AUSTIN, TEXAS — Seattle-based investment firm Security Properties has acquired Brightleaf at Lakeline, a 304-unit apartment complex in North Austin. Completed in 2022, Brightleaf at Lakeline consists of three buildings that house one- and two-bedroom units on a 12.3-acre site. Residences average 880 square feet and are furnished with stainless steel appliances, granite countertops and individual washers and dryers. Amenities include a pool, fitness center, clubhouse, business lounge, outdoor grilling and dining areas and a pet park. San Antonio-based multifamily owner-operator Embrey sold the property for an undisclosed price.

Multifamily

WACO, TEXAS — Greystone has arranged a $30 million loan for the refinancing of The Delaney at Waco, a 169-unit seniors housing property. The community offers independent living, assisted living and memory care services. Tyler Armstrong of Greystone originated the financing, which was structured with a floating interest rate, seven-year term and a 30-year amortization schedule. The borrower was Iowa-based owner-operator Life Care Services. An undisclosed bank provided the loan.

ST. PETERS, MO. — Northmarq has arranged the $70 million sale of Bold on Blvd, a 272-unit luxury apartment complex in the St. Louis suburb of St. Peters. Built in 2022, the property is located at 1100 St. Peters Centre Blvd. The community was roughly 80 percent leased at the time of sale. Parker Stewart, Dominic Martinez and Alex Malzone of Northmarq represented the seller, TWG Development. A private New Jersey-based firm was the buyer. David Garfinkel led a Northmarq team that arranged acquisition financing on behalf of the buyer.

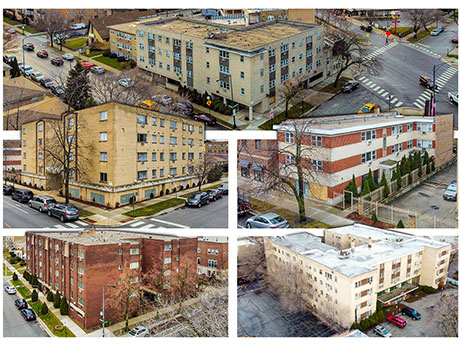

CHICAGO — Kiser Group has brokered the sale of a five-building multifamily portfolio in Chicago for $23 million. The 198 units are located within the West Rogers Park, Bowmanville and Budlong Woods neighborhoods and are largely vacant. Danny Logarakis of Kiser brokered the sale. The seller was a private individual that had owned the properties for more than 40 years. The buyers, Sam Trachtman and Stak Holdings LLC, plan to renovate the kitchens, bathrooms and common areas.

PHOENIX AND GLENDALE, ARIZ. — Tides Equities has purchased three multifamily properties in Phoenix and Glendale from Denver-based PaulsCorp for an undisclosed price. The portfolio includes 445 studio, one- and two-bedroom units. Constructed in 1985 and 1986, the communities were each at least 95 percent occupied at the time of sale. The portfolio includes: The Perry, a 148-unit property at 6231 N. 67th Ave. in Glendale Serena Park, a 141-unit community at 8546 N. 59th Ave. in Glendale Red Sage, a 156-unit asset at 5704 W. Thomas Road in Phoenix Brad Cooke, Cindy Cooke, Matt Roach and Chris Roach of Colliers Arizona handled the transaction.

OGDEN, UTAH — Greystone has arranged a $22.5 million loan to refinance debt on TREEO South Ogden, a seniors housing community in Ogden, approximately 30 miles north of Salt Lake City. Tyler Armstrong, managing director at Greystone, placed the bank loan for Leisure Care, which owns the 143-unit independent living community. The regional bank loan was executed as a floating-rate financing carrying a five-year term and 30-year amortization. The loan featured 12 months of interest-only payments and a mid-200 basis points loan spread.

Timberline Real Estate Ventures Sells 432-Bed Student Housing Community Near Louisiana Tech University

by John Nelson

RUSTON, LA. — Timberline Real Estate Ventures has sold CEV Ruston, a 432-bed community serving students attending Louisiana Tech University in Ruston. Constructed in 2008, the property offers two- and four-bedroom, fully furnished units. Shared amenities include a fitness center, group and private study rooms, a computer center and swimming pool. The community is situated adjacent to campus at 1812 W. Alabama Ave. Scott Clifton, Stewart Hayes, Teddy Leatherman, Kevin Kazlow and Jack Goldberger of JLL represented Timberline in the disposition of the property to Briar Meads Capital. The sales price was not disclosed.

MBA Projects 5 Percent Drop in Commercial and Multifamily Mortgage Financing in 2023, Strong Rebound in 2024

by John Nelson

WASHINGTON, D.C. — The Mortgage Bankers Association (MBA) projects that total commercial and multifamily mortgage borrowing and lending is expected to fall to $700 billion in 2023, a 5 percent decline from an expected volume of $740 billion in 2022. Multifamily lending volume alone is expected to drop to $393 billion in 2023, an 11 percent decline from an expected total of $439 billion in 2022. The projected drop in borrowing and lending reflects current market conditions. Jamie Woodwell, head of commercial real estate research for MBA, which is based in Washington, D.C., underlined that the forecast matched what the association had been hearing from commercial and multifamily mortgage finance professionals, with many indicating the Federal Reserve’s multiple interest rate increases in rapid succession have been a key factor in the projected decline in lending and borrowing activity. At its December meeting, the Federal Reserve raised the benchmark federal funds rate by half a percentage point, a smaller increase than the four consecutive three-quarter-point hikes earlier in 2022. The Fed is showing no sign of slowing rate hikes in 2023, with Chairman Jerome Powell announcing after the meeting that the central bank will continue to raise rates for quite some …

JLL Arranges Construction Financing for $135M Canterly Place Apartments in Livingston, New Jersey

by Jeff Shaw

LIVINGSTON, N.J. — JLL has arranged $88.6 million in construction financing and a $38 million equity placement for Canterly Place, a 300-unit multifamily project in Livingston, approximately 20 miles west of Manhattan. The total project cost is estimated at $135 million. Canterly Place will feature 240 market-rate units and 60 affordable units in one-, two- and three-bedroom floor plans. Residences will be funished with hardwood-style flooring, oversized windows, walk-in closets and individual washers and dryers. Communal amenities will include a pool, clubroom, library lounge, private dining rooom, game room, fitness center, coworking lounge, golf simulator, basketball court and a pickleball court. The site of Canterly Place is located just off Route 10, less than one mile west of Eisenhower Parkway, providing easy access to nearby I-280, I-287 and Route 24. The property offers an easy commute to the region’s major employment hubs in the surrounding area including New York City. Jon Mikula, Jim Cadranell, Matthew Pizzolato and Michael Lachs led the JLL team that arranged the debt and equity on behalf of the borrower, Okner Developers LLX. Northwestern Mutual provided the loan, which was structured with a 10-year term and a fixed interest rare, as well as the joint venture equity. — …

LEAGUE CITY, TEXAS — Greystone has provided a $40.4 million Fannie Mae loan for the refinancing of The Delaney at South Shore, a 204-unit seniors housing property in League City, a southeastern suburb of Houston. Tyler Armstrong of Greystone originated the nonrecourse loan, which carries a fixed interest rate, 10-year term and a 30-year amortization schedule. In addition, the debt was structured with five years of interest-only payments. The borrower was Life Care Services, a seniors housing owner-operator based in Des Moines, Iowa.