Phoenix suburb of Scottsdale. The community features 147 units in a four-story building. “ACOYA Shea is located right in the heart of Scottsdale, and residents will be able to enjoy the walkability of the community and the proximity to all that the area has to offer,” says Dave Eskenazy, chief executive officer of Cogir Management USA. Cogir Senior Living develops, owns and/or operates 60 communities throughout the United States.

Multifamily

DES MOINES, WASH. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of two apartment communities in Des Moines. Spinnaker Landing and Regatta sold for a combined $34.3 million, or $225,987 per unit. Philip Assouad, Giovanni Napoli, Nicholas Ruggiergo, Ryan Harmon and Anthony Palladino of IPA represented the sellers, Spinnaker Landing Apartments LLC and Regatta Apartments LLC, and procured the buyer, a private Los Angeles-based owner, in the transaction. Centrally located between Seattle and Tacoma, Wash., the two garden-style properties are surrounded by office and flex industrial space, including the headquarters of the Federal Aviation Administration and Alaska Airlines. Built in 1987, Spinnaker Landing features 66 units, and Regatta, which was built in 1983, features 86 units.

TIGARD, ORE. — Trion Properties has completed the disposition of York Apartments, a multifamily building in Tigard. An undisclosed buyer acquired the asset for $10.8 million, or $209,000 per unit. Located at 7582 SW Hunziker St., York Apartments features 52 units in a mix of three studio units, 48 two-bedroom/one-bath units and one four-bedroom/two-bathroom unit. Rob Marton of HFO Investment Real Estate represented the seller, while Greg Frick of HFO represented the buyer in the deal.

BRIDGEPORT, CONN. — Eastern Union has arranged a $19.6 million construction loan for the conversion of a former healthcare facility in Bridgeport, located in southern coastal Connecticut, into a 150-unit multifamily complex. The healthcare complex was originally built in 1971 on a 15-acre site at 600 Bond St. in the North Bridgeport section of the city. The facility will undergo a gut renovation into a two-story apartment building that will include a 7,069-square-foot fitness center. Motti Blau, Mendy Pfeifer and Hershy Fried of Eastern Union arranged the debt. The borrower and direct lender were not disclosed.

UNION CITY, WEST NEW YORK AND JERSEY CITY, N.J. — Locally based brokerage firm The Kislak Co. Inc. has negotiated the $11.1 million sale of a portfolio of three multifamily buildings totaling 66 units in Northern New Jersey. The portfolio consists of a 44-unit complex in Union City that sold for $6.2 million; a 16-unit property in West New York that traded for $3.8 million; and a six-unit building in Jersey City that fetched a price of $1.1 million. Don Baxter of Kislak brokered the deal. All parties requested anonymity.

HOUSTON — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of Icon at Yorktown, a 115-unit apartment complex in northwest Houston. Built on three acres in 2021, Icon at Yorktown offers one-, two- and three-bedroom units and amenities such as a pool, fitness center, outdoor grilling stations, package lockers, resident lounge and a coffee bar. Travis Austin, Greg Austin, Jackson Hart, Drew Kile and Will Balthrope of IPA represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $5 million sale of a multifamily development site in the Cobble Hill area of Brooklyn. The site at 232 Smith St. allows for 10,000 square feet of buildable space that will include retail usage. Sean Kelly, Nicole Daniggelis, Stephen Vorvolakos, Shimon Shkury and Victor Sozio of Ariel Property Advisors represented the undisclosed seller in the transaction. The buyer was also not disclosed.

Standard Communities Buys Six Affordable Housing Communities in Metro Los Angeles for $122M

by Amy Works

LOS ANGELES — Standard Communities has led a public-private partnership that acquired six Section 8 communities in Los Angeles County with a total of 407 units. Five of the communities are affordable seniors housing. Standard will extend the communities’ affordability by 20 years under new HUD Housing Assistance Payments contracts. The transaction has a total capitalization of approximately $122 million, including planned renovation costs of over $8 million. The six communities were built between 1969 and 1980. “Extending the affordability of all 407 apartment units isn’t just a matter of housing; it’s a commitment to sustaining the heart of our community. We are not only ensuring that seniors and families have an affordable place to call home, we’re also nurturing the vibrant social and economic fabric of Los Angeles County,” says Jeffrey Jaeger, co-founder and principal of Standard Communities. “This investment brings our portfolio in Los Angeles County to over 1,700 units.” The assets include: • Oxford Park, a 109-unit senior community • Rayen Park, an 84-unit senior community • Sherman Arms, a 74-unit senior community • Villa Marisol, a 48-unit senior community • Columbus Terrace, a 42-unit senior community • Villa San Dimas, a 50-unit family community Standard Communities partnered in this transaction with the …

PHOENIX — Brinkmann Constructors, as general contractor, and Denver-based The X Co., as developer, have broken ground on X Roosevelt, a 19-story multifamily building in downtown Phoenix. Located in the Roosevelt Row Arts District, the 350,000-square-foot X Roosevelt will feature 370 apartments in a live, work and play environment. The community will also feature coworking space; a gym and fitness studio designed around classes; and 3,500 square feet of first-floor retail space. Chicago-based Lamar Johnson Collaborative is serving as architect for the project, which is slated for completion in fall 2025.

PLAINFIELD, N.J. — Paramount Assets, a Newark-based development and management firm that specializes in restoring historic buildings and urban redevelopment projects, has completed Frontier Flats in downtown Plainfield. The building is an adaptive reuse of the former Rosenbaum’s Department Store, which opened in 1927 and closed in the mid-1980s. Frontier Flats now offers 35 market-rate units, an interior courtyard and retail space. The community is currently more than 60 percent leased.