FRENCH VALLEY, CALIF. — SRS Real Estate Partners has arranged the sale of a retail property located at 35914 Winchester Road in French Valley, located in the Inland Empire region. A Southern California-based private developer sold the recently developed building to a Southern California-based private investor for $13.3 million in a 1031 exchange. EoS Fitness occupies the 38,000-square-foot building under a 20-year, absolute triple-net, corporate-guaranteed lease. The gym, which is the anchor tenant at French Valley Marketplace, is slated to open in late August. Additional tenants at the 78,400-square-foot shopping center includes Grocery Outlet, McDonald’s, Chipotle and 7-Eleven. Matthew Mousavi, Patrick Luther and Jack Cornell of SRS Capital Markets represented the seller in the deal.

Net Lease

Beta Agency Arranges $7.5M Sale of Raising Cane’s Chicken Fingers-Occupied Restaurant in Carson, California

by Amy Works

CARSON, CALIF. — Beta Agency has arranged the sale of a restaurant property located at 20707 Avalon Blvd. in Carson, south of Los Angeles. A Los Angeles-based private investor sold the asset to an Orange County, Calif.-based private buyer in a 1031 exchange for $7.5 million. Raising Cane’s Chicken Fingers occupies the 2,950-square-foot property with 12 years remaining on its triple-net lease, which backed by a corporate guarantee. The lease also includes 10 percent rental increases every five years. The restaurant opened in 2022. Adam Friedlander of Beta Agency represented the seller, while George Felix and Dan Blackwell of CBRE represented the buyer in the deal.

SACRAMENTO, CALIF. — Marcus & Millichap has arranged the sale of a net-leased property located at 6401 Stockton Blvd. and 6050 Elder Creek Road in Sacramento. The asset sold for $1.6 million. The undisclosed buyer intends to lease the 43,996-square-foot property to a suitable tenant, according to Marcus & Millichap. Although the use of the property was not disclosed, the address is for a used car dealership in an industrial area. Christopher Hurd of Marcus & Millichap represented the seller, an individual/personal trust, in the deal.

Hanley Investment, Oaks Commercial Arrange $3.8M Sale of McDonald’s-Occupied Property in Fountain Valley, California

by Amy Works

FOUNTAIN VALLEY, CALIF. — Hanley Investment Group Real Estate Advisors, in conjunction with Oaks Commercial Real Estate, has arranged the sale of a single-tenant restaurant property located at 11321 Talbert Ave. in the Orange County city of Fountain Valley. A Newport Beach-based family trust sold the absolute triple-net ground lease to a Fountain Valley-based 1031 exchange buyer for $3.8 million in an all-cash transaction. McDonald’s occupies the 3,500-square-foot property, which is an outparcel to a Costco Wholesale. Situated on an acre, the building was constructed in 2011. Bill Asher and Jeff Lefko of Hanley Investment Group, in association with Fred Encinas of Eastvale-based Oaks Commercial Real Estate, represented the seller. Robert Tran of Westminster-based HPT Realty represented the buyer in the deal.

Marcus & Millichap Brokers Sale of 7,200 SF Western Dental-Occupied Properties in Fremont, California

by Amy Works

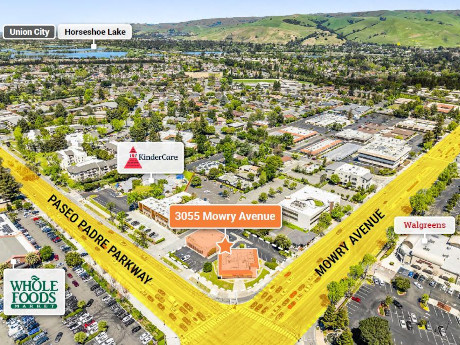

FREMONT, CALIF. — Marcus & Millichap has arranged the sale of two buildings with a combined size of 7,200 square feet in the Bay Area city of Fremont. A private investor sold the medical office assets to an undisclosed buyer for $3.7 million. Western Dental occupies the assets, located at 3055 Mowry Ave. and 38780 Paseo Padre Parkway, on a net-lease basis. Yuri Sergunin, J.J. Taughinbaugh and Eric Carrillo of Marcus & Millichap’s Palo Alto office represented the seller in the deal.

Marcus & Millichap Brokers $2.9M Sale of AutoZone-Occupied Property in Shoreline, Washington

by Amy Works

SHORELINE, WASH. — Marcus & Millichap has arranged the sale of a retail property, located at 18217 Aurora Ave. North in Shoreline, a suburb north of Seattle. A private investor sold the asset to an undisclosed buyer for $2.9 million. AutoZone occupies the 6,030-square-foot property on a net-lease basis. The tenant recently inked an early 10-year extension with scheduled rental increases every five years for the property. Carson Breshears and Hank Wolfer of Marcus & Millichap represented the seller in the deal.

Marcus & Millichap Brokers Sale of Dollar Tree-Occupied Property in Twentynine Palms, California

by Amy Works

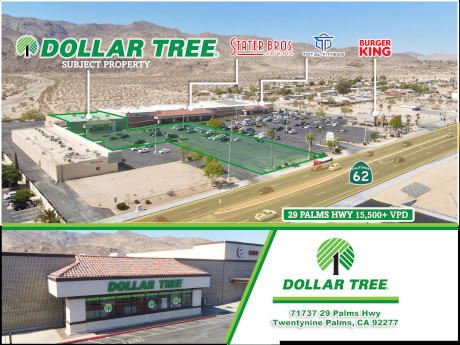

TWENTYNINE PALMS, CALIF. — Marcus & Millichap has arranged the sale of Dollar Tree, a net-leased retail property in Twentynine Palms, just north of Joshua Tree National Park in Southern California. An individual/personal trust sold the asset to an undisclosed buyer for $2.1 million. The 15,506-square-foot Dollar Tree is located at 71737 29 Palms Highway. Dollar Tree has committed to four and a half years on the lease, having recently exercised its five-year option period. There are two additional five-year extension options. The asset occupies a 1.5-acre lot within a 90,000-square-foot retail plaza featuring Stater Bros., Burger King and Total Fitness Gym. Michael Grandstaff and Christopher Hurd of Marcus & Millichap represented the seller, while Karl Markarian of JohnHart Corp. represented the buyer in the deal.

NORMAN, OKLA. — The Boulder Group, a brokerage firm specializing in single-tenant, net-leased retail deals, has arranged the $3.7 million sale of a building at 3501 NW 36th Avenue in Norman, Okla. CVS occupies the building, which according to LoopNet Inc. was built in 2010 and totals 12,888 square feet. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the buyer, a California-based 1031 exchange investor, in the transaction. The seller was undisclosed.

KILLEEN, TEXAS — California-based brokerage firm Hanley Investment Group has negotiated the sale of a 4,900-square-foot retail building in the Central Texas city of Killeen. The building was constructed in 2023 was net leased to Brakes Plus at the time of sale. Garrett Wood of Hanley represented the buyer, a Florida-based 1031 exchange investor, in the transaction. Matt Montagne, Maxwell Watson and Tyler Ellinger of Sands Investment Group represented the seller, a Los Angeles-based private investor.

NORTH RICHLAND HILLS, TEXAS — California-based brokerage firm Hanley Investment Group has negotiated the sale of a 4,956-square-foot retail building in North Richland Hills, a northern suburb of Fort Worth. The building was constructed in 2022 and is net leased to automotive services provider Brakes Plus. Garrett Wood of Hanley represented the buyer, a Florida-based 1031 exchange investor, in the transaction. Drew Isaac, Brian Bailey and Tim Speck of Marcus & Millichap represented the undisclosed, Colorado-based seller.