WASHINGTON, D.C. — Arctaris Impact Investors LLC has completed Phase I of Northeast Heights, a six-story, 281,000-square-foot office building in Ward 7 of Washington, D.C. The office building is located in a Qualified Opportunity Zone, which is an economically distressed area where new investments may be eligible for preferential tax treatment. The office building is the first phase of a three-phase, $600 million effort to revitalize Ward 7, according to Arctaris’ website. Future phases of Northeast Heights are expected to include a grocery store redevelopment, approximately 1,300 residential units and community spaces. According to Arctaris, the project was catalyzed by D.C. Mayor Muriel Bowser’s mandate for city agencies to use the leasing power of the D.C. government to encourage economic development in historically underserved communities. Northeast Heights was pre-leased to the city’s Department of General Services and will serve as the new headquarters for the agency, which employs approximately 700 people. The Department of General Services was the first city agency to sign a contract for office space east of the Anacostia River under this initiative. “Arctaris is proud to be part of the coalition led by Mayor Bowser, combining forces with like-minded, community-oriented investors to help bring new vitality …

Office

— By Jerry Holdner, Avison Young — Southern California Region Lead, Innovation & Insight, AVANT — The San Diego office market is starting to show signs of weakness. Unemployment remains low, but it is important to highlight that job creation has been uneven. The bright spot is that high-value-added jobs in a broad range of sectors, such as scientific research, medical products and pharmaceutical development continue to grow, which bodes well for San Diego. We are still uncertain about a recession. It could be short and shallow like many are predicting, or we could be in for a period of monumental headwinds. Investment sales have retreated as interest rates increased, and office workers have been reluctant to return to the office. This has created an uncertain picture of our office market going forward. The rise and future uncertainty of the pace of inflation has caused many to take a “pencils down” approach. This has caused many to slow, pause or even halt their dealmaking, growth, capital investment and development efforts as the ability to borrow funds has become difficult. San Diego’s office vacancy currently stands at 12.3 percent, and 18.9 percent of the total office market is available (including sublease …

Rockefeller Group Breaks Ground on 1072 West Peachtree Mixed-Use Tower in Midtown Atlanta

by John Nelson

ATLANTA — Rockefeller Group has broken ground on 1072 West Peachtree, a mixed-use high-rise tower in Midtown Atlanta. At a planned height of 730 feet, the tower is slated to be the tallest building delivered in Atlanta in the past 30 years, according to Rockefeller. Situated at the corner of 12th and West Peachtree streets, the property will comprise more than 350 luxury apartments and amenities situated atop 224,000 square feet of flexible, Class A offices and 6,400 square feet of street-level retail space. Sumitomo Mitsui Trust Bank Ltd. is providing construction financing in the form of a senior loan to Rockefeller. A joint venture between Rockefeller, Japan-based Taisei USA LLC and Mitsubishi Estate New York is providing equity. Atlanta-based TVS was the lead architect for 1072 West Peachtree. A construction timeline was not disclosed.

NEWTON, MASS. — Newmark has brokered the sale of a 28,244-square-foot office complex located at 70 Wells Ave. in the western Boston suburb of Newton. The sales price was roughly $4 million. Robert Griffin, Joseph Alvarado, George Demoulas and Casey Valente of Newmark represented the seller, Wingate Cos., in the transaction. The team also procured the buyer, Legacy Real Estate Ventures.

MINNEAPOLIS — CBRE has arranged the $225 million sale of the office component of RBC Gateway Tower, a newly constructed mixed-use development located at 250 Nicollet Mall in Minneapolis. The portion acquired by San Francisco-based Spear Street Capital includes 525,000 square feet of office space, a ground-floor office lobby and 296 below-grade parking spaces. Ryan Watts, Tom Holtz, Brandon McMenomy, Steven Ward, Greg Greene and Harrison Wagenseil of CBRE represented the seller, United Properties, in the transaction. The office portion of the property was 99 percent leased at the time of sale to six tenants including RBC Capital Markets, United Properties and Pohlad Cos. The 1.2 million-square-foot tower also includes the 222-room Four Seasons Hotel Minneapolis — Minnesota’s first five-star hotel, according to CBRE — and 34 luxury Four Seasons Private Residences on the uppermost floors. Three restaurants are also on-site, including a full-service restaurant and bar, Mara, and Socca Café. “RBC Gateway Tower is a crown jewel in the Gateway District, with unmatched location and amenities,” says Watts of CBRE. “Premier properties like this offer exceptional workspaces that cater to the needs of modern employees, making them highly desirable as companies adapt to new workplace trends.” Minneapolis-based United Properties …

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ Second-Quarter 2023 Economic Review by Sector

