GREENWICH, CONN. — Industrious has signed a 17,773-square-foot office lease in the southern coastal Connecticut city of Greenwich. The provider of flexible workspaces will occupy the first floor of Building 5 at Greenwich Office Park, an eight-building, 385,000-square-foot campus. David Block of CBRE represented the landlord, Fareri Associates, in the lease negotiations. Cushman & Wakefield represented Industrious.

Office

MIAMI — L&L Holding Co. and Oak Row Equities, along with project partners Shorenstein Investment Advisors and Claure Group, have opened Wynwood Plaza, a 1 million-square-foot mixed-use campus located at 95 N.W. 29th St. in Miami. The project is anchored by a luxury apartment community, shops and restaurants surrounding a half-acre public plaza and a 12-story office tower that is leased to tenants including Amazon (50,333 square feet). The development team has secured leases for more than half of the 266,000-square-foot office building, with other committed tenants including OKO Group, Weitz & Luxenberg law firm and Claure Group. The Class A office building features private outdoor terraces, floor-to-ceiling windows, a fitness club, golf simulator and conference rooms. Wynwood Plaza Residences comprises 509 apartments ranging in floorplans from studios to two-bedroom units. Monthly rental rates range from $2,495 to $4,660, according to Apartments.com. Amenities include basketball and pickleball courts, a lap pool, swimming pool, hot tub, cold plunge, coworking lounge with private offices and a large conference room, café, game area and a fitness center with a sauna, massage room and outdoor space. Additionally, Luca Steak is expected to open its new restaurant at Wynwood Plaza next year. The design-build team includes …

ALPHARETTA, GA. — Colliers has arranged a 26,285-square-foot lease at Preston Ridge III, a six-story office building located at 3460 Preston Ridge Road in Alpharetta, a northern suburb of Atlanta. The undisclosed tenant has previously subleased space at Preston Ridge III. Deming Fish of Colliers represented the landlord, Hobbs Brook Real Estate (HBRE), in the lease transaction. Preston Ridge III is a newly renovated, 146,000-square-foot office property situated off Ga. Highway 400. New touches to the office building include collaborative areas, fitness center with lockers, a refreshed lobby, common areas and EV charging stations.

BREA, CALIF. — CBRE has arranged the sale of an office property located at 120 S. State College Blvd. in Brea. A local private investor acquired the asset from an undisclosed seller for $19.5 million. Anthony DeLorenzo, Sammy Cemo, Bryan Johnson and Harry Su of CBRE represented the seller in the deal. Built in 1985 and renovated in 2015, the 79,528-square-foot property is situated on 2.3 acres within Brea Place. At the time of sale, the property was fully leased to six tenants, including County of Orange, Calif., CareFusion, Whittier Filtration, HdL Cos. and Yellow Box Corp.

KENNESAW, GA. — Colliers has arranged an 80,000-square-foot office lease at 3074 Chastain Meadows in Kennesaw, a northwest suburb of Atlanta. According to third-quarter research from Lee & Associates, print media services provider Heidelberg USA Inc., the North American subsidiary of the German company Heidelberger Druckmaschinen AG, will fully occupy the single-story building. Deming Fish, Emily Richardson and Mark Maggard of Colliers secured the lease on behalf of the owner, Orion Properties.

UPLAND, CALIF. — CBRE has negotiated the sale of Stewart Plaza, a Class A office property located at 440 N. Mountain Ave. in Upland. A partnership between a local investor and a medical group acquired the asset from Stewart Plaza Owner LLC for $9 million. Sammy Cemo, Austin Reuland, Anthony DeLorenzo and Bryan Johnson of CBRE represented the seller in the deal. The three-story, 46,527-square-foot property has recently undergone more than $1 million in renovations, including a roof replacement, elevator modernization, HVAC replacements, lobby upgrades, new lobby and exterior furniture and a new digital directory.

Progressive Real Estate Partners Arranges $7M Sale of Tower Plaza Commercial Center in Yucaipa, California

by Amy Works

YUCAIPA, CALIF. — Progressive Real Estate Partners has negotiated the sale of Tower Plaza Commercial Center, a retail and office property located at 34590-34664 County Line Road in Yucaipa. Greg Bedell of Progressive Real Estate Partners represented the seller, a private Inland Empire-based investor and the original developer of the property, while Tricia Cerda of REMAX Redlands represented the buyer, an Inland Empire-based private investor. Built in 1995, Tower Plaza Commercial Center offers 39,422 square feet of commercial space spread across three buildings. At the time of sale, the property was fully occupied by 27 tenants, including food, healthcare, beauty, finance, office and retail users. The units range in size from 240 square feet to 2,200 square feet.

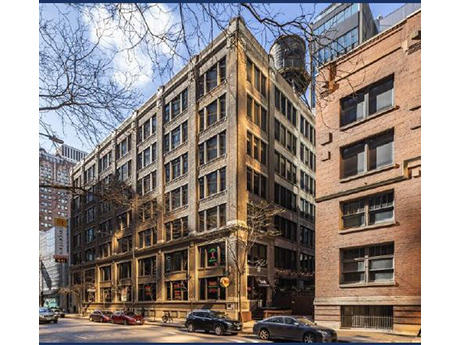

CHICAGO — Associated Bank has provided a $21.1 million construction loan to Wildwood Investments LLC and Concord Capital for the conversion of a 93,707-square-foot office and retail building in Chicago into 72 multifamily units. The seven-story property is located at 230 E. Ohio St. within the Streeterville neighborhood. Plans call for a mix of studio, one-, and two-bedroom units averaging 811 square feet. Existing first-floor retail, including Dao Thai Restaurant & Noodle Palace, Eye Society and YA Skin Studio, will remain open throughout construction. Completion is slated for December 2026. Elizabeth Hozian of Associated Bank handled the loan arrangements and closing.

In the fourth quarter of 2024, the Orlando office market had the first quarter of positive absorption in four years, according to a recent Colliers market report. The market, like many across the nation, has navigated a period of recalibration in the wake of the pandemic and evolving work trends. Yet, a shift in tenant activity has signaled renewed leasing demand across the office landscape. In the fourth quarter, net absorption in the Orlando office market reached a positive 95,843 square feet. This is a significant improvement compared to the same period in 2023, which had a negative absorption of 297,714 square feet. Interestingly, it is the submarkets outside of Orlando’s central business district (CBD) that are shining. This is evident in two recent deals that are having a profound impact on the market. In December, we represented the seller when Charles Schwab purchased the Maitland Summit Office Park for $122 million. This was the largest office deal in Central Florida since 2021 and removed 500,000 square feet of Class A office space from the Maitland submarket, which is about 10 miles north of downtown Orlando. Around the same time, Mitsubishi signed a lease for 109,000 square feet in Lake …

NEW YORK CITY — The New York State Office of General Services has signed a 15-year, 66,106-square-foot office lease expansion at 919 Third Avenue in Midtown Manhattan. The space spans the entire 46th and 47th floors of the 1.5 million-square-foot building and brings the tenant’s footprint at the property to 117,390 square feet. Stephen Siegel, Liz Lash, Peter Larkin and Mark Bezold of CBRE represented the tenant in the lease negotiations. Robert Alexander, Ryan Alexander, Emily Chabrier, Taylor Callahan, Alex D’Amario and Nicole Marshal, also with CBRE, represented the landlord, SL Green.