NASHVILLE, TENN. — Alliance Residential has purchased 3.3 acres at 2500 Bransford Ave. in Nashville to develop Broadstone Berry Hill, a 302-unit apartment community. The Scottsdale, Ariz.-based developer has also recently opened Broadstone SoBro and will soon open Broadstone Centennial in Nashville. The Berry Hill community will be located approximately a half-mile from the newly opened Geodis Park, the 30,000-seat home arena of the Nashville FC MLS team. Unit interiors at Broadstone Berry Hill will include quartz countertops, stainless steel appliances and built-in mud benches and desks in select units. Community amenities will include a rooftop lounge, pool with a pool deck and putting green, coworking space and a clubroom with a tiki bar and demonstrator kitchen. Alliance Residential plans to welcome first residents in summer 2024.

Multifamily

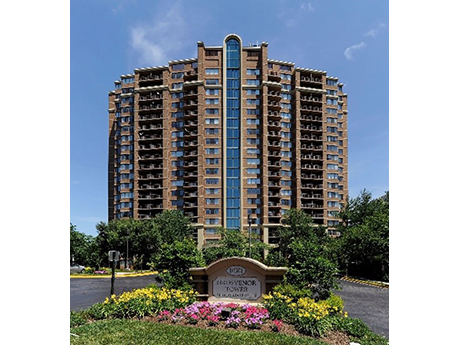

BETHESDA, MD. — Grosvenor and an unnamed investment partner have acquired a 21-story apartment tower in North Bethesda that coincidentally shares a name with the private investor. Grosvenor Tower is located at 10301 Grosvenor Place and features 237 apartments. The acquisition price was not disclosed, but the Washington Business Journal reports that the asset traded for $95 million and that Grosvenor plans to invest $10 million to upgrade the property. The property was originally built in 1987, renovated in 2008 and includes 80 one-bedroom, one-bath apartments and 157 two-bedroom, two-bath apartments. Grosvenor has engaged Bozzuto Management to oversee day-to-day property management. The buyer plans to enhance energy and water efficiency at Grosvenor Tower as part of its $10 million value-add program.

CHARLESTON, S.C. — Capital Square has broken ground on 529 King Street ROOST Apartment Hotel, a five-story luxury apartment hotel located in the Garden District of Charleston. The hybrid property will feature 50 extended stay apartments in studio, one-, two- and three-bedroom floor plans. The property will operate under the ROOST Apartment Hotel brand, a division of Method Residential. The final development will total approximately 32,000 net rentable square feet, including an “open-air living room courtyard” and a rooftop lounge that will be open to the public. Capital Square’s project partners include architect Morris Adjmi & LS3P, general contractor BL Harbert and Method Residential as the retail leasing agent and co-developer of the property. 529 King is situated within an opportunity zone, and Capital Square is funding the project in part with proceeds from its fourth qualified opportunity zone fund, CSRA Opportunity Zone Fund IV LLC. The Richmond-based developer and investor expects to open the property in summer 2023.

SEATTLE — RISE Properties Trust and Tokyu Land US Corp. have purchased Park South Apartments, a multifamily community in Seattle’s South Park neighborhood, from Jackson Square Properties for an undisclosed price. Located at 10102 8th Ave. S., the property features 252 units with in-unit washers/dryers, newly renovated interiors, wood-burning fireplaces and modern appliances. Community amenities include a pool, fitness center, business center, clubhouse, games and an outdoor entertainment area. Eli Hanacek, Jon Hallgrimson, Mark Washington and Kyle Yamamoto of CBRE’s multifamily team in Seattle represented the seller in the transaction.

Meridian Capital Group Arranges $40M Financing for Seniors Housing Property in Simi Valley, California

by Amy Works

SIMI VALLEY, CALIF. — Meridian Capital Group has arranged a $40 million loan to refinance Varenita of Simi Valley, an assisted living and memory care facility in Simi Valley. The borrower is Griffin Living, which opened the property in April. Proceeds from the transaction repaid an existing construction loan and provided a return of capital to the owners while the community was still in lease-up. A finance company provided the funds. Meridian’s Ari Adlerstein, Josh Simpson and Jesse Rauch negotiated the transaction. Varenita of Simi Valley comprises 75 assisted living and 27 memory care units.

HOUSTON — Arizona-based SB Properties has acquired Vargos on the Lake, a 276-unit apartment community in West Houston. The property offers one- and two-bedroom apartments and three-bedroom townhomes. Amenities include a pool with a sundeck, fitness center with yoga and kickboxing stations, resident lounge with billiards and poker tables, conference lounge and a dog park. Jennifer Ray and Ryan Epstein of Walker & Dunlop represented the seller, Berkshire Group, in the transaction. The sales price was not disclosed.

BAYTOWN, TEXAS — Marcus & Millichap has brokered the sale of Cedar Grove Park RV Resort, a 266-site RV park located in the eastern Houston suburb of Baytown. Robert Denninger of Marcus & Millichap represented the seller, a private investor, and the buyer, a limited liability company, in the transaction. Both parties involved in the deal requested anonymity. The property was roughly 90 percent occupied at the time of sale.

ARLINGTON, TEXAS — Locally based investment firm 180 Multifamily Properties has purchased a 224-unit complex in Arlington. According to Apartments.com, the property at 834 Timberlake Drive offers one-, two- and three-bedroom units ranging in size from 600 to 1,010 square feet, as well as a business center and a clubhouse. The new ownership plans to implement a value-add program and rebrand the property as Oakmont Apartment Homes. The seller was Florida-based ZMR Capital.

NEW YORK CITY — JLL has brokered the $50.7 million sale of a 101-unit multifamily building located at 740 West End Ave. on Manhattan’s Upper East Side. Constructed in 1915, the elevator building rises 14 stories and includes six commercial spaces and one superintendent’s apartment. Bob Knakal, Hall Oster, Jonathan Hageman, Paul Smadbeck, Teddy Galligan and Braedon Gait of JLL represented the seller, Wolk Properties, in the transaction, and procured the buyer, Aya Acquisitions.

HARRISON, N.Y. — Locally based brokerage firm Alpha Realty has negotiated the $21.5 million sale of Harrison Playhouse Lofts, a 36-unit apartment complex located north of New York City. The site formerly housed a movie theater, and the complex features one-, two- and three-bedroom units, as well as 5,000 square feet of retail space. Lev Mavashev and Shai Egison of Alpha Realty represented the seller, Verco Properties, in the off-market deal. The duo also procured an undisclosed, locally based private investor as the buyer.