FRANKFORT AND ROSSVILLE, IND. — Maverick Commercial Mortgage Inc. has arranged a $4 million loan for the refinancing of an 81-unit multifamily portfolio in Frankfort and Rossville. A regional lending institution provided the 10-year, fixed-rate loan, which features one year of interest-only payments. The portfolio is 97 percent occupied. The borrower is based in Lafayette, Ind.

Multifamily

ATLANTA — Novare Group, in collaboration with BCDC and ELV Associates, has opened Populus Westside, a multifamily community located in the Upper Westside neighborhood of Atlanta. Situated at 1315 Northwest Drive, the property features 286 units and amenities including outdoor grills, a pet park, clubhouse, fitness center and a swimming pool. An initiative by Invest Atlanta, the City of Atlanta’s economic development arm, as part of a property tax incentive program will make 15 percent of the residences available at reduced rents to individuals and families earning between 60 and 80 percent of the area median income (AMI). The community is located along the proposed extension of the Proctor Creek Greenway, which will offer access to Westside Park and the Atlanta BeltLine. RAM Partners will manage the property, which was designed by Dynamik Design.

NARANJA, FLA. — JQ Group has completed the development of Madison Point Apartments, a mixed-use multifamily community located at 26021 S. Dixie Highway in Naranja, roughly 30 miles outside Miami. ANF Group Inc. served as the general contractor on the project, which features 263 apartments and 14,355 square feet of commercial space across four buildings. Apartments span 637 to 1,175 square feet in one-, two- and three-bedroom layouts. Amenities at the community include a swimming pool, community center, playground, fitness center, library, media center and approximately 200 parking spaces.

TAMPA, FLA. — Orlando-based ZOM Living has completed the construction of Azola South Tampa, a 214-unit multifamily community located at 7701 Interbay Blvd. in Tampa. Units range in size from 747 to 2,115 square feet and include apartments in one- and two-bedroom layouts, as well as six townhomes with three bedrooms and two-and-a-half bathrooms. Amenities at the property include a 6,000-square-foot clubhouse, swimming pool, fire pit and a pool courtyard featuring an outdoor billiards table, TVs, seating, a summer kitchen and two grilling areas. Architectural firm LRK designed the community, which is currently 70 percent occupied. Monthly rental rates at the community begin at $1,987.

DALLAS — Brazos Residential has acquired The Thread Apartments, a 606-unit garden-style community in Dallas. The Thread was built in three phases between 1969 and 1978 and offers studio, one- and two-bedroom floor plans. Northmarq’s Taylor Snoddy brokered the deal, and Kevin Leamy of Northmarq arranged the acquisition financing. The deal marks Brazos Residential’s 16th acquisition since the firm’s inception in 2022. The seller and sales price were not disclosed.

SEGUIN, TEXAS — A joint venture between Periscope Capital Investment and Verdot Capital has received a $32.1 million construction loan for The Virginia, a 198-unit development in the western San Antonio suburb of Seguin. The Virginia will rise three stories and offer one-, two- and three-bedroom units. Alanna Ellis, Jeff Lepley and Alex Sheaffer of JLL arranged the 15-year, floating-rate loan through an undisclosed regional bank on behalf of the development team. The first phase of the project is slated for a 2024 completion. A second phase is set to deliver in 2025, bringing the total units at the community to 424.

CYPRESS, TEXAS — Locally based investment advisory firm Granite Harbor Advisors has arranged an undisclosed amount of equity funding to finance the expansion of Spring Cypress Senior Living, a facility located in the northwestern Houston suburb of Cypress. The property offers independent living, assisted living and memory care living services. The expansion project will add 43 new independent living units split between townhomes and cottages, 95 new assisted living apartments and 14 new memory care units. The project’s first phase is complete and is roughly 95 percent occupied.

PATERSON, N.J. — Locally based brokerage firm Gebroe-Hammer Associates has negotiated the $3.7 million sale of two apartment buildings totaling 18 units in the Northern New Jersey community of Paterson. The buildings are located in the Wrigley Park area and include commercial uses. Debbie Pomerantz of Gebroe-Hammer represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

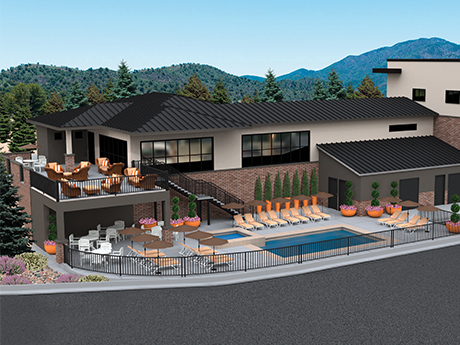

PRESCOTT, ARIZ. — Montezuma Heights Investors has unveiled plans for Montezuma Heights, a $41 million luxury multifamily development in Prescott. The groundbreaking ceremony will be held July 13. The development, located at 609 Bagby Drive, will feature 144 apartment units with one- to three-bedroom floor plans. Amenities will include a state-of-the-art gym, lounge, outdoor grotto with grilling area, dog parks, multiple fire pits and electric car charging stations. The community will also have a trail connection to Granite Creek Park and the Depot shopping center. The developer expects the construction process to take 20 months. MEB Management will serve as the community’s manager and leasing agent.

ST. PAUL, MINN. — Kraus-Anderson has completed Phase II construction of Lexington Landing, a $24 million seniors housing development in St. Paul’s Highland Park neighborhood. Designed by Pope Design Group, the four-story building features 92 independent living units. Amenities include a pickleball court, golf simulator, club lounge, community room, library, community garden, dog park, rooftop patio, fitness room and guest suite. Lexington Landing also offers event and activity programming, spiritual care and scheduled transportation. J.A. Wedum Foundation is the owner and PHS Management LLC is the property manager.