FAYETTEVILLE, N.C. — Olympus Property has purchased King’s Quarter at Jack Britt, a 252-unit, garden-style apartment community located in Fayetteville. Built in 2014, the property features two- and three-bedroom units with upgraded interiors ranging from 1,150 square feet to 1,398 square feet. Units feature granite countertops, stainless steel appliances, walk-in closets and private balcony/patio areas with additional storage. Community amenities include a playground, pool area with cabanas, grilling stations, pet park, fitness center and garages. The seller and sales price were not disclosed.

Multifamily

ROSWELL, N.M. — Blueprint Healthcare Real Estate Advisors has arranged the sale of Sunset Villa Care Center, a 52-bed skilled nursing facility in Roswell. The facility is located within three miles of two regional acute care hospitals. It was built in 1965, but “is very well maintained, and had strong recent and historical financial trends,” according to Blueprint. Blueprint’s marketing efforts focused on highlighting the facility’s high cash flows, operating margins, and the local submarket’s strength. At the time of marketing, the facility was running revenues of about $6 million. The buyer was a private owner-operator based in Los Angeles. The seller and price were not disclosed.

ALBANY, ORE. — Marcus & Millichap has arranged the sale of the 33-unit Sheridan Plaza apartments in Albany. A Portland-based private client group acquired the asset for $4.2 million. The community is located at 208 SE 5th Ave. and 205 SE 6th Ave. Albany is approximately halfway between Eugene and Salem. The undisclosed seller purchased the asset in 2021, at which time it made capital improvements to the property. This included new roofs and gutters, adding a garbage enclosure, resurfacing the parking lot, and new windows and sliders. The sellers were able to increase the cashflow by renovating several units and partnering with professional third-party management. The buyer plans to continue the renovation process and increase rents, according to Marcus & Millichap. The firm’s Georgie Christensen-Riley and Joshua C. Reynolds, along with the Christensen Group, represented the seller in the transaction.

CHICAGO — Matthews Real Estate Investment Services has brokered the sale of a 65-unit multifamily property in Chicago for $6.3 million. The building is located at 7733 S. Shore Drive. Finley Askin of Matthews represented both the buyer and seller. The buyer was an out-of-state investor looking to plant capital in metro Chicago. The seller, which acquired the property in 2021, completed renovations such as a new rubber seal coating on the roof and new windows.

Oxford Properties, RAM Partners Open 352-Unit Celadon on Club Apartments in Metro Atlanta

by John Nelson

LAWRENCEVILLE, GA. — Atlanta-based Oxford Properties and RAM Partners have begun preleasing Celadon on Club, a 352-unit luxury apartment community in Lawrenceville, roughly 40 miles northeast of Atlanta. Located at 3355 Club Drive, the development is situated on 33 acres that formerly housed Gwinnett County’s oldest country club. Amenities at the property, which comprises units in one-, two- and three-bedroom layouts, include a pool, clubhouse, TrackMan golf simulator, workout facilities and private office space available for lease. A trail also connects the property to Club Drive Park, which features outdoor basketball courts, a fishing lake, playground, paved path and grilling pavilion. RAM will manage the community on behalf of Oxford, which developed the project.

GAITHERSBURG, MD. — KLNB’s new multifamily team has arranged the sale of Governor Square Apartments, a 238-unit community located in Gaithersburg, approximately 26 miles northwest of Washington, D.C. The property features units in one-, two- and three-bedroom layouts, ranging in size from 720 to 1,290 square feet. Rawles Wilcox, Jared Emery and Dutch Seitz, part of a group of 18 brokers who joined KLNB through the firm’s acquisition of Edge Commercial Real Estate, represented the buyer, Acento Real Estate Partners, in the transaction. The seller and sales price were not disclosed.

KANSAS CITY, MO. — The Cordish Cos. has topped out Three Light Luxury Apartments in Kansas City’s Power & Light District. JE Dunn Construction Co. is the general contractor. Located at the corner of Truman Road and Main Street, Three Light rises 25 stories and sits directly on the KC Streetcar Line. The $140 million project will include a seven-story parking garage with 472 spaces as well as 7,600 square feet of ground-floor retail space. Three Light will feature more than 30,000 square feet of amenity space, including an eighth-floor outdoor terrace with an infinity-edge pool, clubroom, party room, entertainment kitchen, theater room, game room, business center, fitness center, coworking spaces, dog washing station, concierge services and laundry services. Three Light is slated for completion this fall. Nearly 20 percent of the units have been leased so far. Three Light follows previous multifamily projects, One Light and Two Light.

INDIANAPOLIS — Local healthcare provider Adult & Child Health, Colliers, healthcare real estate company Innovcare and national development firm TWG have unveiled a master plan for the redevelopment of Meridian Street in Indianapolis. Project costs are estimated at $65 million. Plans call for the redevelopment of six buildings along the North Meridian Corridor. The development team plans to convert the properties into new uses such as primary care services, mental health services and affordable housing. All of the buildings are located within a federal Opportunity Zone and near the IndyGo Red Line. The project is made possible through support from the City of Indianapolis. Innovcare will pay real estate property taxes to further the redevelopment and investment of the Meridian corridor. Adult & Child Health signed a long-term lease to relocate to 1840 N. Meridian St. upon completion of the redevelopment project. The 40,000-square-foot building and parking area, previously owned by Indianapolis Public Schools, has sat vacant for seven years. Colliers assisted Adult & Child Health in its new lease as well as the sale of two existing assets at 603 E. Washington St. and 222 E. Ohio St. Indianapolis-based TWG has acquired four vacant buildings and plans to redevelop …

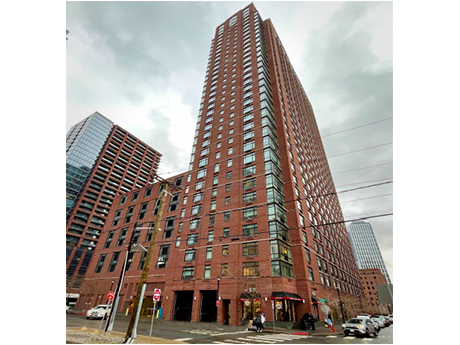

JERSEY CITY, N.J. — NewPoint Real Estate Capital has provided a $153.6 million Freddie Mac loan for the refinancing of The One, a 35-story apartment tower located in Jersey City’s waterfront district. Built in 2015, The One features 451 units in studio, one-, two- and three-bedroom formats, with 10 percent of the units reserved as affordable housing. Residences are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a pool, fitness center, children’s playroom, theater room, golf simulator, game room and a dog park. Carol Shelby and Eric Schleif of Meridian Capital Group placed the loan, which carried a seven-year term and a 35-year amortization schedule, with NewPoint on behalf of the borrower and developer, BLDG Management. The One was 98 percent occupied at the time of the loan closing.

HACKENSACK, N.J. — Locally based developer Hornrock Properties has begun leasing Ivy & Green, a 221-unit apartment complex in the Northern New Jersey community of Hackensack. Designed by Minno & Wasko Architects, the six-story building houses studio, one- and two-bedroom units. Amenities include coworking spaces, private conference rooms, a gaming lounge, speakeasy bar, demonstration kitchen, theater and music studio, a children’s playroom, fitness center, pet spa and package lockers. Monthly rents start in the $2300s. A second phase of Ivy & Green totaling 168 units is also in the development pipeline.