DAHLONEGA, GA. — Mallory & Evans Development has broken ground on Phase II of Bellamy Dahlonega, a student housing community located near the University of North Georgia. The second phase of the project will add two buildings offering 128 beds. Phase I of the project was delivered in fall 2015 and offers 426 beds. The 44 new units will feature two-, three- and four-bedroom configurations and will be fully furnished with bed-to-bath parity. Phase II will also include the development of a new fitness center and renovations to the existing clubhouse. A timeline for the project was not announced.

Multifamily

PHILADELPHIA — New York City-based Trevian Capital has provided a $17.1 million bridge loan for the acquisition of an undisclosed, 71-unit multifamily property located in Philadelphia’s Fishtown neighborhood. The newly constructed property includes ground-floor retail space and was 74 percent occupied at the time of the loan closing. The borrower was not disclosed.

SAN DIEGO — Hines, in partnership with USAA Real Estate, has started construction on the first phase of the 200-acre Riverwalk San Diego, a transit-oriented, mixed-use property in San Diego. The first phase will include 900 residential rental units, ranging from studios to townhomes, in five buildings along Friars Road; a neighborhood-serving retail space; village green; and traffic, sidewalk and bike lane improvements along Friars Road. Completion is slated for early 2025. The Riverwalk plan that was established through a partnership between Hines and the Levi-Cushman family landowners will transform Mission Valley West neighborhood, according to the development partnership.

SALT LAKE CITY — KeyBank Real Estate Capital has arranged a $68.3 million permanent loan through Freddie Mac for The Woodbury Corp., Colmena Group and Western States Lodging. The loan refinances existing debt on Legacy Village of Sugar House, a seniors housing property in Salt Lake City. The 10-story Legacy Village of Sugar House features independent living, assisted living and memory care units. The property also offers retail space, parking and commercial space. Morgin Morris of KeyBank structured the 10-year, fixed-rate loan with an initial five years of interest-only payments. The property is within the master-planned Sugar House neighborhood of Salt Lake City.

Marcus & Millichap Negotiates $24.1M Sale of Tanara Villa Apartments in Tacoma, Washington

by Amy Works

TACOMA, WASH. — Marcus & Millichap has arranged the sale of Tanara Village, a multifamily community in Tacoma. A private seller in a 1031 exchange sold the property to a limited liability company for $24.1 million, or $185,769 per unit. Built in 1969, Tanara Village features 130 apartments spread across five buildings. The community offers four laundry rooms, a recreation room, dog park and 113 parking stalls. The apartments are all one-bedroom/one-bath, 114 of which are 550 square feet and 16 are 600 square feet. Kellan Moll and Scott Morasch of Marcus & Millichap represented the seller and procured the buyer in the transaction.

READINGTON, N.J. — New Jersey-based developer Larken Associates is nearing completion of The Ridge at Readington, a 254-unit multifamily project located about 50 miles southwest of Manhattan. The Ridge at Readington will feature a mix of market-rate and affordable units in one- and two-bedroom formats across nine buildings. Residences will be furnished with stainless steel appliances and quartz countertops. Amenities will include a pool, fitness center, lounge and wet bar, outdoor pavilion, dog park and walking trails. The first move-ins are scheduled for the fourth quarter.

PHILADELPHIA — The Chatham Bay Group has acquired a former factory located at 2019-53 E. Boston St. in Philadelphia’s East Kensington neighborhood for $9.6 million. The Delaware-based investment firm plans to implement an adaptive reuse program that will convert the facility into a 178-unit apartment complex. Philadelphia-based architecture firm Designblendz is designing the project. Phil Sharrow and Craig Thom of Scope Commercial represented Chatham Bay and the seller, Viking Mill Associates LLC, in the transaction.

Landmark, Atlantic American Partners Break Ground on 702-Bed Student Housing Project Near FSU

by John Nelson

TALLAHASSEE, FLA. — A joint venture between Landmark Properties and Atlantic American Partners has broken ground on The Metropolitan at Tallahassee, a 702-bed student housing development near Florida State University. The community will be located at 1701 W. Pensacola St. near the university’s Doak S. Campbell Stadium. The development is set to offer two- to four-bedroom, fully furnished units. Shared amenities will include an outdoor putting green, 24-hour study lounge, computer lab, fitness center, resort-style swimming pool and a grilling area. Landmark Construction will serve as the general contractor for the project, which is scheduled for completion in August 2024.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $8.7 million sale of a 56-unit apartment building in Harlem. The six-story building was originally constructed in 1909. Aaron Jungreis, Ben Khakshoor and Alex Fuchs of Rosewood Realty represented the buyer, a private investor, and the seller, an entity doing business as 610 Realty Associates LLC, in the transaction. The deal traded at a cap rate of 4.8 percent.

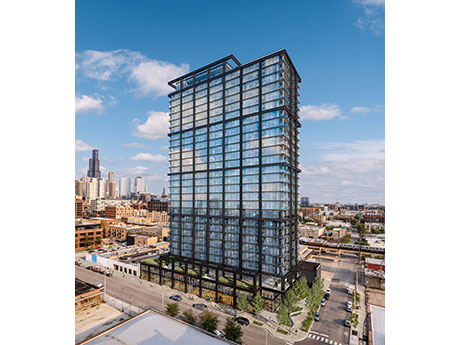

CHICAGO — Sterling Bay has broken ground on 225 N Elizabeth, a $155.6 million apartment development in Chicago’s Fulton Market district. The developer received $91.7 million in construction financing from Citizens and Old National Bank. The 28-story building will feature 350 units, 20 percent of which will be designated as affordable housing. Plans also call for roughly 9,000 square feet of retail space, 95 parking spaces and indoor and outdoor amenities on the third and top floors of the building. Sterling Bay is developing the project in partnership with Ascentris, a Denver-based private equity firm. Chicago-based McHugh Construction is the general contractor and Hartshorne Plunkard is the lead architect. Completion is slated for the second quarter of 2024.