BROWNWOOD, TEXAS — Colliers Mortgage has provided an undisclosed amount of Fannie Mae acquisition financing for Southside Village Apartments, a 104-unit multifamily asset in Brownwood, about 140 miles northwest of Austin. The 12-building, garden-style property was built in 1973 and offers amenities such as a playground, basketball court and a dog park. Fritz Waldvogel of Colliers Mortgage originated the financing through a partnership with Old Capital Lending. The borrower was an entity doing business as The Magnolia on 4th LLC.

Multifamily

NEW YORK CITY — Locally based developer and private equity firm Delshah Capital has completed 22 Chapel Street, a 180-unit multifamily project in downtown Brooklyn. The transit-served property consists of 125 market-rate apartments and 55 affordable housing units in studio, one- and two-bedroom formats. Amenities include a fitness center, rooftop terrace, a social lounge, library and coworking space, children’s play area and a communal kitchen. The affordable housing component will be restricted to households earning up to 130 percent of the area median income. CetraRuddy Architecture designed the project, while OTL and Titanium Construction provided general contracting and construction management services.

COLUMBUS, OHIO — United Way of Central Ohio has selected the AspireCOLUMBUS proposal from the Columbus Metropolitan Housing Authority (CMHA) and national nonprofit The Community Builders (TCB) for the redevelopment of its headquarters building at 360 S. Third St. The CMHA-TCB proposal is a $70 million project slated for completion in late 2025 or early 2026. Plans call for a 12-story building with 30,000 square feet of commercial space and 135 mixed-income units. Moody Nolan will lead the design. The CMHA-TCB partnership has a purchase sale agreement of $4 million to take ownership of the building. Battelle Memorial Institute Foundation donated the one-acre site to United Way of Central Ohio in 1978 for use as its headquarters. When the nonprofit decided to sell the property, it enlisted the help of a real estate task force consisting of United Way employees, board members, community volunteers and outside advisors. Funding for the redevelopment project will come from New Markets Tax Credit equity, traditional debt, CMHA funding, Low-Income Housing Tax Credit equity and potential gap funding from state and local partners.

Fountain Residential Partners Disposes of 241-Bed Student Housing Community Near KSU in Metro Atlanta

by John Nelson

KENNESAW, GA. — Fountain Residential Partners has sold 14 SixtyFive, a 241-bed student housing community near Kennesaw State University in metro Atlanta. The development was recently completed and offers two-, three-, four- and five-bedroom, fully furnished units with bed-to-bath parity. Community amenities include study spaces on every floor, a gaming room, 24-hour fitness center, outdoor kitchen, barbecue grills, resort-style swimming pool and a study lounge. The 52-unit property is situated one mile north of campus at 1465 Shiloh Road in Kennesaw. Teddy Leatherman, Stewart Hayes and Scott Clifton of JLL represented the seller in the disposition of the property to Nuveen Real Estate. The sales price was not disclosed.

Ryan Cos., Aegis Living Plan 92-Unit Seniors Housing Community in Seattle’s Ballard Neighborhood

by Amy Works

SEATTLE — Ryan Cos., as builder, and Aegis Living, as developer, unveils plans to develop a five-story assisted living and memory care community on Market Street in Seattle’s Ballard neighborhood. The team broke ground on the project in March, with opening slated for early 2024. Totaling 75,000 square feet, the community will feature 92 residential apartments, dining facilities, a movie theater, activity rooms, a wellness suite and community rooftop space. The property will also include business offices and one level of underground parking. DAHLIN is serving as architect for the project, which will be Aegis’ second senior living community in northwest Seattle. Ryan has built more than 60 senior living communities in 17 states across the country.

Trion Properties Receives $99.2M Recapitalization for Two Multifamily Communities Near Portland, Oregon

by Amy Works

TIGARD AND BEAVERTON, ORE. — Trion Properties, in partnership with Tokyu Land US Corp., has recapitalized two apartment properties in Tigard and Beaverton totaling 373 units. The properties include Hudson Tigard Apartments, a 227-unit community in Tigard, and Aster Parc Apartments and Townhomes, a 146-unit property at 18745 SW Farmington Road in Beaverton. Trion implemented upgrades, executed rebranding and improved operations in order to increase value since purchasing the assets in 2018 and 2019. Trion acquired Hudson North Apartments and Hudson South Apartments separately in 2018 for $38.1 million and combined them into Hudson Tigard Apartments. The assets were recapitalized for a total of $59.2 million, with a new loan amount of $39.4 million secured through Freddie Mac and serviced by Walker & Dunlop. Hudson North Apartments is located at 10890 SW Canterbury Lane and Hudson South Apartments is located at 10695 SW Murdock St. Aster Parc Apartments and Townhomes, which Trion purchased in two phases in 2018 and 2019 for a total of $20.4 million, was recapitalized for approximately $40 million. The recapitalization involves a new $24 million loan secured through Pacific Premier Bank and an equity partnership formed between Trion and Tokyu Land US Corp.

