NEW YORK CITY — A partnership between two privately owned firms, William Macklowe Co. and Senlac Ridge Partners, will develop a 180-unit multifamily project in Brooklyn’s Park Slope neighborhood. The complex will include 45 affordable housing units and a parking garage, as well as 67,000 square feet of commercial space that is now partially leased to CVS and German discount grocer Lidl. Construction is slated for a late 2024 completion. RIPCO Real Estate represented the developer in the retail lease negotiations.

Multifamily

Berkadia Negotiates $145M Acquisition of Granite Pointe Multifamily Property in Washington

by Amy Works

SPOKANE VALLEY, WASH. — Berkadia has brokered the sale of Granite Pointe, a garden-style apartment community in Spokane Valley. A Spokane-based developer sold the asset for $145 million. Kenny Dudunakis, David Sorensen, Benjamin Johnson and George Pallis of Berkadia Bellevue represented the buyer in the transaction. Additionally, Allan Freedman, Ed Zimbler and Nick Provost of Berkadia Los Angeles secured $102.7 million in acquisition financing for the undisclosed buyer. A bank provided the four-year bridge loan. Located at 12707 E. Mansfield Ave., Granite Pointe features 559 one-, two- and three-bedroom floor plans with in-unit washers/dryers and private patios or balconies. Community amenities include a fitness center, movie theater and clubhouse.

LOS ANGELES — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Addison Arms Apartments, a multifamily community located in the Sherman Oaks neighborhood of Los Angeles. A private, Los Angeles-based owner sold the asset to a private family for $21 million, or $375,893 per unit. Originally constructed in 1969, Addison Arms features 57 apartments. The seller spent $2.2 million on capital expenditures to upgrade the property systems, common area amenities and 45 percent of the unit interiors. Improvements include a new roof, commercial air conditioning system and upgrades to the landscaping, signage, exterior paint, leasing office, clubhouse, hallways and exterior lighting. The project also added one accessory dwelling unit. Kevin Green, Joseph Grabiec and Greg Harris of IPA represented the seller and procured the buyer in the deal.

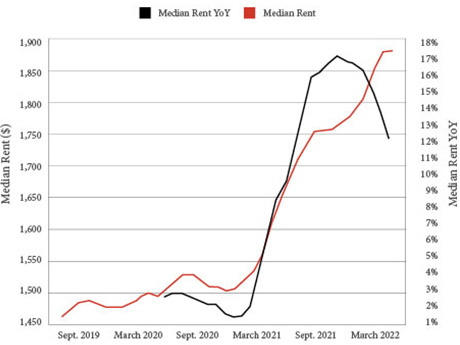

SANTA CLARA, CALIF. — During the pandemic, moving to the suburbs could save apartment renters more than $600 per month. Today, that difference is only $100. Regardless of location, rents everywhere reached an all-time high in July. Avail, a subsidiary of Realtor.com, recently released its Quarterly Landlord and Renter Survey, which collected and analyzed rental data from about 50 metros and suburbs. The study found that median asking rents in cities were $1,928 per month in July, while suburban rents averaged $1,821. That’s a stark difference from just a few years ago, when lower rents lured many remote workers to the suburbs to save money during the pandemic. A report published by Yield PRO in September 2020 estimated median urban asking rents to be $1,955 per month while suburban apartments were a much better bargain at an average of $1,349. Nationally, asking rents are about 23 percent higher today than they were in July 2020, according to Realtor.com, which also claims the latest across-the-board average of $1,879 is the highest rate in the past 17 months. Rent growth in the double digits is historically significant, but landlords are expected to lay off rent hikes in coming months while tenants grapple with inflation. …

GLENDALE, ARIZ. — American Landmark Apartments has purchased Cabana 99th, a multifamily community located at 10000 W. Missouri Ave. in Glendale. The buyer has renamed the 286-unit property as The Lotus. Built in 2022, The Lotus features studio, one- and two-bedroom floor plans ranging from 468 square feet to 828 square feet. Apartments offer dishwashers, full-size washers/dryers, large energy-efficient windows, stainless steel appliances, nine-foot ceiling heights, wood-style vinyl plank flooring and workstation desks in select units. Community amenities include a swimming pool, electric vehicle charging stations, a hammock garden, keyless entry locks, monthly resident events, a business center, multi-purpose lawn, outdoor fitness space, secured bike storage and outdoor barbecue area. Terms of the transaction were not released.

