NEW YORK CITY — CBRE has negotiated a 14,375-square-foot office lease at 535 Madison Avenue in Midtown Manhattan. Steve Siegel, Craig Reicher, Tim Dempsey, Ramneek Rikhy and Marlee Tepliztky of CBRE represented the tenant, locally based law firm Fried Frank, in the lease negotiations. The tenant, which has committed to a 15-year term, plans to relocate from The Seagram Building to the 37-story tower in early 2024. Brian Gell and Laurence Briody, also with CBRE, represented the landlord, Park Tower Group.

Office

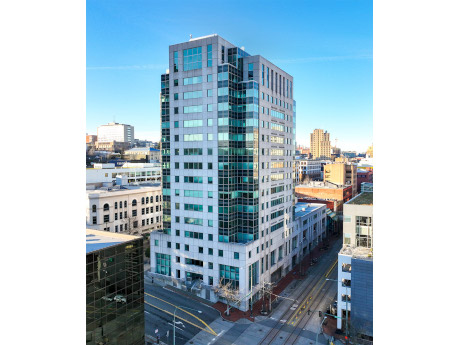

TACOMA, WASH. — Kirkland-based MJR Development has released plans to renovate the office building at 1145 Broadway in downtown Tacoma. Renamed as Tacoma Centre, the 15-story, 200,000-square-foot office building will include a café, bar, lounge areas, conference rooms and a fitness center with locker rooms. With the renovations, the tower will offer office space optimized for a culture of work/life balance and creative collaboration. Once complete, Tacoma Centre will offer a high-end lounge to accommodate casual team meetings, happy hours and corporate events and soirees. The remodeling will focus on common areas, and the building will remain open to tenants during construction. Interior designs will use natural materials, tall windows and expansive views. The renovation is slated for completion in summer 2023. MJR acquired the property, previously known as Tacoma Financial Center, in January 2022. Will Frame, Drew Frame and Ben Norbe of Kidder Mathews represented MJR in the sale and are now managing the leasing.

PITTSBURGH — Law firm Metz Lewis Brodman Must O’Keefe has signed a 19,228-square-foot office lease at Four Gateway Center, a 22-story building in Pittsburgh. The locally based law firm will relocate from the Henry W. Oliver Building in summer 2023. Nick Francic and Reid Mauro of JLL represented the tenant in the lease negotiations. Jeremy Kronman, Adam Viccaro and Dominika Demantova of CBRE represented the landlord, Hertz Investment Group.

BohlerContent PartnerDevelopmentFeaturesIndustrialMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Retail Development Program Lessons Apply Across Property Types

Retail development programs have allowed retailers to streamline their goals by creating prototype models based on site particulars. This process saves developers and retailers money as they can be flexible in choosing models that work for each site without needing to alter layouts and features too much between builds. But what makes for successful prototypes and program standards? Can this approach work outside of the retail world? “The lessons of retail programs can apply across property types in this sense: land development consultants and site designers can learn how specific clients need their set of standards and guidelines implemented. It’s essential to thoroughly understand a program client’s procedures, and we’re expected to know these parameters inside and out,” says Steven T. Fortunato, a senior project manager at Bohler’s Rehoboth Beach office in Delaware. Bohler is a land development design and consulting firm that specializes in helping developers move their projects forward faster. “The retail program methodology translates well to other sectors. Starting off with either a new developer or a new client is an opportunity to learn their standards — or help the client create them. The end result must offer the same level of confidence whether the product is retail or …

WOODBURY, MINN. — Davis, a Minneapolis-based firm, has purchased Woodlake Medical Building, a 42,467-square-foot property located on 4.7 acres at 2080 Woodwinds Drive in Woodbury, a southeast suburb of St. Paul. The $18 million acquisition marks the latest addition to the Davis Medical Investors Fund, which now comprises 13 buildings in five states and a total of 567,356 square feet. The property is fully leased by Woodlake Surgery Center, St. Paul Eye Clinic and Midwest ENT, all of which signed new 15-year leases. Bridgewater Bank provided financing for the deal. The seller was not disclosed.

TAMPA, FLA. — Tampa Electric and Peoples Gas have signed a deal with Bromley Cos. to occupy the 298,000-square-foot anchor space at 1 Midtown Place in Tampa. Beginning in 2025, the companies will own 11 floors of the building, construction of which will start in early 2023. Bromley is developing the 17-story building, which will be situated within the 23-acre mixed-use Midtown Tampa development, with Highwood Properties. Tampa Electric and Peoples Gas currently occupy TECO Plaza at 702 N. Franklin St. in downtown Tampa, which has been home to the companies since 1981.

CHATTANOOGA, TENN. — Marcus & Millichap’s Institutional Property Advisor’s (IPA) has arranged the sale of CHI Memorial, a 17,837-square-foot medical office building in Chattanooga. An undisclosed buyer purchased the property for $7.4 million. The building is fully occupied by three tenants: Skin Cancer & Cosmetic Dermatology, CHI Memorial and Center MedSpa, all on triple-net leases. Joe Massa, Anthony Lunceford and Michael Grenaway of IPA represented the undisclosed seller in the transaction.

HOUSTON — Locally based brokerage firm Davis Commercial Real Estate has arranged the sale of a 16,571-square-foot office building located at 800 Tully Road in West Houston. According to LoopNet Inc. the property was built on a half-acre lot in 1984. Ashley Casterlin of Davis Commercial represented the seller, American Savings Life Insurance Co., in the transaction. Independent realtor Marcela Banh represented the buyer, Advantis Investments Group LLC.

BRISTOL, PA. — NAI Mertz has brokered the sale of a 23,433-square-foot office building in Bristol, located northeast of Philadelphia in Bucks County. Zena Charokopos and Rick Gordon of NAI Mertz represented the seller in the transaction. Adam Lashner and Jeff Licht, also with NAI Mertz, represented the buyer, which plans to use the property as an adult care facility. Both parties requested anonymity.

JLL Arranges $20.6M in Acquisition Financing for Multi-Tenant Distribution Facility in San Diego

by Amy Works

SAN DIEGO — JLL Capital Markets has arranged $20.6 million in acquisition financing and joint-venture equity for a multi-tenant corporate headquarters and distribution facility located at 2425 Auto Way in Escondido. The borrower is a joint venture between Stos Partners and a private investor. Aldon Cole and Brad Vansant of JLL Capital Markets Debt & Structured Finance arranged the short-term, floating-rate loan through an insurance company. Sound Image and Goodman fully lease the 88,690-square-foot facility, which features 20-foot to 22-foot clear heights, dock- and grade-level loading doors, 200 parking spaces and 10,000 square feet of office space.