ATLANTA — ECI Group, an Atlanta-based multifamily developer and investor, has obtained a $625 million loan for the refinancing of a 13-property multifamily portfolio in the Sun Belt. Goldman Sachs Bank USA provided the loan, and Jones Lang LaSalle Securities LLC served in an advisory role to ECI Group, which will use the loan to refinance the portfolio and fund renovations for six communities. Built between 1979 and 2021, the 3,478-unit portfolio comprises Class A and B properties in Florida, Georgia, Tennessee and Texas. The assets had an average occupancy of 96.6 percent at the time of the loan closing.

Multifamily

Walker & Dunlop Provides $105M Acquisition Loan for Affordable Housing Community in Metro D.C.

by John Nelson

LANDOVER HILLS, MD. — Walker & Dunlop has provided a $105 million acquisition loan for The Verona at Landover Hills, a 727-unit multifamily community located in the Washington, D.C., suburb of Landover Hills in Prince George’s County. Walker & Dunlop’s John Gilmore and his team structured the acquisition financing through Fannie Mae’s Multifamily Affordable Housing platform on behalf of the buyer, a joint venture between Dantes Community Partners and the Urban Investment Group (UIG) within Goldman Sachs Asset Management. Built in 1966, The Verona previously operated as a traditional market-rate community but Dantes and UIG entered into an agreement with Prince George’s County Department of Housing & Community Development at closing where new affordability restrictions were placed on the asset. The 30-acre property consists of 25 four-story apartment buildings with 91 separately addressed entryways. Units feature new stainless steel appliances and upgraded cabinetry and countertops.

Ziegler Arranges $71M Bond Financing for Seniors Housing Community in Winchester, Virginia

by John Nelson

WINCHESTER, VA. — Ziegler has arranged $71 million in bond financing for Shenandoah Valley Westminster-Canterbury (SVWC), a continuing care retirement community (CCRC) in Winchester, approximately 75 miles west of Washington, D.C. SVWC was founded in 1982 and provides housing, healthcare and other services to nearly 400 residents on its 87-acre campus through the operation of 218 independent living units (164 apartments and 54 cottages), 48 assisted living units, 12 memory care units and 51 skilled nursing beds. SVWC is completing an independent living unit expansion project known as the Hackwoods, the first phase of which will include 48 new independent living unit apartments. To fund the first phase of the project, SVWC issued two tranches of drawdown bank loans that Atlantic Union Bank and Pinnacle Financial Partners purchased. The first portion of the financing was $51 million in bonds via a 12-year bank commitment, with a variable interest rate. The second portion, totaling $20 million, features a 4.5-year final maturity to be repaid from initial entrance fees to the new independent living units.

ST. LOUIS — Berkadia has brokered the sale of The Oliver in St. Louis for an undisclosed price. The newly built multifamily community features 151 units and is situated within an opportunity zone. Bobby Mills, Andrea Kendrick and Ken Aston of Berkadia represented the sellers, Missouri-based Larson Capital Management and Ridgehouse Cos. Bob Falese and Jeremy Lynch of Berkadia arranged acquisition financing on behalf of the buyer, Fortbridge Capital Partners.

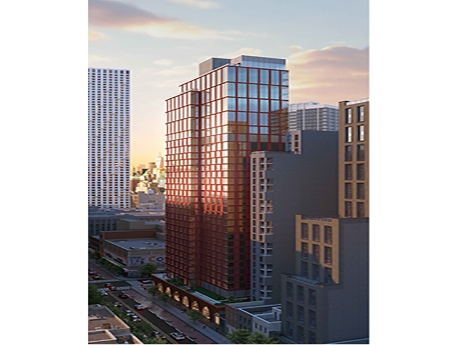

NEW YORK CITY — Cushman & Wakefield has arranged a $134 million construction loan for 15 Hanover Place, a mixed-income residential project that will be located in downtown Brooklyn. The 34-story building will house 314 units, 95 of which will be reserved as affordable housing, as well as 9,000 square feet of commercial space. Gideon Gil, Zachary Kraft and Sebastian Sanchez of Cushman & Wakefield arranged the loan through Santander Bank and City National Bank on behalf of the borrower, locally based developer Lonicera Partners. A tentative completion date has not yet been established.

DALLAS — A partnership between two locally based firm, Mintwood Real Estate and Woods Capital, will undertake a multifamily conversion project at Santander Tower in downtown Dallas. The project will redevelop multiple floors of the 1.4 million-square-foot office building at 1601 Elm St. into 228 multifamily units, including communal amenity spaces. Units will come in one- and two-bedroom floor plans, and amenities will include a pool, fitness center and other gathering and meeting spaces. Dallas-based architect WDG designed the multifamily units and indoor amenities, and Swoon provided interior design services. TBG Partners designed the exterior amenities. Adolfson & Peterson Construction is serving as the general contractor. Completion is scheduled for fall 2023.

SAN ANTONIO — Walker & Dunlop has arranged $85.7 million in debt and equity financing for the recapitalization of Bulverde Oaks, a 440-unit apartment community located on the north side of San Antonio. The breakdown of debt versus equity within the capital stack was not disclosed. According to Apartments.com, the property offers one- and two-bedroom units ranging in size from 629 to 1,283 square feet. Residences are furnished with stainless steel appliances, individual washers and dryers and private balconies/terraces. Amenities include a pool, fitness center, clubhouse and event space. Sean Reimer, Sean Bastian and Triston Stegall of Walker & Dunlop placed the loan through Bank OZK on behalf of the borrower, U.S. Living, and secured the preferred equity investment from Mount Auburn Multifamily.

SAN ANTONIO — A partnership between California-based DB Capital Management and Sabal Financial Group has acquired Villas of Henderson Pass, a 228-unit multifamily property located on the north side of San Antonio. Built in 1986, the property offers a mix of one- and two-bedroom units across 20 two- and three-story buildings. The asset was 98 percent occupied at the time of sale. The new ownership plans to upgrade the unit interiors, building exteriors and amenity spaces and to rebrand the property as Summit Henderson Pass. The seller was not disclosed.

MAPLE GROVE, MINN. — JLL has arranged the $73.7 million sale of Rush Creek Apartments, a 246-unit multifamily community located at 7148 Brockton Lane in the Twin Cities suburb of Maple Grove. Constructed in 2021, Rush Creek offers studio, one-, two- and three-bedroom units with an average size of 988 square feet. Individual units feature granite countertops, stainless-steel appliances, energy-efficient appliances, in-unit washers and dryers, walk-in closets and a patio or balcony. Community amenities include a fitness center, business center, clubhouse, swimming pool with a sundeck, heated underground parking and an outdoor patio. JLL marketed the property on behalf of the seller, a partnership between St. Cloud, Minn.-based Trident Development and West Palm Beach, Fla.-based North American Development Group. JLL also provided a $47.9 million Fannie Mae loan for the acquisition. Dan Linnell, Mox Gunderson, Josh Talberg and Adam Haydon of JLL represented the seller. Brock Yaffe led the JLL team representing the borrower.

NAPERVILLE, ILL. — 33 Realty has brokered the $21.7 million sale of Quail Ridge of Naperville Condominiums in the Chicago suburb of Naperville. The buyer, Bear Peak Capital, will convert the units from condominiums into apartments and also make upgrades. The property was originally built in 1977. Matt Petersen and Sean Connelly of 33 Realty represented the buyer. Under the Condominium Property Act in Illinois, condo unit owners can elect to sell a property if 75 percent or more are in agreement. Sellers then have the option to either move out of their units or lease them back from the new owner.