JERSEY CITY, N.J. — Bank of America has signed a 550,000-square-foot office lease at Newport Tower in Jersey City. Newport Tower is a 36-story, 1.1 million-square-foot waterfront building that recently underwent a multimillion-dollar renovation and connects via skybridge to the 1 million-square-foot Newport Centre Mall. Building amenities include eight onsite dining options, a fitness center, game room, tenant lounge, coworking spaces and meeting rooms. Robert Rudin, David DeMatteis, Mina Shehata, Dirk Hrobsky, Karl Helgessen, Jan Randall Dausend and Christina Magill of Cushman & Wakefield represented the landlord, BentallGreenOak, in the lease negotiations. Bob Alexander, Ryan Alexander and Taylor Callaghan of CBRE represented Bank of America.

Office

HAMILTON, N.J. — Fennelly Associates has signed a 19,008-square-foot office lease at a 47,464-square-foot building located at 200 Horizon Drive in the Central New Jersey community of Hamilton. The tenant, Micro-Air, a designer and manufacturer of air conditioning control systems for boats and RVs, is relocating from a 7,850-square-foot space in nearby Allentown. Jerry Fennelly of Fennelly Associates represented the landlord, Cammeby’s Management, in the lease negotiations. Micro-Air was self-represented.

Anchor Point Capital Negotiates $12.2M Sale of Plaza Diamond Bar Office/Retail Campus in Los Angeles County

by Amy Works

DIAMOND BAR, CALIF. — Anchor Point Capital has arranged the sale of Plaza Diamond Bar, a two-building office and retail property in Diamond Bar, approximately 30 miles east of Los Angeles. Two separate buyers, both private investors, acquired the assets for a combined total of $12.2 million. The seller of both assets was a partnership led by Metro Properties LLC. The office building, located at 2040 S. Brea Canyon Road, sold as an all-cash deal, and the retail building, at 2020 S. Brea Canyon Road, sold with a creative seller financing structured by Anchor Point Capital. Built in 2007, the two-story, 25,000-square-foot office building was 40 percent occupied by a variety of medical and related tenants. Built in 1980 and renovated in 1992, the single-story, 8,000-square-foot, multi-tenant retail building was 50 percent leased at the time of sale. Eric Vu of Newport Beach-based Anchor Point Capital handled the transactions.

OVERLAND PARK, KAN. — Walnut Risk Management LLC has signed a 5,640-square-foot office lease at the Aspiria campus in Overland Park. The insurance broker firm specializes in commercial and personal lines insurance brokerage. Construction has begun on the build-out of Walnut Risk Management’s new office, and the company plans to take occupancy in June. Wichita-based Occidental Management owns and manages the Aspiria campus, which is the redevelopment of the former Sprint headquarters.

Affordable HousingDevelopmentFloridaLeasing ActivityMixed-UseMultifamilyOfficeRestaurantRetailSeniors HousingSoutheastTop Stories

SG Holdings Completes Leasing at $350M Mixed-Use Development in Miami, Plans Summer Opening

by John Nelson

MIAMI — SG Holdings has completed leasing at Sawyer’s Walk, a 3.4-acre mixed-use development underway in Miami’s Overtown neighborhood. The project, which will feature retail space, offices and affordable housing for seniors, is set to open this summer. SG Holdings is a partnership comprising Swerdlow Group, SJM Partners and Alben Duffie. The development team broke ground on Sawyer’s Walk in summer 2021. The development costs were not disclosed, but the Miami Herald reported the price tag hovers around $350 million. “The anticipated delivery of our mixed-use development will serve as an economic catalyst for Overtown, with the creation of over 1,000 quality jobs, the opening of a new full-service supermarket and mix of national retail stores that will serve the immediate community and surrounding neighborhoods,” says Michael Swerdlow, managing partner of Swerdlow Group. Sawyer’s Walk will feature 175,000 square feet of retail space. Committed tenants include Target (50,000 square feet), Aldi (25,000 square feet), Ross Dress for Less, Five Below, Tropical Smoothie Café and Burlington. MSC Group, a global cargo ship line and the world’s third-largest cruise line, purchased the property’s 130,000 square feet of office space with plans to combine its South Florida cruise and cargo operations under one roof. …

By Nick Fiquette, Sansone Group Lingering effects of COVID-19 In the aftermath of the global pandemic, the St. Louis real estate market finds itself at a crossroads, continuing to see the persistent impacts of COVID-19. Corporate strategies are evolving as companies evaluate their real estate footprints to accommodate the changing work environment and desires of employees. As lease expirations loom, businesses are engaged in a delicate dance of evaluating their physical space needs. The pendulum of work-from-home policies, initially adopted to streamline footprints, appears to be swinging back. Recently, Edward Jones listed a 227,000-square-foot Class A building that it owns on the market for lease and is planning on occupying it instead. This example could serve as a positive indicator for the future of the office market. The market is transforming as companies look to accommodate employee demands, prioritizing safe, walkable areas and amenity-rich buildings. This shift is particularly evident in the struggle faced by commodity real estate, as businesses increasingly gravitate toward locations that contribute positively to the employee experience. As a result, investors are remaining cautious about purchasing office assets due to surging interest rates and uncertainties surrounding the future of the office market. Corporate giants reevaluate real …

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

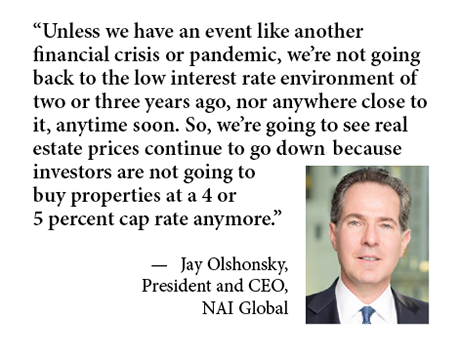

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

Feil Organization Signs New Tenant to 9,000 SF Office, Retail Lease in Metairie, Louisiana

by John Nelson

METAIRIE, LA. — The Feil Organization has signed FastPass Tag and Title LLC to a 9,000-square-foot lease in Metairie, a suburb of New Orleans. The tenant will occupy two suites at 3445 North Causeway Boulevard, a 10-story, 127,858-square-foot office building. One suite will include a retail space where customers can obtain and renew their drivers’ licenses and IDs, while the second space will be dedicated to the company’s back-of-house and office operations. Scott Graf of Corporate Realty represented Feil Organization in the lease transaction.

NEW YORK CITY — JLL has arranged a $33 million loan for the refinancing of 111 West 19th Street, an eight-story, 189,731-square-foot office and retail building in Manhattan’s Chelsea neighborhood. The building was originally constructed in 1901 and comprises eight suites, according to StreetEasy.com. Aaron Niedermayer of JLL arranged the financing through Citigroup Inc. on behalf of the borrower, locally based investment firm The Kaufman Organization.

JERSEY CITY, N.J. — Biotechnology firm Eikon Therapeutics has signed a 36,284-square-foot office lease at 3 Second Street, an 18-story, 600,000-square-foot building in Jersey City. The building boasts a redesigned lobby with concierge services, tenant lounge and multiple onsite dining options. David DeMatteis, Robert Rudin, Mina Shehata and Dirk Hrobsky of Cushman & Wakefield represented the landlord, funds managed by Ares Management, in the lease negotiations. Bill Hartman and James Gale of CBRE represented Eikon Therapeutics.