HOMESTEAD, FLA. — Mast Capital, in partnership with Angelo Gordon, has sold Seascape Pointe, a townhome community located in Homestead, roughly 40 miles southwest of Miami. IMC Equity Group purchased the property for an undisclosed price. Located on 31.7 acres at 1140 S.E. 24th Road, the Seascape Pointe features 54 buildings comprising 306 two-story, direct-access townhomes. Residences range in size from 1,387 square feet to 1,501 square feet in three- and four-bedroom layouts. Amenities include a clubhouse, swimming pool, outdoor fitness area, playground, dog park and 24-hour gated entrance. Mast Capital and Angelo Gordon originally acquired the community as a joint venture in 2020 and instituted capital improvements, as well as the addition of 14 new townhomes.

Multifamily

BLOOMINGTON, IND. — Gray Capital has acquired Echo Park Apartments in Bloomington for an undisclosed price. The company says its business plan includes improving onsite management and reducing expenses. Amenities at the property include a bark park, resort-style pool, trash pickup and in-unit washers and dryers. Gray Capital’s property management company, Gray Residential, is now managing Echo Park as well as nearby apartment property Forest Ridge. Echo Park is the fourth property within Gray Capital’s $100 million multifamily investment fund, The Gray Fund. Previous acquisitions include Sycamore Terrace in Terre Haute, Ind.; Club Meridian in Lansing, Mich.; and Stonybrook Commons in Indianapolis. Gray Capital maintains roughly $775 million in assets under management.

NILES, MICH. — Marcus & Millichap has brokered the $4.2 million sale of Village West in Niles, a city in Southwest Michigan. The 54-unit apartment building is located at 746 Colony Court. Renovations made to the property in 2020 and 2021 included a new roof, windows and gutters, as well as upgraded electrical and HVAC systems. Aaron Kuroiwa, Jack Friskney and Austin Meeker of Marcus & Millichap represented the seller, a limited liability company that plans on using proceeds from the sale and a 1031 exchange to buy another multifamily asset in Indiana or Florida. The Marcus & Millichap trio also represented the buyer, a limited liability company that secured agency financing with five years of interest-only payments.

Morgan Stonehill Breaks Ground on 360-Unit Seasons at Meridian Apartments in Metro Boise

by Amy Works

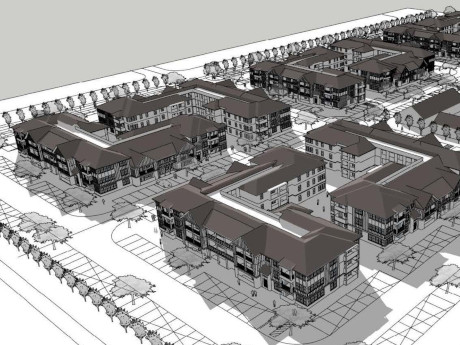

MERIDIAN, IDAHO — Developer Morgan Stonehill, with Los Angeles-based Newman Garrison + Partners as architect, has released plans for Seasons at Meridian, a 360-unit apartment community located at 2700 E. Overland Road in Meridian, a western suburb of Boise. The team broke ground on the development in January. Seasons at Meridian will feature 10 residential buildings arranged around an open-air courtyard space. Each building will offer a mix of studio, one-, two- and three-bedroom units ranging from 488 square feet to 1,328 square feet. The community will offer more than 30,000 square feet of amenity space, including a 10,000-square-foot clubhouse, a pool, park, community garden, fitness facility, bike maintenance room and barbecue areas. Additionally, the project is designed to provide direct pedestrian linkages to the adjacent commercial and retail developments with access to nearby recreational trails, landscaped areas and pocket parks. Completion is slated for second-quarter 2025.

SCOTTSDALE, ARIZ. — Arizona-based Mark-Taylor Residential has opened San Bellara, a multifamily property located at 17800 N. 78th St. in Scottsdale. Mark-Taylor will manage the 180-unit community in-house. San Bellara features a mix of one-, two- and three-bedroom layouts with granite countertops, stainless steel appliances, walk-in closets, in-unit washers/dryers, air conditioning, private patios or balconies and direct-access garages. The pet-friendly property also offers a swimming pool, hot tub, fitness center, business center, outdoor cabanas with a poolside kitchen, an electric car station and a resident clubhouse with flat-screen TV.

Cushman & Wakefield | PICOR Arranges $6.7M Sale of Beverly On Fifth Apartment Building in Tucson, Arizona

by Amy Works

TUCSON, ARIZ. — Cushman & Wakefield | PICOR has brokered the sale of The Beverly On Fifth, a residential property in Tucson. Beverly On Fifth Owner LLC acquired the acquired the asset from Dry Desert LLC for $6.7 million. Located at 5601 E. 5th St., The Beverly On Fifth features 35 apartments. Allan Mendelsberg and Joey Martinez of Cushman & Wakefield | PICOR represented both parties in the transaction.

VIRGINIA BEACH, VA. — Blackfin Real Estate Investors has purchased Waterford Apartments on Lake Smith in Virginia Beach for $55.4 million. Built in 1980, the community comprises 376 units and was previously renovated to feature walk-in closets, custom maple cabinets, granite countertops, updated lighting and fixtures and dishwashers. The property was fully occupied at the time of sale. Hank Hankins, Victoria Pickett, Charles Wentworth and Garrison Gore of Colliers represented the undisclosed seller in the transaction.

JACKSONVILLE, FLA. — RangeWater Real Estate has purchased a 28.6-acre site in the San Jose neighborhood of Jacksonville for the development of a 280-unit multifamily community. Located at 3730 Dupont Ave., the property, dubbed The Maggie, will feature residences in one- and two-bedroom layouts, as well as a clubhouse with meeting space, resident’s lounge, fitness center, deck and grilling area, dog park and fountains. Delivery of the first units and clubhouse is scheduled for late spring 2024. ParkProperty Capital is partnering with RangeWater on the project, which will mark RangeWater’s sixth development in the Jacksonville area.

MYRTLE BEACH, S.C. — ACRE and partner ARK Residential have announced plans for The Springs at Arcadia, a 150-unit single-family-rental (SFR) community in Myrtle Beach. Located within the master-planned Arcadia community, the development will offer three- and four-bedroom detached homes ranging in size from 1,500 to 2,300 square feet. Residents will have access to Arcadia’s amenities, which include a clubhouse, pickleball courts and a pool. Construction, which is currently underway, is scheduled for completion in the first quarter of 2024. Preleasing began in January of this year, and Elmington Property Management will manage the community. John Alascio, Chuck Kohaut, T.J. Sullivan and John Spreitzer of Cushman & Wakefield arranged $37 million in financing through Arbor Realty Trust Inc. for the project.

PERRY, N.Y. — KeyBank has provided $10.6 million in financing for the acquisition and rehabilitation of Silver Lake Meadows, a 52-unit affordable housing complex in Perry, about 50 miles east of Buffalo. Silver Lake Meadows comprises seven buildings that house one- and two-bedroom units that are reserved for renters earning up to 30, 50 and 60 percent of the area median income. John-Paul Vachon and Kate de la Garza of KeyBank originated the financing package, which includes $5.4 million in Low-Income Housing Tax Credit equity and a $5.5 million construction loan. The sponsor is a partnership between locally based nonprofit Wyoming County Community Action Inc. and developer Rochester’s Cornerstone Group.