WILMINGTON, MASS. — Locally based developer The Procopio Cos. has topped off Lume, a 49-unit multifamily project in Wilmington, a northern suburb of Boston. The 74,000-square-foot, transit-served development carries a price tag of $20 million. Upon completion this fall, Lume will consist of 39 garden-style apartments and 10 townhomes. Amenities will include a fitness center, clubroom, coworking space and a pet spa. DMS Design is the project architect, with interiors by Conant Design Group. Boston-based Charlesgate is the leasing and management agency.

Multifamily

Triumph Properties Buys Land Parcel for 287-Unit Aileron Multifamily Development in North Phoenix

by Amy Works

PHOENIX — Triumph Properties has closed an $82.5 million total capitalization for Aileron, a multifamily project located in North Phoenix. The company acquired the 9.8-acre land parcel from Moderne Capital Partners, which will partner with Triumph on the project. Aileron will feature 286 apartments in a mix of studios, one- and two-bedroom units averaging 842 square feet. Units will feature vinyl plank and carpet flooring, quartz countertops, tile backsplashes, wood cabinets, stainless steel appliances, in-unit laundry and air conditioning. Community amenities will include a pool, spa, clubhouse, fitness center, barbecue area, secured access and a package center.

DENVER — Legacy Partners and Pacific Life have purchased Araceli DTC, a to-be-developed residential tower in Denver. Situated on 1.3 acres at 4552 S. Ulster, the property will feature 236 apartments spread across 10 levels and a three-level garage podium. The property will feature panoramic views and an average unit size of 896 square feet. Community amenities will include a pool amenity deck, a protected Uber/Lyft pickup/drop-off area and electric car charging stations. Completion is slated for 2024. Mark Erland, Matthew Benson and Kevin Barron of JLL Capital Markets arranged $106 million in joint-venture equity and construction financing for Legacy Partners. The financing is a four-year, floating-rate senior construction loan, which an investment manager provided.

PHOENIX — Taurus Investment Holdings has purchased an apartment property located in Phoenix’s northwest region for $42 million. The buyer will rebrand the Class B property, which was previously known as Rise Metro, as Raystone. Built in 1981, Raystone features 160 units. Through its energy-focused subsidiary, RENU Communities, Taurus plans to transition Raystone to a low-carbon, energy-efficient multifamily complex by replacing all HVAC units with highly efficient air-source heat pumps, replacing existing electric water heaters with heat pump water heaters, implementing an energy monitoring system in each unit, upgrading lighting and installing solar panels.

TACOMA, WASH. — Portland, Ore.-based Ethos Development has broken ground on The Moraine, a multifamily property in Tacoma. The eight-story, 115,000-square-foot podium building will include 160 apartments, a fitness center, media room, roof deck with communal kitchen and billiards room. The project has a voluntary target of 25 percent minority and disadvantaged business participation during construction, a target to recycle 70 percent of the construction waste stream, and the building will have both onsite solar panels and a green roof. The units are designed to provide market-rate affordability by way of efficient floor plans, and 20 percent of the units will be available to those earning no more than 80 percent of area median income as part of the tax exemption program of Pierce County. The project team includes Portland-based Works Progress Architecture, Walsh Construction Co. and Ethos Commercial Advisors.

RIVERSIDE, CALIF. — PSRS has arranged the $3.5 million cash-out refinancing of Riverside Apartments, a multifamily property located in Riverside. David Sarnoff of PSRS secured the 10-year, fixed-rate loan with a flexible prepayment structure. The name of the borrower was not released. Built in 1990, the wood-frame property features 32 garden-style apartments.

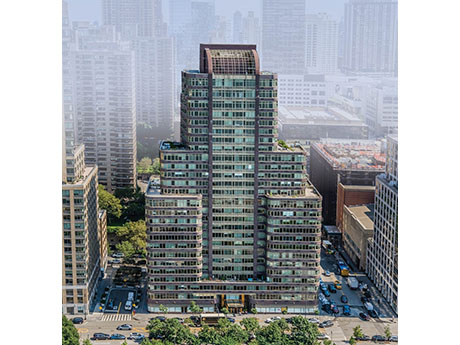

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

SAN MARCOS, TEXAS — Austin-based Palladius Capital Management has purchased The Heights, a 672-bed student housing community serving students at Texas State University in San Marcos, located south of the state capital. The property is located about three miles from campus, comprises 240 units and offers amenities such as a pool, fitness center, clubhouse and study lounges. The seller and sales price were not disclosed. The new ownership plans to implement a value-add program focused on unit interiors, building exteriors and amenity spaces.

ATLANTA — New York-based Eastern Union has secured an $83.3 million bridge loan for The Halsten at Vinings Mountain, a 440-unit multifamily property in Atlanta. Michael Muller of Eastern Union arranged the non-recourse, two-year loan, which has three 12-month extension options. The loan was underwritten with interest-only payments for a period of up to three years. The borrower was not disclosed. Formerly known as Stone Ridge at Vinings, The Halsten offers studio, one-, two- and three-bedroom floorplans. Completed in 1973, the property spans 452,385 square feet. The new owner plans to upgrade the property’s exteriors and modernize and renovate the interiors. Unit features include walk-in closets, patios and balconies and washer and dryer hookups. Community amenities include a business center, clubhouse, playground, tennis court, grill, picnic area, fitness center, laundry facilities and a pet play area. Located at 3000 Cumberland Club Drive, the property is situated two miles from The Battery Atlanta and 15.7 miles from downtown Atlanta.

WEST PALM BEACH, FLA. — Greystone has provided a $17.5 million HUD-insured loan for the redevelopment of Christian Manor Apartments, a 200-unit affordable seniors housing community located in West Palm Beach. Jon Morales of Greystone arranged the loan on behalf of the borrower, Phase Housing Corp. Inc. Located in Palm Beach County, Christian Manor includes four, three-story buildings that offer studio and one-bedroom units. Originally built in 1972, the property will provide affordable housing for low-income, which is classified as below 60 percent of area median income, and “extremely low-income” seniors (below 28 percent AMI) over 62 years of age. The project team worked with HUD and the West Palm Beach Housing Authority to obtain project-based rental assistance for over half of the residents who, although eligible, were previously not receiving this support. The expected construction cost for the redevelopment of the property is $38.7 million. Along with the funding from Greystone, the project also received 4 percent Low-Income Tax Credit (LIHTC) equity, and secondary debt consisting of a Florida State Apartment Incentive Loan and Florida Extremely Low-Income funds. The non-recourse loan carries a 40-year term at a low, fixed interest rate. Paul Ponte of Phase Housing Corp. Inc., Jason …