AMARILLO, TEXAS — Coldwell Banker Commercial First Equity has negotiated a 51,848-square-foot office lease in Amarillo. The 237,204-square-foot building at 701 S. Taylor St. is located in the downtown area. Rachel Shreffler of Coldwell Banker represented the landlord, an entity doing business as 1908 Properties LLC, in the lease negotiations. The name and representative of the tenant were not disclosed, but the space can support more than 300 employees.

Office

We are fortunate to live and work in a region that experiences steady growth and maintains a healthy economy. From a commercial real estate perspective, the Richmond market is a consistent performer due to its diversified economy and reliable and consistent business drivers. Industrial and multifamily construction activity has remained strong without being overbuilt, eliminating the pattern of “boom and bust” that some other areas experience. A submarket that has been red hot is Scott’s Addition, a 20-square-block neighborhood that has been transformed from warehouses and light industrial to a mixed-use mecca of multifamily, office and retail. Developers and tenants alike appreciate the proximity to the interstate, numerous amenities and abundant diversity within the community. Exceptional walkability scores, along with a thriving restaurant and brewery scene, seem to be driving tenants’ willingness to pay the highest rents in the area. The high cost of new construction also informs these rents and, ultimately, is passed through to end users. Scott’s Addition will likely continue to be a desirable location for many, although high rents and challenging parking will remain an issue for some. Another very desirable submarket and consistent performer is Glen Forest. Primarily office- and medical-focused, this area offers Class …

HOUSTON — Noble Corp. has signed a 110,250-square-foot office lease in West Houston. The global offshore drilling contractor is taking three floors at Building 1 at the 39-acre CityWestPlace, with occupancy slated for early 2025. Mark O’Donnell, Jim Bell and Jennifer Meehan of Savills represented the tenant in the lease negotiations. J.P. Hutcheson and Rima Soroka internally represented the owner, a partnership between Parkway and Midway.

BLOOMINGTON, MINN. — Burns & McDonnell, an engineering, construction and architecture firm, has signed a 67,000-square-foot office lease at Norman Pointe II in Bloomington. Michael Gelfman and Nate Karrick of Colliers represented ownership. The lease marks one of the largest office leases in the Minneapolis market this year, according to Colliers. Burns & McDonnell previously occupied 45,000 square feet at 8201 Norman Center Drive in Bloomington. Built in 2007, Norman Pointe II is located at 5600 American Blvd. at the I-494 and Highway 100 interchange. The 10-story building totals 331,447 square feet and offers amenities such as a café, 100-person conference center, fitness center, daycare and covered parking. Doug Fulton and Rob Youngquist of Avison Young represented Burns & McDonnell, which secured building signage. Norman Pointe II is now 95 percent leased.

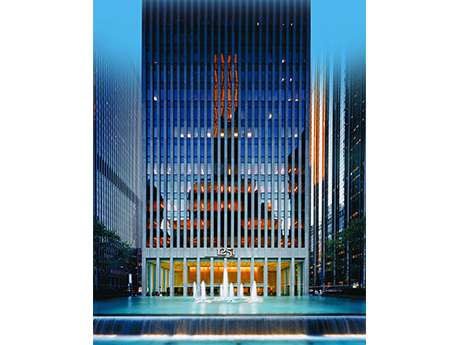

NEW YORK CITY — Daiwa Capital Markets America Inc. (DCMA) has signed a 20-year, 44,100-square-foot office lease in Midtown Manhattan. The financial services firm will occupy the entire 49th floor at 1251 Avenue of the Americas. Erik Schmall and Scott Weiss of Savills represented DCMA in the lease negotiations. David Falk and Peter Shimkin of Newmark represented the landlord, Mitsui Fudosan America. A tenant-only conference facility is under construction at the building, and the lobby was recently renovated. Three new food-and-beverage concepts are also set to open at the building in the coming weeks.

ASHBURN, VA. — Finmarc Management Inc. has sold a 25.3-acre site at 19886 Ashburn Road in Ashburn, a city in Loudoun County. The buyer, a data center developer doing business as JK Land Holdings LLC, purchased the site for $60 million. The new ownership plans to develop a new 360,000-square-foot data center on the site. The construction timeline for the project was not disclosed. Ryan Goeller of KLNB represented JK Land Holdings in the land acquisition, and Rob Faktorow, Josh Greenberg and Anna Faktorow of CBRE represented the seller. Finmarc acquired the site, which includes a 110,000 square foot office building and a nearly 80,000-square-foot industrial/R&D structure, in 2019. The two-building portfolio currently serves as the global headquarters for Telos Corp., a cybersecurity IT firm that has occupied the facility since 1988.

NEW YORK CITY — GrowthCurve Capital LP has signed a 13,350-square-foot office lease in Midtown Manhattan. The private equity firm is relocating from 1301 Avenue of the Americas to the 33rd floor of the 990,000-square-foot building at 250 W. 55th St. Peter Turchin, Caroline Merck, Arkady Smolyansky and Ali Gordon of CBRE represented the landlord, Boston Properties, in the lease negotiations. Jonathan Luttwak and James Cassidy of DHC Real Estate Services, along with Louis D’Avanzo of Cushman & Wakefield, represented the tenant.

Marcus & Millichap Negotiates Sale of Harbor West Medical Plaza in La Habra, California

by Amy Works

LA HABRA, CALIF. — Marcus & Millichap has brokered the sale of Harbor West Medical Plaza, an office property located at 860 E. La Habra Blvd. in the Orange County city of La Habra. An undisclosed seller sold the asset to a private investor for $1.8 million. The two-story Harbor West Medical Plaza features 12,760 square feet of medical and professional office space with 22 suites, most of which were occupied at close of escrow. Alex Mobin and Greg Bassirpou of Marcus & Millichap’s Orange County office represented the seller in the deal.

HOUSTON — Austin-based Capital Commercial Investments has purchased The Offices at Greenhouse, a 203,284-square-foot office complex located in the Energy Corridor area of West Houston. The property offers a conference center, tenant lounge, outdoor green space, bike storage space and onsite car wash/detailing services. Capital Commercial plans to upgrade certain areas of the property and has tapped Transwestern as the leasing agent. The seller and sales price were not disclosed.

BH Properties Receives $3M Bridge Loan for Acquisition of Olympic Block Mixed-Use Complex in Seattle

by Amy Works

SEATTLE — Gantry has arranged a $3 million bridge loan to finance the acquisition and repositioning of Olympic Block, a downtown Seattle mixed-use complex. The borrower is BH Properties. Located at 101 Yesler Way, the 75,000-square-foot property offers creative office space and ground-floor retail space. Acquired through a deed in lieu of foreclosure, the financing was based on a reset 2024 valuation, recognizing current vacancy and related cash flow challenges. Mark Ritchie and Alicia Sabanero of Gantry secured the three-year, fixed-rate loan through one of Gantry’s correspondent insurance company lenders. The financing features interest-only payments for the entirety of its duration.