GRAND RAPIDS, MICH. — CBRE has relocated its Grand Rapids office from 634 Front Ave. to 200 Ottawa Ave. The brokerage has expanded its footprint from 1,444 square feet to 4,350 square feet. The new space in the central business district features conference rooms and free-address seating — where no employee has a dedicated desk or private office.

Office

SOUTHLAKE, TEXAS — RobotLAB Inc., an educational technology company that manufactures robotics and virtual reality products, has signed a 26,000-square-foot office lease in Southlake, a northern suburb of Fort Worth. The tenant is taking space at the 380,000-square-foot VariSpace Southlake facility, which offers an array of flexible workspace options. Chris Taylor, Johnny Johnson and Zach Bean of Cushman & Wakefield represented the landlord, VariSpace, in the lease negotiations. Eric Cannon of Silver Tree Management represented RobotLAB.

Chevron Acquires 77 Acres in Metro Houston, Plans Include Potential Research-and-Development Campus

by John Nelson

CYPRESS, TEXAS — Oil-and-gas giant Chevron Corp. (NYSE: CVX) has acquired 77 acres in the northwest Houston suburb of Cypress. The parcel is situated within Bridgeland Central, a multi-phase campus spanning 925 acres within the larger Bridgeland master-planned community. The land seller was The Howard Hughes Corp. (NYSE: HHH), the master developer of the 11,500-acre Bridgeland development. The sales price for the Chevron land deal was not disclosed. “Chevron’s acquisition marks a pivotal moment for Bridgeland as the community enters its next phase of development as a leading job center for the region,” says Jim Carman, president of the Houston region for Howard Hughes Corp. “One of the top-selling communities in the country, Bridgeland is poised to benefit from the influx of businesses and their employees seeking to live and work in a centralized location that offers commercial opportunities, as well as single-family and multifamily housing options to meet growing demand.” Daniel Abate, head of corporate real estate for Chevron, says the company could potentially establish a research-and-development campus on the newly acquired land. “Chevron is attracted to the opportunities Bridgeland has to offer and views this acquisition as a strong addition to our asset portfolio,” says Abate. Details about the …

DALLAS — Mexican investment firm Grupo Haddad has completed the $8 million renovation of a 110,000-square-foot office building located at 2501 Cedar Springs Road in Uptown Dallas. The seven-story building was originally constructed in 1982. The renovation delivered an upgraded lobby, ground-floor restaurant with patio seating, tenant conference center, upgraded parking garage and enhanced common areas and restrooms. Significant improvements were also made to the building’s systems and equipment. Grupo Haddad has tapped Newmark to lease the newly renovated space.

ST. PAUL, MINN. — Transwestern Real Estate Services has brokered the sale of Landmark Towers, a 200,000-square-foot office building in St. Paul. The buyer, Sherman Associates, intends to convert the property into apartment units. Mike Salmen and Erik Coglianese of Transwestern represented the undisclosed seller. The property is located at 345 Saint Peter St.

CHICAGO — BGO has launched Move-In Ready Offices (MIRO) to provide small and medium-sized businesses with immediate access to adaptable workspaces. Current MIRO suites range from 1,000 to 18,000 square feet and offer immediate occupancy and flexible lease terms. BGO currently has MIRO suites available in Chicago, New York, Boston, San Francisco and Washington, D.C. The firm plans to deliver more prebuilt suites across its entire U.S. office portfolio. Gensler and Michaelis Boyd designed the spaces. MIRO offers both private workstations and collaboration spaces. Tenants also benefit from access to amenity centers, townhalls and various perks. As of June 30, BGO had $83 billion of assets under management.

MIDDLEBURY, CONN. — Watchmaker Timex Group USA has sold its 84,886-square-foot corporate headquarters complex in Middlebury, Conn., for $7.5 million. Chris O’Hara of Coldwell Banker Commercial represented Timex Group in the sale to a partnership between Drubner Equities Florida LLC and Atlantic Management. The site spans 93 acres, and the new ownership plans to redevelop the complex into a 720,000-square-foot industrial park.

CANTON, MASS. — Massachusetts-based design-build firm Dacon has completed a 30,000-square-foot, build-to-suit headquarters project for healthy snack food provider 88 Acres in Canton, a southern suburb of Boston. The facility at 85 John Road, which allows the company to more than quintuple its production, features a quality control lab, R&D lab, production area, cooling room, warehouse, executive offices and conference rooms. Camber Development owns the building.

COLORADO SPRINGS, COLO. — Marcus & Millichap has brokered the sale of an office building located 5010 El Camino Drive in Colorado Springs. A private investor sold the asset to an undisclosed buyer for $1.4 million. The two-story property features 9,000 square feet of multi-tenant office space. Erik Enstad, Brandon Kramer and Chadd Nelson of Marcus & Millichap represented the seller in the transaction.

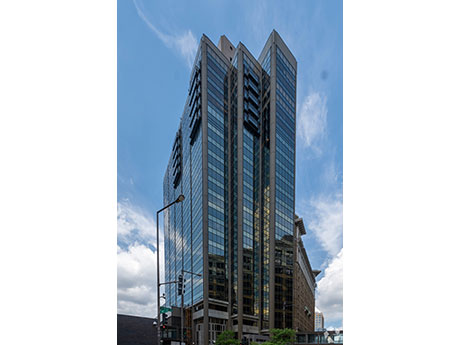

Canyon Partners, J.P. Morgan Provide $174.6M Recapitalization Loan for One22One Office Tower in Nashville

by John Nelson

NASHVILLE, TENN. — Canyon Partners Real Estate and J.P. Morgan have co-originated a $174.6 million construction loan for the recapitalization of One22One, a 24-story office tower in Nashville. The borrower, a joint venture between locally based GBT Realty and Koch Real Estate Investments, delivered the Class A property last summer. One22One comprises 373,232 square feet of office space, 16,938 square feet of retail space and 13 stories of parking totaling 930 spaces. Amenities include a conference center, outdoor terrace overlooking downtown Nashville, tenant lounge, port cochere and a fitness center. Tenants include law firm Bradley Arant Boult Cummings LLP, FirstBank, which will also relocate its headquarters to One22One, and Slalom, a global management consulting company.