PERU, ILL. — Cawley Chicago has brokered the sale of the property formerly housing Raccuglia Law Offices and an assemblage of properties in Peru, about 100 miles southwest of Chicago. The sales price and buyer were not disclosed. The Raccuglia family hired Cawley Chicago’s Jon Chamlin to liquidate the real estate portfolio of their late father, attorney Anthony Raccuglia. Included in the sale was a development site on the corner of Rock and Maple drives that consists of 0.67 acres of commercial land. The law office, constructed in 1968, will remain the local offices of Meyers Flowers Bruno McFedron & Herrmann.

Office

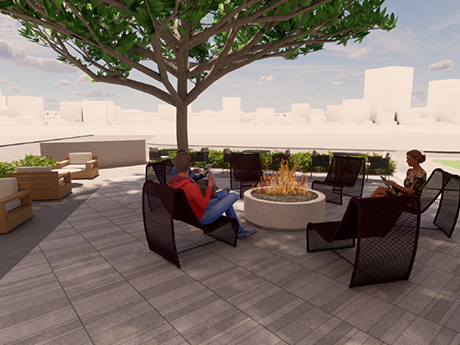

ROCKY HILL, CONN. — Virginia-based nonprofit United Way has signed a 41,815-square-foot office lease at 55 Capital Blvd. in Rocky Hill, a southern suburb of Hartford. The building is located within the 506,500-square-foot Corporate Ridge development, which offers a fitness center, game room, outdoor gathering areas and a full-service cafeteria. Bob Kelly and Jon Putnam of Cushman & Wakefield represented the landlord, KS Partners LLC, in the lease negotiations. The representative of the tenant was not disclosed.

SANTA ANA, CALIF. — A joint venture between locally based investment firm Barker Pacific Group and Las Vegas-based Kingsbarn Realty Capital has purchased Griffin Towers, a 560,000-square-foot office complex in the Southern California community of Santa Ana. The joint venture purchased Griffin Towers for $82 million from institutional investment firm Blackstone, which paid $129 million for the property in 2014, according to several business publications including The Deep Dive. Built in 1987 and recently renovated, Griffin Towers consists of twin 14-story buildings that are located at 5 and 6 Hutton Centre Drive, as well as a six-story parking garage. Amenities include a conference center with a catering kitchen, a fitness center with locker rooms, multiple electric vehicle charging stations and an outdoor bocce ball court. The buildings are home to tenants such as UKG, Michael Baker International, Psomas, Nation’s Direct Mortgage, HNTB and the Ayn Rand Institute. CBRE serves as the leasing agency for Griffin Towers. Barker Pacific Group also manages the property. The new ownership plans to continue with capital improvements by adding new amenities and upgrading select office suites. Kevin Shannan, Paul Jones and Brandon White of Newmark represented Blackstone in the transaction. David Milestone and Henry Cassiday …

CONSHOHOCKEN, PA. — The Buccini/Pollin Group, a development and investment firm with offices in Maryland and Delaware, has acquired One Tower Bridge, a 271,678-square-foot office building in the northern Philadelphia suburb of Conshohocken. Designed by Skidmore, Owings & Merrill and completed in 1989, the 15-story, riverfront building offers a fitness center, outdoor terrace and a multi-purpose room. One Tower Bridge was 92 percent leased at the time of sale, with Morgan Stanley serving as the anchor tenant. Buccini/Pollin plans to invest $9 million in capital improvements to the building. The seller and sales price were not disclosed.

LOS ANGELES — Waterbridge Capital has received $75 million in short-term first mortgage debt for its acquisition of Union Bank Plaza in downtown Los Angeles. B.H. Properties structured the financing in partnership with Hankey Capital. The quick closing allowed the buyer to acquire the historic high rise at a significant discount and avoid paying an additional 5.5 percent transfer tax under Los Angeles’ newly enacted Measure ULA, which went into effect April 1. Newmark’s Kevin Shannon represented the seller in the transaction. Colliers’ Mark Schuessler, Sean Fulp, Ryan Plummer and Jason Roth sourced the financing on behalf of the borrower.

LOS ANGELES — Stockdale Capital Partners has created a new open-ended, core-plus healthcare fund that will actively pursue medical office acquisitions. The seed investment was a 147,078-square-foot medical office building located at 2100 West 3rd Street Medical Center in Los Angeles. The space is 99 percent leased to major tenants, including Children’s Hospital of Los Angeles, Providence Health & Services and AltaMed Health Services Corporation.

NEW YORK CITY — Securitas Security Services USA has signed a 19,500-square-foot office lease at 498 Seventh Avenue in Midtown Manhattan. The company will relocate from 1412 Broadway to the 14th floor of the 25-story, 960,000-square-foot building in the fourth quarter. Andrew Conrad and Matt Coudert internally represented the landlord, George Comfort & Sons, which owns the building in partnership with Loeb Partners Realty and JR AMC, in the lease negotiations. David Opper and Eddie Sisca of CBRE represented the tenant.

BH Group, PEBB Enterprises Acquire Office Depot Campus in Boca Raton, Florida for $104M

by Jeff Shaw

BOCA RATON, FLA. — A joint venture between BH Group and PEBB Enterprises has acquired the Office Depot headquarters campus in Boca Raton for $104 million. The 650,000-square-foot asset was built in 2008 on 28.9 acres as a build-to-suit development for Office Depot. The buyers plan to renovate the property to make it a multi-tenant campus, then lease approximately half of the space back to Office Depot. The property features three five-story, LEED Gold-certified office buildings with backup generators and hurricane-proof windows. Amenities include an onsite cafeteria, outdoor patio, fitness center, conference center, auditorium and two parking garages. Located three miles west of I-95, the campus sits adjacent to famed golf course The Old Course at Broken Sound and 700-acre master-planned community The Park at Broken Sound. The complex is also located 1.5 miles north of Lynn University and the Boca Raton Innovation Campus, as well as three miles north of Florida Atlantic University. John Criddle, Joe Freitas and Max Pawk of CBRE will market the vacant space for lease following the renovations. “For the first time since the campus was constructed, the North Tower office building will be available as a multi-tenant property with floorplates of approximately 40,000 square feet,” says Joe Freitas. …

DALLAS — Dallas-based Entos Design has begun construction on a multimillion-dollar capital improvement program at Chateau Plaza, a 178,970-square-foot office building in Dallas’ Uptown neighborhood. Capital improvements will include upgrades to the lobby, tenant lounge, public corridors and boardroom, as well as the addition of a fitness center and outdoor patio. Chateau Plaza was originally built in 1985 and last renovated in 2011. A group of institutional investors advised by J.P. Morgan Global Alternatives owns the 18-story building and will rebrand it as 2515 McKinney. Stream Realty Partners manages the property and will market the newly renovated space for lease. Completion is slated for the fall.

AUSTIN, TEXAS — Expansive, a provider of flexible workspace solutions formerly known as Novel Coworking, will open a 48,000-square-foot space in Austin’s Highland neighborhood on Thursday, May 4. The space, which will be the company’s second in the state capital, will be located within a five-story building at 305 E. Huntland Drive and will offer private offices, training and meeting rooms and outdoor amenity areas. Users will also have access to an onsite biergarten and indoor/outdoor lounge areas at the building.