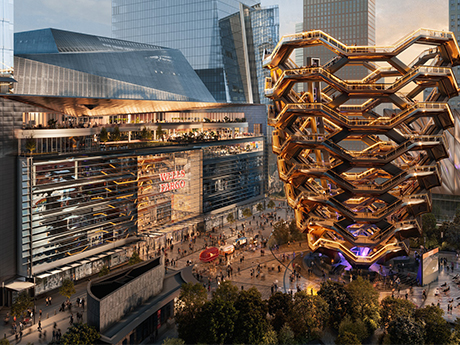

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …

Office

STRASBURG, COLO. — Trevey Commercial Real Estate has arranged the sale of an office and retail property located at 1477 Main St. in Strasburg, a small town approximately 30 miles east of Denver. Maverick Holdings LLC sold the building to Strasburg Management Group for $1.3 million. Situated on 0.2 acres, the freestanding, owner-user building features 7,793 square feet of office and retail space. Heath Honbarrier and Nick Beach of Trevey Commercial Real Estate represented the seller, while Matt Trone of Cushman & Wakefield represented the buyer in the deal.

DENVER — NorthPeak Commercial Advisors has negotiated the sale of an office building located at 1638-1640 Logan St. in Denver. The asset traded for $1.2 million, or $221 per square foot. The undisclosed buyer plans to add a coffee shop to the first floor of the 5,657-square-foot building and keep the existing office tenants on the upper floors. Joe Hornstein and Scott Fetter of NorthPeak Commercial Advisors represented the undisclosed seller in the deal.

PLANO, TEXAS — Cybersecurity firm Intrusion has signed a 10,705-square-foot office lease at Plano Tower, a 225,445-square-foot building located on the northern outskirts of Dallas. The building houses amenities such as a recently upgraded lobby and conference center, as well as a fitness center and a deli. Chris Mathis of Newmark represented the tenant in the lease negotiations. Boxer Property Group owns the building.

NEW YORK CITY — IMA New York, a division of insurance brokerage firm IMA Financial Group, has signed a 10,000-square-foot office lease at 1155 Avenue of the Americas in Midtown Manhattan. The lease term is 10 years. The tenant will occupy space on the 33rd floor of the 42-story building. Howard Hersch and Brett Harvey of JLL represented the tenant in the lease negotiations. Tom Bow, Rocco Romeo and Nora Caliban internally represented the landlord, The Durst Organization, which recently completed a $130 million capital improvement program at the property.

HOUSTON — Locally based brokerage firm Fritsche Anderson Realty Partners has negotiated the sale of an 84,000-square-foot office building that sits on a 4.8-acre site at 509 N. Sam Houston Parkway E in North Houston. According to LoopNet, the building rises six stories and was originally constructed in 1984 and renovated in 2021. Brandon Wuntch, Drew Altmann and Jim McGonigle of Fritsche Anderson represented the undisclosed buyer in the transaction. The seller and sales price were also not disclosed.

BUFFALO, N.Y. — Locally based financial intermediary Largo Capital has arranged an $11.1 million first mortgage loan for the refinancing of a 150,000-square-foot office building in Buffalo. Jack Phillips of Largo Capital arranged the financing on behalf of the undisclosed buyer. The direct lender was not disclosed. The building was fully leased at the time of the loan closing.

Joint Venture Releases Plans, Renderings for $500M Mixed-Use Destination in Downtown Orlando

by John Nelson

ORLANDO, FLA. — A joint venture between SED Development LLC, JMA Ventures LLC and Machete Group Inc. has released new plans and renderings for a mixed-use destination in downtown Orlando. The development, dubbed the Orlando Sports + Entertainment District, will span 8.5 acres adjacent to Amway Center, the home arena for the NBA’s Orlando Magic. The Orlando Sentinel reports the project will cost roughly $500 million to develop. The 900,000-square-foot destination will include a 260-room hotel with an outdoor lounge and pool deck, as well as meeting space and a chef-driven restaurant. Other components will include a 270-unit high-rise apartment tower, 200,000 square feet of Class A offices that are 30 percent preleased, 1.5 acres of central green space, 100,000 square feet of shops and restaurants and a 3,500-seat live music venue that can double as an events space with the capacity to host up to 1,000 guests. The construction timeline for Orlando Sports + Entertainment District was not released.

NEW YORK CITY — Beechhurst Executive Suites has renewed its lease for 6,936 square feet on the second floor of Whitestone Plaza, a 62,000-square-foot urban community shopping center located on the north side of Queens. Randall Briskin represented the landlord, The Feil Organization, in the lease negotiations on an internal basis. The tenant was self-represented. Other tenants at Whitestone Plaza include CVS and North Shore Farms supermarket.

NEW YORK CITY — Law firm Meltzer, Lippe, Goldstein & Breitstone LLP signed a 5,835-square-foot office lease expansion at 70 E. 55th St. in Midtown Manhattan. The lease term is 10.5 years. The 27-story, 154,000-square-foot building is known as Heron Tower and was originally constructed in 1985. Diana Biasotti, Kristen Morgan and Thomas Swartz of JLL represented the landlord in the lease negotiations. Nicholas Markel of Cresa represented the tenant.