Lee & Associates’ newly released 2023 Q2 North America Market Report outlines industrial, office, retail and multifamily outlooks trends in the United States. This sector-based review of commercial real estate trends for the second quarter of the year examines the difficulties facing each property type and where opportunities in the landscape may be emerging. Troubles with absorption dogged each sector, with the exception of retail, throughout the first half of 2023. Scheduled deliveries for industrial, office and multifamily indicate this trend will continue throughout much of the United States for the foreseeable future. Lee & Associates has made the full market report available here (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city). The summaries from each sector below provide high-level considerations of the overall outlook and challenges in the market. Industrial Overview: Industrial Growth on Track for Least Gain in Years In a reversal from the ballooning logistics capacities required during the pandemic, demand for industrial space has slowed across North America. After continuously rebuilding inventories from the fall of 2021 through the third quarter of last year, many retailers and wholesalers are taking a breather, pausing further inventory accumulation out of caution over …

Altus Realty to Convert Downtown D.C. Office Building Into Mint House Flexible Rental Space

by John Nelson

WASHINGTON, D.C. — Altus Realty plans to convert an 11-story office building located at 1010 Vermont Ave. NW into Mint House Downtown Washington, D.C. Set to open in early 2025, the property will encompass 85 apartment-style flexible rental units that Mint House will operate. The spaces will be designed for guests who need accommodations ranging from two days to two months. The rooms will range from studios to two-bedroom units that will include a kitchen with a stove and dishwasher, as well as washers/dryers and work spaces. Amenities will include an onsite fitness facility, meeting space and a café. Altus Realty plans to begin repositioning the former office building this fall. The property is situated near a Metro station, McPherson Square Park, The White House and DuPont Circle. This will be the first location in downtown D.C. for Mint House, which operates 25 flexible rental destinations in 16 states. Mint House recently opened locations in Dallas; Birmingham, Ala., and St. Petersburg, Fla.

Redline Completes Renovations at Port 26 Creative Office Building in North Charleston, Signs First Tenant

by John Nelson

NORTH CHARLESTON, S.C. — Redline Property Partners has completed renovations at Port 26, an 85,000-square-foot creative office/flex building located at 2155 Eagle Drive in North Charleston. The firm purchased the former industrial facility in December 2021. Building renovations included transforming the building’s exterior, common areas and restrooms; redesigning entrances and lobbies; and creating tenant lounges, outdoor patios and a dog park. Redline also fully upgraded most of the building’s systems. Situated along I-26, Port 26 will soon be home to its first tenant, RXO, a transportation and logistics provider. Nick Tanana and Brady Dashiell of Cushman & Wakefield provide leasing services for Port 26 on behalf of Redline.

Trinity Partners Arranges Sale of 58,064 SF Office Building in Charlotte’s SouthPark Submarket

by John Nelson

CHARLOTTE, N.C. — Trinity Partners has arranged the sale of a 58,064-square-foot office building located at 6201 Fairview Road in Charlotte’s SouthPark office submarket. An affiliate of Charlotte-based Big V Property Group purchased the office building from an affiliate of The Daniels Co., an investment firm based in Bluefield, W.Va. Roger Cobb of Selwyn Property Group represented the buyer in the transaction. Dunn Mileham, David Morris and Eric Jennings of Trinity Partners represented the seller. The sales price was not disclosed. The office building was 59 percent leased at the time to sale, and Big V plans to relocate its Charlotte office to the fourth floor.

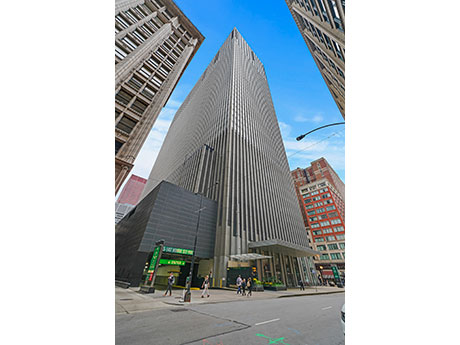

CHICAGO — Analytics8, a consulting firm that specializes in data strategy implementation, has signed a 13,355-square-foot office lease at 55 East Monroe in Chicago for its new U.S. headquarters. The firm is more than doubling its current 6,000-square-foot space at 150 N. Michigan. Victor Sanmiguel of Bespoke Commercial Real Estate represented Analytics8. Michael Lirtzman, Marina Zelenkova and Michelle Levy of Colliers represented the landlord, PGIM Real Estate. Rising 49 stories and totaling 1.2 million square feet, 55 East Monroe is situated in the city’s East Loop submarket. Amenities include a 3,400-square-foot conference center, 10,000-square-foot fitness center and the 10,000-square-foot Forum 55 food hall. More than 90,000 square feet of leases have been signed at the property within the last seven months. PGIM has unveiled plans to upgrade the building’s common areas, including the lobby, conference center and other amenity spaces in 2024.