CLEVELAND — The NRP Group, a Cleveland-based multifamily developer and operator, plans to break ground on approximately 6,000 apartment units spread across 23 construction projects in 2022. The properties will be a mix of affordable, market-rate and mixed-income communities. The total investment for the projects is estimated at $1.9 billion. The 23 communities are made up of 11 market-rate developments totaling 3,762 units; 10 affordable developments totaling 1,865 units for residents at or below 60 percent of the area median income (AMI); and two projects with 658 apartment homes in which half of the units are priced at market levels and half are priced for residents earning 80 percent of the AMI. Planned construction starts are distributed across the NRP footprint in Texas, the Washington, D.C., metro area, New York, New Jersey, Florida, North Carolina and Ohio.

Multifamily

CORALVILLE, IOWA — Artisan Capital Group and MJW Investments have purchased Latitude at River Landing in Coralville, which is located just north of Iowa City. The purchase price was undisclosed. The buyers plan to rebrand the 663-bed student housing property as The Banks-Student Living. Completed in 2019, the community features an outdoor pool, fitness center, lounge, game room, basketball court, study rooms and campus shuttle service. Located near the University of Iowa, the property is situated within Iowa River Landing, a master-planned development featuring retail, restaurant, entertainment and hospitality space. JLL arranged debt financing through Pacific Life.

GARY, IND. — Colliers Mortgage has provided a $14.5 million Fannie Mae loan for the refinancing of Gary NSA I & II Apartments in Gary, a city in Northwest Indiana. Constructed between 1914 and 1928, the affordable housing property features 249 units across 14 buildings. The community is covered entirely by a HUD rental Housing Assistance Payments (HAP) contract throughout the loan term. The 10-year loan features a 30-year amortization schedule. An entity doing business as Gary NSA I & II Housing LLC was the borrower.

KANSAS CITY, MO. — Northmarq has arranged the sale of Centropolis on Grand, a 56-unit apartment building in Kansas City’s River Market neighborhood. The sales price was undisclosed. Gabe Tovar and Jeff Lamott of Northmarq represented the seller, KC Commercial Realty Group, which developed the property in 2016. Tovar and Lamott are also arranging permanent financing on behalf of the buyer, Minneapolis-based Oaks Properties. The transaction marks the buyer’s first investment in the Kansas City market.

LEWISVILLE, TEXAS — San Francisco-based Legacy Partners will develop Merit, a 296-unit apartment community in the northern Dallas suburb of Lewisville. The development will feature one-, two- and three-bedroom units that will range in size from 630 to 1,500 square feet and will be furnished with granite countertops, stainless steel appliances, work-from-home spaces and private balconies or patios. Amenities will include a pool, fitness center, dog park, coworking space, outdoor gaming area and a 24-hour convenience mart. Dallas-based JHP Architecture is designing Merit, and Provident General Contractors is building the community. Chinmay Bhatt, Cody Kirkpatrick and Noam Franklin of Berkadia secured a $20.2 million equity investment from Pondmoon Capital Holdings USA for the project. Completion is slated for mid-2023.

NEW BRUNSWICK, N.J. — CBRE has negotiated the $173.4 million sale of Plaza Square, a 415-unit apartment community located in the Northern New Jersey community of New Brunswick. The transit-served property was built in 2004 and offers amenities such as a pool, fitness center, resident clubhouse, business center and a dog run. Jeffrey Dunne, Jeremy Neuer, Richard Gatto, Fahri Ozturk, Stuart MacKenzie and Eric Apfel of CBRE represented the seller, Manulife Investment Management, in the transaction. The team also procured the buyer, Renaissance Management.

LYNN, MASS. — Locally based developer The Procopio Cos. has topped off Mosaic, a 146-unit multifamily project in the northeastern Boston suburb of Lynn. Mosaic will offer studio and one-bedroom units and amenities such as a pool, outdoor grilling areas, a rooftop lounge and remote work areas. In addition, the transit-served property will house three retail spaces. Massachusetts-based DMS Design and CUBE3 are the project architects, and Dellbrook | JKS is the general contractor. Greystar is providing management and leasing services. Full completion is slated for the summer. Rents start at $1,900 per month for a studio apartment.

NEW YORK CITY — New York City-based bridge lender Emerald Creek Capital has provided an $11.5 million acquisition loan for a 27-unit residential building on Manhattan’s Upper West Side. The seven-story building houses studio to five-bedroom units and includes two ground-floor retail spaces. Jeff Seidler and Dean Wang of Emerald Creek Capital originated the financing. The borrower was not disclosed.

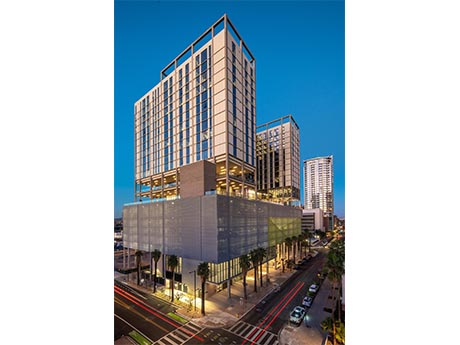

PHOENIX — Chicago-based developer The X Co. has completed X Phoenix, a 20-story multifamily high-rise project located at 200 W. Monroe St. in the state capital’s downtown area. The 731,321-square-foot building houses 330 residential units and represents Phase I of a larger development. Phase II of X Phoenix will feature a 26-story multifamily tower that will be developed on an adjacent parcel. Construction of Phase II is scheduled to begin this spring. Phase I of X Phoenix included a parking garage with 612 stalls, plus an indoor mezzanine storage space with 159 bike parking spots and a wash station. The eighth floor of the building houses two pools with a poolside bar and restaurant that is scheduled to open in April. In addition, the ninth floor of the building features a 9,000-square-foot fitness center with locker rooms and a yoga studio. Lastly, the building contains 50,000 square feet of commercial space that will be built out to support restaurant and coworking uses. Chicago-based Fitzgerald & Associates designed X Phoenix, with Workshop/APD handling interior design. Clayco, a design-build firm with five offices across the county, provided construction management services. Kimley-Horn and Peterson Associates provided engineering services. The X Co. has built …

LAS VEGAS — Griffin Capital has completed the disposition of South Beach Apartments, a 220-unit multifamily community in the Las Vegas submarket of Summerlin/Spring Valley. Logan Capital Advisors acquired the asset for $97.5 million, or $443,180 per unit. Taylor Sims, Carl Sims and Brady Cleary of Cushman & Wakefield’s Multifamily Advisory Group in Las Vegas represented the seller in the deal. Located at 8920 W. Russel Road, South Beach Apartments features a mix of one- and two-bedroom floor plans, with loft and den options, ranging from 680 square feet to 1,380 square feet. Onsite amenities include saltwater pools, a beach volleyball court, soccer field, half basketball court, yoga studio, Pilates studio, indoor and outdoor fitness centers, a dog wash and a 16-foot TV by the pool. The community was built in 2017.