MANOR, TEXAS — Atlanta-based developer RangeWater Real Estate is underway on construction of The Darby, a multifamily development in the northeastern Austin suburb of Manor that will consist of 326 apartments and 24 townhomes. Apartments will feature one-, two- and three-bedroom floor plans ranging in size from 757 to 1,400 square feet, and townhomes will come in three-bedroom formats with garages and private yards. The communal amenity package comprises a pool, fitness center, dog park and outdoor grilling and dining areas. Construction is scheduled to be complete in fall 2023.

Multifamily

SAN ANTONIO — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the sale of Pecan Springs, a 344-unit apartment community in northwest San Antonio. Built on 16 acres in 2013, Pecan Springs features one-, two- and three-bedroom units and amenities such as a pool, fitness center, business center, resident lounge, dog park, outdoor grilling stations and package lockers. Will Balthrope and Drew Garza of IPA represented the seller, Tampa-based American Landmark, and procured the buyer, Alabama-based StoneRiver Co., in the transaction. At the time of sale, Pecan Springs had an average occupancy rate of 96 percent on a trailing 12-month basis.

HARTFORD, CONN. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Capitol View Apartment Homes, a 264-unit multifamily complex in downtown Hartford. Built in 1955 and renovated between 2002 and 2013, the 10-story building houses units with an average size of 542 square feet and offers amenities such as a lounge, fitness center and concierge service. Victor Nolletti, Wes Klockner and Eric Pentore of IPA represented the seller, an entity doing business as MATP LLC, in the transaction. The trio also procured the buyer, EOM Equity LLC.

FALL RIVER, MASS. — Greystone has provided a $15.3 million Fannie Mae loan for the refinancing of a historic, 103-unit multifamily asset in Fall River, located near the Massachusetts-Rhode Island border. Commonwealth Landing was originally built in the 1880s as a cotton mill and was converted into a multifamily complex with one-, two- and three-bedroom units in 2016. Shana Daby of Greystone originated the fixed-rate, nonrecourse loan, which features three years of interest-only payments, on behalf of the borrower, an entity doing business as Mechanics Mill Two LLC. Michael Corso of Kingston Capital provided debt advisory services.

TAMPA, FLA. — RD Management LLC and Core Spaces have opened Hub Tampa, a 359-unit student housing community located at the corner of University Square and Club drives in Tampa. The $65 million, off-campus property is situated near the University of South Florida (USF) and features 900 student housing beds. Amenities include a health and wellness center, rooftop pool and a study and work center, as well as an activities and events area. The student housing property is part of a mixed-use redevelopment of University Mall named RITHM. The 113-acre campus will include new Sprouts Farmers Market and Burlington stores that are set to open in 2023, as well as an extended stay Marriott hotel.

MOBILE, ALA. — CLK, a Long Island-based commercial real estate investment firm, has acquired The Park Apartments, a 201-unit multifamily community located at 1 Country Lane in Mobile. Lakewood, N.J.-based Walden Asset Group sold the property for $15.8 million, or $78,600 per unit. Aaron Jungreis and David Wildes of Rosewood Realty Group represented both the buyer and seller in the off-market transaction. Built in 1975, Park Apartments features 20 two-story buildings, a pool, fitness center, playground and a picnic area. The property is situated on 11.5 acres within three miles of the Mobile Regional Airport and the University of Southern Alabama. The community was 95 percent occupied at the time of sale.

GRAND FORKS, N.D. — Colliers Mortgage has provided a $10.9 million HUD-insured loan for the acquisition and rehabilitation of a three-property, 182-unit affordable housing portfolio in Grand Forks. University Square comprises 60 units, Columbia Square South includes 72 units and Columbia Square East features 50 units for seniors. All units are covered by Section 8 Housing Assistance Payments (HAP) contracts. The properties will undergo $13.6 million in renovations. Additional funding comes from low-income housing tax credits, housing incentive funds from the North Dakota Housing Finance Agency and tax-exempt bonds, which were underwritten by Colliers Securities LLC. The borrower, Schuett Grand Forks LP, is an entity controlled by The Schuett Cos. Inc., which will also manage the properties. The 40-year loan features a 40-year amortization schedule.

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

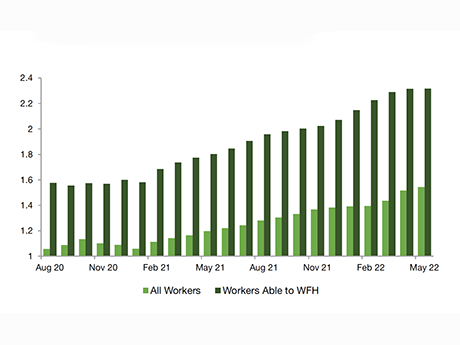

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

Greenwater Investments Sells Villas Los Limones Apartment Property in Phoenix for $58.2M

by Amy Works

PHOENIX — Greenwater Investments has completed the disposition of Villas Los Limones, an apartment community in Phoenix. Rincon Partners acquired the asset for $58.2 million, or $260,000 per unit. Situated on nine acres, Villas Los Limones features 224 apartments spread across 18 buildings. The average apartment size is 678 square feet. Community amenities include a pool, clubhouse and laundry facilities. Cliff David, Steve Gebing, Hamid Panahi and Clint Wadlund of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer in the deal.

SCOTTSDALE, ARIZ. — Revel Communities has completed construction of Revel Scottsdale and Revel Legacy, both independent living communities in Scottsdale. Then properties are the 12th and 13th independent living communities the brand has opened since launching in 2018, and its first two in Arizona. Revel Scottsdale offers 157 units near the bustling shops and dining of Old Town Scottsdale, with rents starting at $3,695 per month. Revel Legacy offers 169 units among the mountain views of North Scottsdale with rents starting at $3,795 per month.