PASADENA, CALIF. — A partnership between Community Builders Group and Bridge Financial Advisors is opening Pasadena Studios, a $45 million affordable housing property in Pasadena. The six-story community will offer 180 micro-units, ranging from 245 square feet to 270 square feet. Each apartment will feature a private balcony, offering an indoor-outdoor living experience and additional square footage. The 56,000-square-foot asset features free internet service, a fitness center, laundry room, landscaped rooftop deck with seating, two grilling stations, fire features, landscaped courtyard, outdoor seating areas, lobby area seating with a kitchenette and community space, two elevators, secure entrances, security surveillance and bike storage. The project team includes Westport Construction, Natoma Architects and LCRA. WinnResidential, the property management arm of WinnCompanies, will manage the community.

Multifamily

FONTANA, CALIF. — CBRE has brokered the sale of an apartment property located at 8919 Mango Ave. in Fontana. A local private investor acquired the asset from an undisclosed private seller for $6.3 million. Built in 1973, the community features 25 apartments in a mix of one-, two- and three-bedroom floor plans, with an average unit size of 787 square feet. Units offer high-speed internet access, air conditioning, heating and kitchen appliances. Onsite amenities include laundry, carport and surface parking, a secure entry gate and landscaping. Eric Chen, Blake Torgerson and Hunter Wetton of CBRE represented the buyer and seller in the deal.

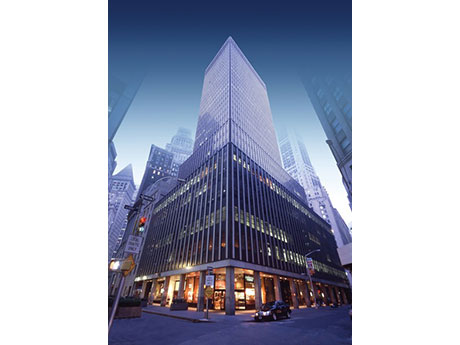

NEW YORK CITY — JLL Capital Markets has arranged $220 million in financing for the conversion of 55 Broad Street in New York City’s Financial District into 571 luxury apartment units. Conversion of the 30-story office tower will occur in phases. JLL arranged the four-year, floating-rate loan through Mexico City-based Banco Inbursa on behalf of the borrower, a partnership between Metro Loft Developers LLC and Silverstein Properties. JLL also advised on the procurement and structuring of equity for the deal. The Rudin Family sold the building to the developers for about $173 million, according to Crain’s New York Business. Upon completion, 55 Broad Street will feature studios, one-, two- and three-bedroom units along with roughly 17,000 square feet of amenity space. Amenities will include a rooftop pool, fitness center, coworking facilities and sports simulators. The project will be one of the first fully electric residential buildings in Manhattan, leveraging self-contained heating and cooling systems. Mechanical renovations will bring the building to 100 percent carbon neutral and will enable the creation of additional amenities and rentable floor area. Located less than two blocks from the Bowling Green subway station, 55 Broad Street offers connectivity to destinations across the city and the …

HOUSTON — NewPoint Real Estate Capital has provided a Freddie Mac loan of an undisclosed amount for the refinancing of Stadia Med Main, a 338-unit apartment community in Houston’s Medical Center/West University submarket. Built in 2020, Stadia Med Main offers one- and two-bedroom units and amenities such as a clubhouse, game room, fitness center, business center, pool, outdoor lounge areas and a dog park. Barry Lefkowitz of Meridian Capital Group arranged the seven-year, fixed-rate loan, which retires the loan that the borrower, Aspen Oak Capital Partners, used to acquire the asset in 2022. Stadia Med Main was 95 percent occupied at the time of the loan closing.

JERSEY CITY, N.J. — Slate Property Group and McCourt Partners have provided a $59 million bridge loan for a 285-unit multifamily project in the McGinley Square area of Jersey City. The borrower, a partnership between Sequoia Development Group and Bushburg Properties, will use the proceeds to complete construction, lease-up and stabilization of the 16-story building. Units will come in studio, one-, two- and three-bedroom floor plans. Amenities will include a dog run, fitness center, coworking lounge, conference room and an indoor/outdoor rooftop deck, as well as 5,109 square feet of commercial space. Sam Rottenberg of SPR Group arranged the two-year, floating-rate loan on behalf of the developers. Full completion is slated for the first quarter of 2024.

HILLSBOROUGH, N.J. — New Jersey-based developer Adoni Property Group has completed The Franklin at Hillsborough, a 44-unit multifamily project in Northern New Jersey. The property, which is now 90 percent occupied, offers one- and two-bedroom units ranging in size from 1,000 to 1,300 square feet that are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Rents at the remaining two-bedroom units start at $2,900 per month.

NEWTON, MASS. AND ATLANTA — The RMR Group, an alternative asset management company based in Newton, has purchased the multifamily platform of Carroll, a multifamily investment firm based in Atlanta. RMR has acquired 100 percent of the equity interests of MPC Holdings (Carroll) in an $80 million, all-cash transaction. Founded in 2004, Carroll provides asset and property management services to 81 multifamily properties comprising more than 28,000 units that are primarily located across the Sun Belt. Carroll had approximately 700 employees as of first-quarter 2023. The acquisition will add $7 billion in assets under management (AUM) to RMR, which had $37.3 billion in AUM as of first-quarter 2023. Carroll will retain existing general partner co-investments and promote fees derived from those investments. The Carroll acquisition will give RMR a foothold in the multifamily sector for the first time and will include the company’s property management division, Arium Living. RMR acquires properties for four publicly traded REITs: Service Properties Trust, Diversified Healthcare Trust, Office Properties Income Trust and Industrial Logistics Properties Trust.

Excelsa Properties Purchases Concord Park at Russett Apartments in Metro Baltimore for $105.5M

by John Nelson

LAUREL, MD. — Excelsa Properties has acquired Concord Park at Russett, a 335-unit multifamily property located at 7903 Orion Circle in Laurel, a suburb of Baltimore. The undisclosed seller sold the value-add property to Excelsa US Real Estate II LP and an Excelsa co-investment vehicle for $105.5 million. The buyer assumed an in-place, interest-only loan on the property that was underwritten with a fixed 3.4 percent interest rate and has six years of term left. Excelsa supplemented the loan with a fixed-rate, interest-only loan with a similar maturity date that has a weighted average interest rate of 3.7 percent. The company also plans to make $4.4 million in capital improvements to Concord Park at Russett, including a new roof, HVAC systems, new signage, parking garage repairs, new kitchen appliances and hardwood flooring, among other improvements. Existing community amenities include a resort-style swimming pool, clubhouse with a fireplace, business center, theater room, fitness center, yoga and HIIT training studio, library and a business lounge.

MERRILLVILLE, IND. — KeyBank Real Estate Capital (KBREC) has arranged a $74.6 million Freddie Mac loan for the acquisition of Lakes at 8201 in Merrillville, a city in Northwest Indiana. Built between 1992 and 1993, the 628-unit garden-style multifamily property consists of 20 buildings as well as an office and clubhouse. John Ward and Joseph Tinti of KBREC arranged the nonrecourse loan on behalf of the borrower, The Beitel Group. Loan terms were not provided.

KENOSHA, WIS. — MLG Capital has purchased Market Square, a 330-unit apartment community in Kenosha. The purchase price and seller were undisclosed. Located at 3100 Market Lane, the property was built in 2017 and 2019. The acquisition marks MLG’s first in Kenosha and brings the firm’s total number of units owned in Wisconsin to more than 3,300. This is the 64th property acquired as part of MLG’s Legacy Fund, which offers a tax-deferred exit strategy for private real estate owners.