PHOENIX — Tortosa LLC has completed the disposition of The Strip, a two-story retail and office building in Phoenix, to 4700 Alliance LLC, a Seattle-based investment company, for $4.4 million. Located at 4700 N. 12th St., the multi-tenant property was fully leased at the time of sale. The ground-floor space consists of retail tenants, including a craft beer and wine bar/restaurant, a craft coffee shop, a wine shop and café, a locally famous cake bakery and a soon-to-be completed speakeasy bar and co-working lounge. The second floor includes a salon, two architectural firms, a fitness tech company and headquarters for a restaurant group. Eric Wichterman, Mike Coover, Steve Lindley and Alexandra Loye of Cushman & Wakefield’s private capital and capital markets teams in Phoenix represented the seller in the transaction.

Office

IRVING, TEXAS — Engineering firm Kimley-Horn has signed a 25,767-square-foot office lease at Mandalay Tower 2, a 16-story building within Irving’s Las Colinas district. Rodney Helm, Zach Bean and Chris Taylor of Cushman & Wakefield represented the landlord, Parmenter Realty Partners, in the lease negotiations. Kimley-Horn plans to move into Mandalay Tower 2, which offers a restaurant, fitness center, sundry shop and conference facilities, in May 2023.

DRIPPING SPRINGS, TEXAS — Avison Young has brokered the sale of a 19,472-square-foot office building in the western Austin suburb of Dripping Springs. Giovanni Palavicini of Avison Young represented the buyer, locally based coworking concept FUSE Workspace, in the transaction. Dan Lewis and David Alsmeyer of TIG Real Estate Solutions represented the seller, private developer Steve Herren. FUSE Workspace also plans to occupy the building and is targeting a first-quarter 2023 opening.

NEW YORK CITY — Cushman & Wakefield has brokered the $11 million sale of Acme Hall, a historic building located at 435 Ninth Street in the Park Slope neighborhood of Brooklyn. The four-story, 20,303-square-foot building was originally constructed in 1890 and houses office and retail space. Dan O’Brien, Jonathan Squires, Caroline Hodes and Josh Neustadter of Cushman & Wakefield represented the undisclosed seller in the transaction. The buyer was also not disclosed.

By Charlie Farra, Senior Managing Director, Newmark The Puget Sound office market has fared better than many peer metro areas during the pandemic. While the market remains tenuous in the region, local office fundamentals have improved to date in 2022. A consistent through the chaos is a flight to quality. If employers expect a return to office, they are being tasked with creating a physical environment that is far more favorable than a home office or local coffee shop. We are referring to this as “commute-worthy real estate.” Energy, collaboration, amenities, views, natural light and safety are some of the main points of focus and, due to current economic conditions, the ability to find such space at discounted pricing is within reason. New office leases are trending toward 75 percent of their pre-pandemic footprint as companies consider how and where to operate their businesses going forward. Professional service companies currently account for the most demand and are in the office more frequently than the technology sector. In tech cities like Seattle, this is a seismic shift from the previous decade, which saw skylines transform from the expansions of Amazon, Microsoft, Meta and Google. Many companies returning to the office are utilizing a hybrid …

KING OF PRUSSIA, PA. — Locally based investment firm Equus Capital Partners has sold a 150,466-square-foot office campus in King of Prussia, located north of Philadelphia. Built in 1978, the two-building complex was 95 percent leased at the time of sale. Brett Grifo and Keith Braccia of Cushman & Wakefield represented Equus, which acquired the property in 2018 and invested roughly $5 million in capital improvements, in the transaction. The buyer and sales price were not disclosed.

SAN ANTONIO — Houston-based investment firm Fuller Realty Interests has purchased Parkway Plaza, a 189,390-square-foot office complex located adjacent to San Antonio International Airport. The complex comprises five single-story buildings that were constructed between 1999 and 2002. Bryan Leonard of Northmarq arranged an undisclosed amount of acquisition financing through a regional bank on behalf of Fuller Realty Interests. The seller was not disclosed.

CHARLOTTE, N.C. — Gigabit-speed internet provider Google Fiber has signed a 10-year lease at Camp at North End, a 76-acre adaptive reuse development in north Charlotte. The company will occupy 5,884 square feet at the historic Gama Goat Building, located at 1801 N. Graham St. John Christenbury of CBRE represented Google Fiber, which will relocate from its current Charlotte headquarters space at the Phillip Carey building in Uptown’s First Ward Park neighborhood. Jessica Brown and David Dorsch of Cushman & Wakefield represented the landlords, ATCO Properties & Management and Shorenstein Properties LLC. Other office tenants at Camp at North End include Kingsmen Software, Centene Corp., Ally Financial, AON and CloudGenera. Google Fiber is working with Alliance Architecture and Swinerton on the build-to-suit space at the Gama Goat Building, which the firm will occupy beginning in early 2023.

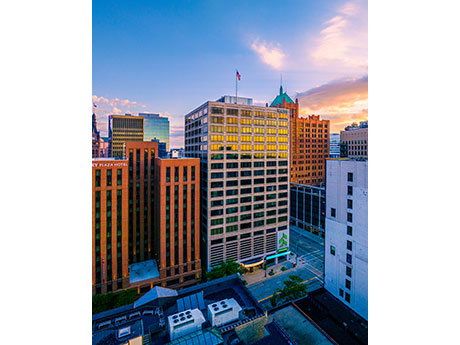

MILWAUKEE — The U.S. Department of the Interior’s Bureau of Land Management (BLM) has signed a 15-year lease for 8,797 square feet on the 11th floor of Two-Fifty, an office tower in Milwaukee. The property rises 20 stories and spans 200,000 square feet at 250 E. Wisconsin Ave. within the city’s central business district. The BLM is responsible for sustaining the health, diversity and productivity of public lands. Ned Purtell and John Davis of Founders 3 Real Estate Services represented the landlord, Buffalo Grove, Ill.-based Millbrook Real Estate Co. Since purchasing Two-Fifty in 2015, Millbrook has invested more than $8.5 million in improvements, including a new tenant lounge, conference center and lobby renovation. The building is currently home to tenants such as HNTB, Associated Bank and the Milwaukee Bar Association.

CARLSBAD, CALIF. — Oxford Properties has expanded its life sciences portfolio in metro San Diego with the acquisition and long-term leaseback of Ionis Pharmaceuticals’ 18.4-acre life sciences campus and corporate headquarters in Carlsbad. As part of the transaction, Ionis will lease the properties for a minimum of 15 years. Additional terms of the transaction were not released. The three-building campus offers 250,000 square feet of existing office and life sciences space with chemistry labs, biology labs and R&D support systems, as well as a modern office space. The buildings were constructed between 2011 and 2021. Founded in 1989, Ionis is a publicly traded biotech company and a leader in discovering and developing RNA-targeted therapeutics.