SAN DIEGO — Cabrillo Credit Union has acquired a 20,060-square-foot office building in the Kearny Mesa submarket of San Diego for $7.9 million. The building is located at 3710 Ruffin Road. It features solar panels, open ceilings, creative office space, private offices, conference rooms, and employee breakrooms and restrooms on each floor. The property was renovated in 2019. CBRE’s Phil Linton and Nick Bonner represented the seller, the Council of Community Clinics, which will lease back a quarter of the building.

Office

DALLAS — Law firm Simon Greenstone Panatier has signed a 28,366-square-foot office lease at Bank of America Plaza in downtown Dallas. The 72-story, 1.8 million-square-foot complex offers a fitness center, conference facilities, tenant lounge, car wash services and multiple onsite dining options. Ryan Hoopes, Tom Sutherland and Dean Dahlsten of Cushman & Wakefield represented the tenant in the lease negotiations. Russ Johnson and Joel Pustmueller of JLL represented the landlord, Metropolis Investment Holdings Inc.

NEW YORK CITY — West Publishing Corp. has signed a five-year, 46,105-square-foot office lease extension at 3 Times Square in Midtown Manhattan. The company will occupy the entire 17th floor and a portion of the 18th floor at the 885,000-square-foot building, which was originally constructed in 2001 as the headquarters for Reuters and recently underwent a capital improvement program. Mitchell Konsker, Dan Turkewitz and Christine Tong of JLL represented the tenant in the lease negotiations. Tom Keating represented the landlord, locally based investment firm Rudin, on an internal basis.

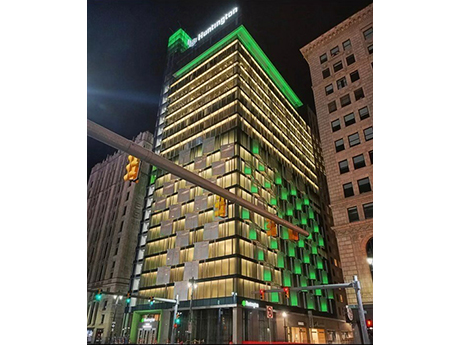

DETROIT — The Herrick Co. has acquired a 21-story office tower at 2025 Woodward Ave. in downtown Detroit for $150 million. Locally based architecture firm Neumann Smith designed the 421,481-square-foot building, which was delivered in fall 2022 and acts as a headquarters for Huntington National Bank’s (NASDAQ: HBAN) commercial division. The bank fully occupies the property on a triple-net-lease basis. The building features ground-floor retail space, including a Huntington Bank branch; 10 floors of structured parking; a cafe; and a rooftop terrace with space for movies or sporting events to be projected on the side of the tower. The deal is the largest building acquisition to close in Detroit since the start of the COVID-19 pandemic, according to Crain’s Detroit Business. The seller was not disclosed. Huntington acquired TCF Financial Corp. in 2020 for $22 billion. The combined company operates more than 1,000 branches in 11 states. The bank’s stock price closed at $11.42 per share on Wed. June 7, down from $13.10 one year ago. The Herrick Co. is a national real estate investment firm that has completed more than $6 billion in transactions. The company focuses on acquiring single-tenant buildings net leased to office, industrial and retail users, …

EL SEGUNDO, CALIF. — Diamond Realty Holdings has purchased an industrial flex/office building in El Segundo for $6 million. The property is located at the intersection of Lairport Street and East Mariposa Avenue. A long-term tenant currently occupies 2,400 square feet of the main, 14,400-square-foot structure. The remaining 12,000 square feet is available for lease and fully divisible. The new ownership plans to complete interior and exterior renovations to improve the façade and access to the site, as well as create open flex industrial space that can accommodate a variety of uses. CBRE’s Bob Healey, John Lane, Richard Melbye and Jane Healey represented both the buyer and the undisclosed seller in the transaction.

SALT LAKE CITY — CBRE has arranged leases for four new tenants at a 22-story, Class A office building in Salt Lake City. The building is located at 222 South Main St. and is now fully occupied. The new tenants include UMB Bank, global law firm Greenberg Traurig, CBRE itself and HKS Architects. CBRE’s Scott Wilmarth and Nadia Letey represented the landlord, KBS, in the lease transactions.

Pasadena Child Development Associates Leases 16,163 SF Medical Office Space in Pasadena, California

by Jeff Shaw

PASADENA, CALIF. — Pasadena Child Development Associates (PCDA) has leased 16,163 square feet of office and medical office space in Pasadena. The lease encompasses two adjacent buildings, one located at 790 East Green St. and the other at 118 South Oak Knoll Ave. Both buildings are located in Pasadena’s Central Business District. The East Green space is an 8,027-square-foot office medical building. The Oak Knoll space is a two-story office building covering 8,136 square feet. Tina LaMonica of NAI Capital Commercial represented the tenant in the lease transactions.

NEW YORK CITY — First Look Media, a nonprofit organization that offers streaming and production services, has signed a 7,896-square-foot office lease at 853 Broadway in Manhattan. The lease term is five years, and the space spans the entire 10th floor. The 21-story, 157,000-square-foot building is currently undergoing a multimillion-dollar renovation. Andrew Wiener and Rob Fisher internally represented the landlord, The Feil Organization, in the lease negotiations. Gary Stein, Ken Ruderman and Michael Bertini of Savills represented First Look Media.

BOISE, IDAHO — Capstone Cos. has expanded its brokerage firm with a new regional office in Boise. Colton Yasinski, who has transacted hundreds of units in the Idaho market, including affordable LIHTC product, value-add multifamily and Class A market rate assets, leads the new office. Expanding into Boise reinforces Capstone’s presence in the Western U.S. as the company seeks rapid growth and expansion in the multifamily sector. With the opening of this new office, Capstone continues its nationwide growth with a total of 21 offices and more than $12 billion in sales.

PITTSBURGH — CBRE has negotiated a 40,000-square-foot office lease at Nova Place, a 32-acre campus located on Pittsburgh’s north side. The tenant, S&B USA Construction, plans to take occupancy of spaces on the eighth and ninth floors of Nova Tower 2 during the fourth quarter. Jeremy Kronman and Andrew Miller of CBRE represented the landlord, Faros Properties, in lease negotiations. The tenant representative was not disclosed.