WOODSTOCK, GA. — Mesa Capital Partners has broken ground on Sutton Row, a 290-unit apartment community located in the Atlanta suburb of Woodstock. Cadence Bank and Atlantic Union Bank are providing construction financing for the development. The project team comprises Focus Design Interiors (interior designer), English & Associates (architect) and Tri-Bridge Residential (general contractor). Amenities at Sutton Row will include a multi-story clubhouse with a resident coffee bar and market, coworking lounge with private conference space and a fitness center that features a yoga studio and spin room. Residents will also have the chance to enjoy various outdoor spaces such as a resort-style swimming pool, covered pavilion with grilling stations and direct access to the future Cherokee County multiuse trail. Leasing is expected to begin in late 2026, with full completion scheduled for 2027.

Multifamily

Waterton, NRP Group Acquire Las Vegas Site for 368-Unit South Valley Apartments Project

by Amy Works

LAS VEGAS — Waterton and The NRP Group have acquired an 8.5-acre site on South Las Vegas Boulevard in Las Vegas and financially closed for the development of South Valley Apartments. The project is the first partnership between Waterton and The NRP Group. South Valley will features 368 studio, one-, two- and three-bedroom floor plans with select one-bedroom units featuring dens spread across two four-story, elevator-serviced residential buildings. Units will include quartz countertops, subway tile backsplashes, stainless steel appliances in the kitchens and vinyl plank flooring. Community amenities will include an outdoor pool, two courtyards, outdoor seating areas with fire pits and grilling stations, a club lounge, coworking space and a conference room. Waterton and The NRP Group are providing equity commitments while CIBC is providing a senior loan. The NRP Group will serve as general contractor and provide property management services. Delivery of the first residences is slated for mid-year 2027 with completion scheduled for early 2028.

JLL Secures $19.5M Refinancing for Villas Las Mandarinas Multifamily Community in Tucson

by Amy Works

TUCSON, ARIZ. — JLL Capital Markets has secured a $19.5 million loan for the refinancing of Villas Las Mandarinas, a multifamily property located at 4250 E. 29th St. in Tucson. Brad Miner and Drew Lydon of JLL arranged the fixed-rate loan through Santander Bank N.A. for the borrower, GDL Asset Management and GDL Property Management. Built in 1977 and renovated in 2023, Villas Las Mandarinas features 322 apartments, averaging 322 square feet, and modern amenities.

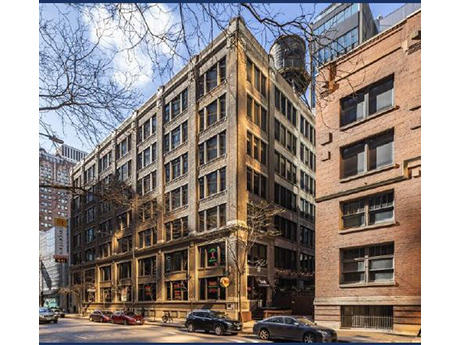

CHICAGO — Associated Bank has provided a $21.1 million construction loan to Wildwood Investments LLC and Concord Capital for the conversion of a 93,707-square-foot office and retail building in Chicago into 72 multifamily units. The seven-story property is located at 230 E. Ohio St. within the Streeterville neighborhood. Plans call for a mix of studio, one-, and two-bedroom units averaging 811 square feet. Existing first-floor retail, including Dao Thai Restaurant & Noodle Palace, Eye Society and YA Skin Studio, will remain open throughout construction. Completion is slated for December 2026. Elizabeth Hozian of Associated Bank handled the loan arrangements and closing.

PLATTEVILLE, WIS. — Marcus & Millichap has brokered the $5.1 million sale of a 66-unit multifamily portfolio in Platteville, a city in southwestern Wisconsin. Blake Hanlon and Mark Peltin of Marcus & Millichap represented the seller and procured the buyer, a group of investors from out of state. Michael Hughes of Marcus & Millichap Capital Corp. arranged acquisition financing. The sale marked the first time the properties had ever been brought to market. The majority of the portfolio was developed and held by the same family office for more than 40 years. The new ownership plans to improve operations. The buildings feature a mix of floor plans and are situated near the University of Wisconsin-Platteville.

GARLAND, TEXAS — A partnership between Canadian owner-operator Tricon Residential and Texas-based developer HHS Residential has completed a 100-unit build-to-rent residential project in Garland, a northeastern suburb of Dallas. Residences will feature three- and four-bedroom floor plans and will have attached two-car garages and fully fenced backyards. Amenities will include a dog park and multiple outdoor recreational spaces. Information on starting rents was not announced.

DANBURY AND NORWALK, CONN. — CBRE has brokered the $39.7 million sale of a portfolio of two affordable seniors housing properties totaling 169 units in Connecticut. Residences at both the 116-unit Kimberly Place in Danbury and the 53-unit One Leonard in Norwalk are reserved for renters age 62 and above. Simon Butler, Biria St. John, Jeff Dunne, Eric Apfel, Tim Flint and Taylor Froland of CBRE represented the seller, an affiliate of First Atlantic LLC, in the transaction and procured the buyer, an affiliate of Heritage Housing Inc.

WORCESTER, MASS. — Nonprofit owner-operator The Community Builders (TCB) has completed Merrick at the Square, a 49-unit affordable housing project in downtown Worcester. The building offers 11 units for households earning up to 30 percent or less of the area median income (AMI), five units reserved for renters earning 50 percent or less of AMI and 33 units for those making 60 percent or less of AMI. Amenta Emma Architects designed the project, and Saloomey Construction served as the general contractor.

Newmark Provides $67.5M Agency Refinancing for Rockwell at Crown Apartments in Metro D.C.

by Abby Cox

GAITHERSBURG, MD. — Newmark has provided a $67.5 million agency loan for the refinancing of Rockwell at Crown, a 335-unit multifamily apartment community located in Gaithersburg, roughly 20 miles northwest of Washington, D.C. Jim Badolato, Rob Cantazano, Greg Primiano, Deric Obeldobel and Elias Sulpizio of Newmark originated the financing through Fannie Mae on behalf of the borrower, Sentinel Real Estate. Completed in 2022, Rockwell at Crown offers a mix of one-, two- and three-bedroom units, with select layouts featuring dens and built-in desks. Amenities at the property include a resort-style swimming pool with sun shelf and cabanas, fitness center, electric vehicle charging stations, coworking areas and landscaped outdoor spaces.

CHARLESTON, S.C. — Woodfield Development has opened Cooper River Farms II, the second phase of the 56-acre Cooper River Farms apartment community located in Charleston. The new four-story building adds 71 studio, one- and two-bedroom residences. Amenities at the property include a fourth-floor sky lounge, community bar, TVs and a pool table. The second phase builds on the existing Cooper River Farms community, which features a saltwater swimming pool, fitness center, nature trails and a dog park. Construction on the development began in May 2024, and the first apartments were delivered in July 2025. The building is currently 50 percent occupied.