OMAHA, NEB. — Mohr Partners Inc. has brokered the sale of Orpheum Tower in downtown Omaha for an undisclosed price. Upon its construction in 1910, the 16-story tower was the tallest office building in Omaha at 220 feet. It was converted into 132 apartment units and served as the city’s tallest apartment tower until 2013. The building is listed on the National Register of Historic Places. Grant Palmer and Eric Beichler brokered the sale. A private REIT purchased the asset.

Multifamily

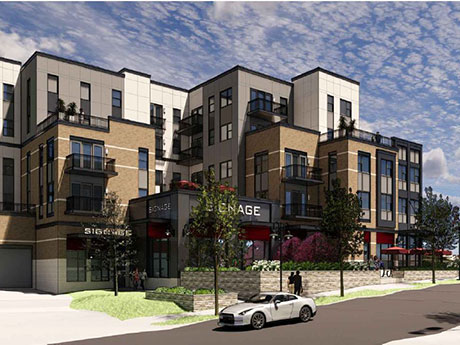

BLOOMINGTON, IND. — The Annex Group has closed on funding and started construction of The Annex of Bloomington, a $23 million workforce housing community in Bloomington. The 102-unit, two-building property will be situated within an area called the University Village Downtown Character Overlay District. Completion is slated for spring 2023. The project team includes general contractor Gilliatte General Contractors Inc., architect KTGY and engineer Smith Design Group Inc. Star Financial Bank provided $18.1 million in funding. Bloomington has a high population of renters, and the student population of Indiana University puts a strain on the market, according to Kyle Bach, CEO of Annex. Bach says this new project is in response to the need for housing in the area. A percentage of the units are restricted for residents earning below 120 percent of the area median income.

ARLINGTON, TEXAS — Miami-based Eagle Property Capital (EPC) has sold Montecito Club, a 331-unit apartment community in Arlington that was built in phases between 1968 and 1979. Montecito Club features studio, one-, two- and three-bedroom residences that offer private balconies and patios in select units. Communal amenities include a pool, business center, fitness center, resident clubhouse, sports court, dog park and outdoor grilling and picnic areas. New York City-based APF Properties purchased the asset for an undisclosed price. EPC originally acquired the asset in 2016 and renovated unit interiors, upgraded common areas and amenity spaces and implemented more water- and energy-saving programs.

DALLAS — Los Angeles-based Banyan Residential, in partnership with Bridge Investment Group, has broken ground on Banyan Flats, a 289-unit multifamily project that will be located at 2022 N. Beckley Ave., just west of downtown Dallas. Floor plans will feature micro, studio, one-, two- and three-bedroom units ranging in size from 415 to 1,425 square feet. Amenities will include a pool, fitness center, clubhouse, dog wash and a rooftop deck. JHP Architecture is designing the project. J.P. Morgan provided construction financing for the project, which is slated for a 2023 completion.

Ziegler Arranges $52M Bridge Loan for Kalakaua Gardens Seniors Housing Community in Honolulu

by Amy Works

HONOLULU — Ziegler has arranged a bridge loan placement totaling $52 million for Kalakaua Gardens, a continuing care retirement community in Honolulu. The property features 164 units of independent living, assisted living, memory care and skilled nursing. The borrower is Island Paradise Investments (IPI). IPI opened Kalakaua Gardens in late 2016. The community is situated at the gateway to Waikiki within the lively Ala Moana enclave and in close proximity to several hospitals and medical clinics. The community was built for ohana-style living, where residents are encouraged to live and be social within inviting open spaces that offer 360-degree views of the islands. The loan refinanced the original construction loan and provided additional proceeds for planned renovations, other reserves and closing costs.

GLENDALE, COLO. — Kairos Investment Management Co. has acquired Forest Manor Apartments, an affordable multifamily property located at 625 S. Forest St. in Glendale. Terms of the transaction were not released. Built in 1974, Forest Manor features 103 apartments in a mix of a single studio, 74 one-bedroom and 28 two-bedroom units with air conditioning, carpeted floors and spacious closets. The property was last renovated in 2001. Community amenities include a swimming pool and laundry facilities. Kairos plans to renovate the asset by implementing interior and exterior upgrades, including interior repairs and upgrades to units, new flooring for interior hallways, exterior roof repairs, pool renovation and common-area amenities.

HEMPSTEAD, N.Y. — Charlotte, N.C.-based Grubb Properties, in partnership with First Street Capital, will develop a 173-unit multifamily project within a Qualified Opportunity Zone in the Long Island community of Hempstead. Grubb Properties will operate the community, which will include 2,500 square feet of commercial space, under its Link brand. About 10 percent (17) of the units will be designated as affordable housing. Construction is scheduled to begin in the third quarter, and initial occupancy is slated for the third quarter of 2024. Grubb Properties is also underway on Link-branded projects in Manhattan’s Financial District and in the Long Island City area of Queens.

HOBOKEN, N.J. — JLL has arranged a $35.9 million loan for the refinancing of Hudson Square North, a 150-unit apartment complex located outside of New York City in Hoboken. The transit-oriented property offers one-, two- and three-bedroom units that average 890 square feet and are furnished with washers and dryers, stainless steel appliances and quartz countertops, as well as 2,739 square feet of retail space. Thomas Didio, Thomas Didio Jr., Carlos Silva and Salvatore Buzzerio of JLL arranged the 10-year, fixed-rate loan through Minnesota Life Insurance Co. on behalf of the owner, Ironstate Development.

ORLANDO, FLA. — Berkadia has arranged the sale of West Vue, a 442-unit, garden-style apartment community in Orlando. A joint venture between New York-based Phoenix Realty Group and Prospect Capital acquired the property for $97.5 million. Matt Wilcox, Brett Moss, Tyler Swidler and Cole Whitaker of Berkadia represented the Jacksonville-based seller, RISE: A Real Estate Co. Built in 2021, West Vue offers one-, two- and three-bedroom floorplans with units ranging from 759 square feet to 1,369 square feet. Unit features include nine-foot ceilings, wood-plank style flooring, pendant lights, stainless steel appliances, granite countertops, center island with breakfast bar seating, side-by-side refrigerators, walk-in closets, walk-in showers, dual vanities, full-sized washer and dryers, balconies and screened-in patios. Community amenities include two swimming pools with sun shelves and private cabanas, a 24-hour clubhouse with Wi-Fi, media and game lounge, rentable private offices and study spaces, 24-hour fitness center, yoga studio, courtyards, dog park, children’s playground and a summer kitchen with grills. The property was 65.2 percent occupied at the time of sale. Located within the 1,800-acre master-planned MetroWest community, West Vue is situated close to Walgreens, 24 Hour Fitness, Wawa and an under-construction Bravo grocer. Located at 5915 Raleigh St., the property is …

CHICAGO — McHugh Construction has started building Platform 4611, a nine-story apartment building in Chicago’s Uptown neighborhood. The project includes 200 units and 9,000 square feet of ground-floor retail space. The developers are The John Buck Co. and Free Market Ventures. Pappageorge Haymes Partners is the architect. Levels two through eight will include a mix of studio, one- and two-bedroom units, while the top floor will include four three-bedroom penthouse units and a host of building amenities. Plans call for touchless entry, reservable office space on each floor, a fitness center and a rooftop amenity floor with coworking space and an outdoor terrace. Completion is slated for late 2022 or early 2023. The name Platform 4611 is a nod to the project’s transit-oriented nature. The Wilson Chicago Transit Authority (CTA) train station is located across the street.