FRANKLIN AND HENDERSONVILLE, TENN. — CBRE has arranged $32.2 million in financing for the acquisition of Vitality Living Franklin and Vitality Living Hendersonville, both located in high-growth suburbs of Nashville. The borrowers were Winterpast Capital Partners (WCP), Scribner Capital and its institutional partner, and Broadview Real Estate Partners. Vitality Living, WCP’s wholly owned operating platform, will manage the communities under a traditional third-party agreement. The portfolio consists of 256 assisted living and memory care units. Aron Will, Tim Root and Michael Cregan of CBRE National Senior Housing arranged the financing, which features a three-year term and two years of interest-only payments. A regional bank provided the funds.

Multifamily

HOUSTON — Locally based developer McNair Interests has broken ground on Phase II of Remy on the Trails, a 221-unit multifamily project in Houston’s Westchase neighborhood. The site at 10505 Deerwood Road spans 6.8 acres. The complex will house one-, two- and three-bedroom units that will range in size from 900 to 1,500 square feet. Amenities will include a pool, fitness center, clubroom, dog park and outdoor grilling and dining stations. Project partners include Cadence Bank (construction lender), Arch-Con Corp. (general contractor), The Preston Partnership (lead architect), MaRS (interior design) and Kimley-Horn (landscape design). The first move-ins are expected to begin in summer 2024.

WHIPPANY, N.J. — Coldwell Banker Realty New Homes has begun leasing 34 Eden, an 81-unit apartment complex located in the Northern New Jersey community of Whippany. Units come in one-, two- and three-bedroom formats and range in size from 690 to 1,500 square feet. Amenities include a pool, fitness center, resident lounge, business center and a pet wash station. The first move-ins will begin in August. Rents start at roughly $3,000 per month for a one-bedroom apartment. The owner/developer was not disclosed.

PROVIDENCE, R.I. — New York City-based Dwight Capital has provided a $19.5 million HUD-insured loan for the refinancing of 580 South Water, a 69-unit apartment complex in Providence. The riverfront property offers one- and two-bedroom units and amenities such as a fitness center, lounge area/workspace and a rooftop lounge. Josh Hoffman and Jonathan Pomper of Dwight Capital originated the financing through HUD’s 223(f) program. The borrower was not disclosed.

SARASOTA, FLA. — Thompson Thrift has announced plans for the development of The Concord, a 257-unit apartment community to be constructed on 8.5 acres in Sarasota. Upon completion, the property will feature units in one-, two- and three-bedroom layouts. Amenities at the community will include a fitness center, heated swimming pool, outdoor entertainment and grilling areas, a dog run and pet spa, social hub and work-from-home suites. Completion of the development is scheduled for fall 2024.

RIVERSIDE, ALA. — Berkadia has arranged a $13 million loan for the refinancing of RiverHouse Apartments, a multifamily community located in Riverside. Located at 300 Riverhouse Loop, the property comprises 144 units and was recently renovated. Tom Genetti of Berkadia secured the financing through Fannie Mae on behalf of the borrower, Birmingham-based The Oakley Group.

NEW YORK CITY — BHI, a full-service commercial bank that is the U.S. division of Israel’s Bank Hapoalim, has provided a $65.3 million construction loan for a 121-unit multifamily project that will be located in the Astoria neighborhood of Queens. The nine-story, waterfront building will include two retail spaces, a community center and onsite parking. The borrower and developer is NuVerse Advisors LLC. Units will come in studio, one-, two- and three-bedroom floor plans. Construction is expected to last about 30 months, putting the project on track for a late 2025 or early 2026 delivery.

NEW YORK CITY — Locally based investment firm Slate Property Group has acquired Queenswood Apartments, a 296-unit affordable housing complex in the borough’s Corona neighborhood. The two-building complex, which was constructed in 1990, was facing imminent expiration of its affordability mandate. Slate has secured a 40-year extension of that mandate with the NYC Housing Development Corp. and the NYC Department of Housing Preservation & Development. Under the new agreement, 35 units will be reserved for renters earning 30 percent or less of the area median income (AMI); eight residences will be earmarked for households earning 50 percent or less of AMI; 230 units will be restricted for tenants making 80 percent or less of AMI; and 22 apartments will be set aside for those making 100 percent or less of AMI.

NORTH ARLINGTON, N.J. — Northmarq has arranged a $13 million loan for the refinancing of The Opus, a 49-unit apartment complex located in North Arlington, located north of Newark in Bergen County. Built in 2021, the property features one-bedroom units and penthouse suites and amenities such as a rooftop terrace, fitness center and a resident lounge. Robert Ranieri of Northmarq originated the debt, which was structured with a fixed interest rate, five-year term and one year of interest-only payments, through an undisclosed local bank. The borrower was also not disclosed.

Empire Group Obtains $88.5M Construction Financing for Build-to-Rent Residential Community in Phoenix

by John Nelson

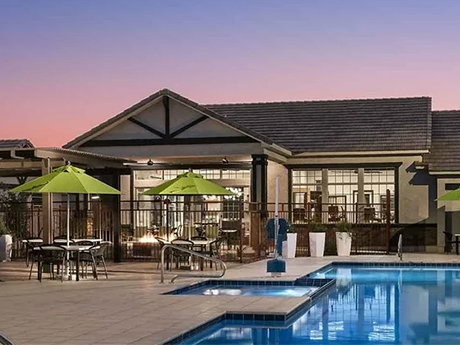

PHOENIX — Empire Group, a multifamily and commercial real estate development firm based in Scottsdale, Ariz., has obtained an $88.5 million construction loan for the development of Village at Bronco Trail. The 354-unit build-to-rent (BTR) community will be situated on a 30-acre site at 29th Avenue and Sonoran Desert Drive on the city’s north side. Empire Group expects to deliver the first swath of single-family homes at Village at Bronco Trail in 2024. Homes will average 920 square feet and amenities will include detached garages, a dog park, grilling area, resort-style pool, clubhouse and common area open spaces. Each home will have a private yard; kitchen with quartz countertops, stainless steel appliances and backsplashes; full-size washers and dryers; and upgraded smart-home features and technology. The property will be situated within two miles of the chip manufacturing plant for Taiwan Semiconductor Manufacturing Co., which is a $40 billion facility and a major economic demand driver for the North Phoenix residential market. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on behalf of Empire Group. The direct lender was not disclosed, but the mortgage brokerage firm was able to secure multiple term sheets from lenders during due diligence. “The BTR …