ATLANTA — Delays in the arrival of building materials — everything from windows and roof trusses to microchips for electrical panels — is one of the biggest hurdles slowing down new seniors housing developments, according to Kristin Kutac Ward, CEO of Solvere Living. Ward’s comments came during the ninth annual InterFace Seniors Housing conference. The event, which took place Aug. 17 at the Westin Buckhead in Atlanta, was hosted by France Media’s InterFace Conference Group and Seniors Housing Business and drew 324 attendees. Joining Ward on the development panel was Tod Petty, vice chairman with Lloyd Jones Senior Living; Matthew Griffin, senior vice president, eastern states, with Griffin Living; and Jim Vogel, president of Solvida Development Group. Rick Shamberg, managing director of Scarp Ridge Capital, served as the moderator. Despite the challenges in today’s building environment, there is pent-up demand and plenty of excitement regarding new seniors housing projects, said Ward. As baby boomers age, there will be a need for seniors housing care for about 50 million more people in the U.S., according to Shamberg. There’s ample opportunity for developers to fill that void in housing. According to Petty, the need for seniors housing units will be most pronounced …

BRIDGEPORT, CONN. — Flaherty & Collins Properties (F&C), in partnership with RCI Group and the City of Bridgeport, has unveiled plans for a $200 million waterfront apartment community at Steelepointe Harbor, a mixed-use development along Long Island Sound. Plans call for 420 units and 10,000 square feet of retail space. Amenities will include a pool, outdoor kitchens, gathering spaces, secure parking and a dedicated dog park and pet spa. A water taxi will provide residents with service to nearby beach areas. A fitness center will offer fitness classes, a spin studio, sauna and jacuzzi. Residents will also have access to a pickleball court. Bridgeport is located 50 miles northwest of New York City. Steelepointe Harbor is accessible along the I-95 corridor and a short walk to the Bridgeport Transportation Center, which features access to the train station and the Bridgeport & Port Jefferson Ferry to Long Island. The Hartford Healthcare Amphitheatre live event venue, which opened in 2021, is less than a mile away. Previous development phases of Steelepointe Harbor included a Bass Pro Shops, Chipotle and Starbucks in late 2015, followed by the addition of Bridgeport Harbor Marina. The 220-slip marina is approaching full occupancy in its third year. …

Multifamily Market Experiences Increased Demand Despite Rising Rents and Interest Rates, Berkadia Poll Shows

by Jeff Shaw

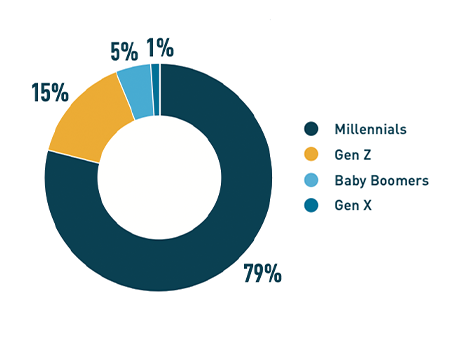

NEW YORK CITY — Berkadia’s newly released 2022 Mid-Year Powerhouse Poll reveals that the multifamily market continues to experience increased demand among investors and renters despite rising rents and interest rates. The survey respondents included 123 Berkadia investment sales agents and mortgage bankers across 65 offices, 80 percent of whom reported that they expect multifamily rental demand to continue to outpace supply for the remainder of 2022. The survey was conducted in July. Nearly 80 percent of Berkadia mortgage bankers and investment agents responded that millennials, persons born roughly between 1981 and 1996, are likely to be the generation that will make up the highest percentage of multifamily renters in the next one to two years. An even greater percentage of Berkadia professionals in the Western region (88 percent) report that the majority of their current renters are millennials. The survey results also revealed that baby boomers tend to rent single-family rental/build-for-rent (SFR/BFR) housing most commonly, while Gen Z typically rent workforce housing. Seventy-two percent of advisors reported that, besides cost, location is most important to renters today. While movement away from metropolitan areas continues — a trend made popular during the COVID-19 pandemic as renters sought more space — 59 percent of …

DENTON, TEXAS — Resia, a Miami-based developer formerly known as AHS Residential, has received an undisclosed amount of construction financing for a 322-unit multifamily project in the North Texas city of Denton. The unnamed project will consist of two seven-story buildings with one-, two- and three-bedroom units, as well as a pool, fitness center, clubhouse and a business center. Construction is expected to be complete in the second quarter of 2023. Regions Bank provided the financing.