Blueprint Arranges Sale of 92-Unit Pinewood Terrace Seniors Housing Community in Colville, Washington

by Amy Works

COLVILLE, WASH. — Blueprint Healthcare Real Estate Advisors has negotiated the sale of Pinewood Terrace, a 92-unit skilled nursing facility located in Colville, a tiny city of fewer than 5,000 residents in the northeastern corner of Washington State. Cascadia Healthcare acquired the property for an undisclosed price. The seller was looking to exit Washington for states with more favorable reimbursement rates and lower regulatory hurdles. Cascadia, meanwhile, is growing its regional team in the Washington and northern Idaho markets to help with quality of care and synergy between local buildings.

STILLWATER, OKLA. — Apex Student Living has acquired Apex on Perkins, a 732-bed community located near Oklahoma State University in Stillwater, for $23.7 million. According to Apartments.com, the property offers a pool, fitness center, business center and a clubhouse. The seller was a partnership between two Manhattan-based investment firms, Ladder Capital and Tailwind Capital. Apex is a joint venture between Toronto-based Alexandra Capital and Connecticut-based Axela Group.

Resia Obtains $60M Construction Loan for Mixed-Income Multifamily Project in Decatur, Georgia

by John Nelson

DECATUR, GA. — Resia, formerly known as AHS Residential, has obtained $60 million in construction financing for a 476-unit apartment development in metro Atlanta. Located at 4151 Memorial Drive in Decatur, the community will feature five seven-story midrise buildings comprising one-, two- and three-bedroom floor plans. Twenty percent of the units will have income restrictions, according to Resia. Amenities will include assigned parking, a business center, fitness center and a swimming pool. Bank of America provided the loan to Resia, which broke ground on the unnamed community in the first quarter of 2022 and expects to deliver the asset in the third quarter of 2023. The project is the developer’s third property in the metro Atlanta area.

Greystone Arranges $52.6M Construction Financing for Seniors Housing Community in Gainesville, Florida

by John Nelson

GAINESVILLE, FLA. — Greystone has arranged $52.6 million in debt and equity construction financing for Discovery Place at Celebration Pointe in Gainesville. Upon completion, the seniors housing community will feature 180 units and a high-end amenity package, according to Greystone. The type of care was not disclosed. Cary Tremper and Matt Miller of Greystone originated the transaction on behalf of the borrower, Bonita Springs, Fla.-based Discovery Senior Living. Discovery Place will serve as an anchor at Celebration Pointe, a 1.5 million-square-foot mixed-use project along I-75 that features Regal Cinemas, Bass Pro Shops, Dave & Buster’s, offices, apartments and several stores and restaurants. Built by Celebration Pointe Holdings and RaCo Real Estate Advisors, Phase II of Celebration Pointe will feature a 142,000-square-foot events center that is sanctioned by the NCAA to host athletic and scholastic events.

VIRGINIA BEACH, VA. — Northmarq has negotiated the $43 million sale of Bayville Apartments, a 240-unit, Class B multifamily property located at 1512 Kindly Lane in Virginia Beach. Wink Ewing, Mike Marshall and Matt Straughan of Northmarq represented the seller, Thalhimer Realty Partners, in the transaction. Keith Wells, Reina Abboud and Hunter Wood of Northmarq’s debt and equity team arranged an undisclosed amount of acquisition financing on behalf of the buyers, Linden Property Group and Matador Capital Management. Bayville Apartments consists of one-, two- and three-bedroom floor plans with short-term leases available for residents. Community amenities include a business center, bark park, onsite maintenance and management, package receiving, a playground and a pool.