LAFAYETTE, COLO. — Real Capital Solutions has acquired Medtronic Lafayette Campus from Ryan Cos. for $188 million. The acquisition consists of two five-story life sciences office buildings located at 200 and 250 Medtronic Drive in Lafayette, approximately 20 miles north of Denver. Completed earlier this year, the 42-acre, 404,159-square-foot property is Medtronic’s second largest U.S. campus, which will eventually house about 1,200 employees. As sole tenant of the property, the medical device company has a guaranteed, 20-year, triple-net lease.

Net Lease

Pinnacle Real Estate Arranges $5.8M Acquisition of Single-Tenant Retail Property in Gilbert, Arizona

by Amy Works

GILBERT, ARIZ. — Pinnacle Real Estate Advisors has brokered the purchase of a retail property located at 777 W. Ray Road in Gilbert. Lanwin 120 Windsor LLC acquired the asset from an undisclosed seller for $5.8 million. A gas station occupies the 2,044-square-foot property on an absolute, triple-net, 20-year lease with zero landlord responsibilities and 3 percent annual rent increases. The asset was built in 2000 and remodeled in 2023. Barton Thompson of Pinnacle Real Estate Advisors represented the buyer in the deal.

SACRAMENTO — Hanley Investment Group has brokered the $5 million sale of a single-tenant retail property located in Sacramento. Chipotle Mexican Grill occupies the 2,347-square-foot building within The Quad District, a new mixed-use development, on a triple-net lease. Bill Asher and Jeff Lefko represented the developer and seller, Chase Partners LTD. KDC constructed the property, which Vermeltfoort Architects designed. A California-based buyer purchased the property.

HAVERSTRAW, N.Y. — The Boulder Group, an Illinois-based brokerage firm, has arranged the $5 million sale of a 3,034-square-foot retail property in Haverstraw, about 35 miles north of Manhattan, that is net leased to 7-Eleven. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the seller, a regional developer, in the transaction. The buyer was a New York-based private investor that acquired the asset via a 1031 exchange. Both parties requested anonymity.

BUENA PARK, CALIF. — SRS Real Estate Partners has arranged the sale of a single-tenant retail property located at 6931 La Palma Ave. in Buena Park. An undisclosed partnership sold the asset to a private, non-1031 investor for $6.9 million. Both the buyer and seller are based in Southern California. Matthew Mousavi and Patrick Luther of SRS’ National Net Lease Group represented the buyer and seller in the transaction. Superior Grocers occupies the 34,199-square-foot property, which was built in 1996 on 1.7 acres. There are seven years remaining on the tenant’s corporate-guaranteed triple-net lease.

LAS VEGAS — Quick-service chicken chain Bojangles has signed a development agreement to bring 20 new restaurants to Las Vegas, as well as the development of restaurants within 10 TravelCenters of America franchise locations across Western markets. TravelCenters of America franchisee LVP Restaurant Group LLC, an entity of LV Petroleum, and its investment partner, Kingsbarn Realty Capital, will lead the projects. Kingsbarn Realty Capital provides institutional and accredited investors access to an array of alternative real estate investments in the Las Vegas area. In partnership with LVP Restaurant Group, Kingsbarn will identify and acquire properties suitable for the new Bojangles developments. Kingsbarn has over $1.9 billion of assets under management, a $2 billion development pipeline and has acquired more than 270 properties within the United States. In July, Bojangles launched its expansion strategy, including a streamlined menu, new building design and new staffing model. The strategy simplifies operations and enhances the guest experience. To date, the brand has implemented the new strategy within seven restaurants in Texas, Florida, Tennessee, Arkansas and Louisiana.

NEEDHAM, MASS. — Fantini & Gorga, a mortgage banking firm based in metro Boston, has arranged $10 million in acquisition financing for a portfolio of four retail properties occupied by Walgreens in the Northeast. Three of the properties are located in Massachusetts, and the fourth is in New York. Casimir Groblewski and Colin Monahan of Fantini & Gorga arranged the debt through multiple banks on behalf of the borrower, Union Station LP, which acquired the portfolio via a 1031 exchange.

Marcus & Millichap Brokers $3.3M Sale of New Restaurant in LaGrange, Georgia Leased to Chick-fil-A

by John Nelson

LAGRANGE, GA. — Don McMinn of Marcus & Millichap’s Taylor McMinn Retail Group has brokered the $3.3 million sale of a newly constructed restaurant in LaGrange that is ground-leased to Chick-fil-A for 15 years. Located at 2110 Vernon St. on a 1.5-acre lot, the nearly 5,000-square-foot building is a relocation of a former Chick-fil-A and serves as an outparcel to a new Publix-anchored shopping center that Taylor McMinn Retail Group will be marketing. An unnamed, out-of-state private investor purchased the restaurant at list price within 30 days of listing with all-cash, according to McMinn, who represented the undisclosed seller in the transaction. “Pricing for quality net-lease retail continues to receive strong demand and command attractive pricing in spite of the rising interest rate environment,” says McMinn.

ALBUQUERQUE, N.M. — Hanley Investment Group Real Estate Advisors has arranged the sale of a 3,331-square-foot, single-tenant retail property in Albuquerque. Raising Cane’s Chicken Fingers occupies the building on a 15-year, triple-net lease. Bill Asher, Jeff Lefko and Jeremy McChesney of Hanley represented the seller and developer, TradeCor LLC, in the transaction, in association with ParaSell Inc. Greg Swedelson and Jon-Eric Greene of SSG Realty Partners represented the buyer, an undisclosed private investor.

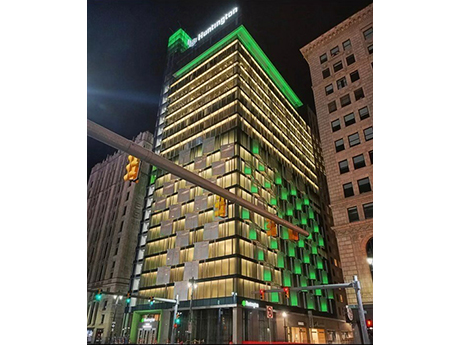

DETROIT — The Herrick Co. has acquired a 21-story office tower at 2025 Woodward Ave. in downtown Detroit for $150 million. Locally based architecture firm Neumann Smith designed the 421,481-square-foot building, which was delivered in fall 2022 and acts as a headquarters for Huntington National Bank’s (NASDAQ: HBAN) commercial division. The bank fully occupies the property on a triple-net-lease basis. The building features ground-floor retail space, including a Huntington Bank branch; 10 floors of structured parking; a cafe; and a rooftop terrace with space for movies or sporting events to be projected on the side of the tower. The deal is the largest building acquisition to close in Detroit since the start of the COVID-19 pandemic, according to Crain’s Detroit Business. The seller was not disclosed. Huntington acquired TCF Financial Corp. in 2020 for $22 billion. The combined company operates more than 1,000 branches in 11 states. The bank’s stock price closed at $11.42 per share on Wed. June 7, down from $13.10 one year ago. The Herrick Co. is a national real estate investment firm that has completed more than $6 billion in transactions. The company focuses on acquiring single-tenant buildings net leased to office, industrial and retail users, …