GLENVIEW, ILL. — Dermody Properties has completed its acquisition of the 232-acre former corporate office campus of Allstate Corp. located on Sanders Road in Glenview, roughly 22 miles northwest of downtown Chicago. While the acquisition price was not disclosed, REBusinessOnline reported last year that the transaction would be valued at $232 million. Dermody plans to redevelop the property into a 10-building logistics park. The redevelopment, named The Logistics Campus, will span 3.2 million square feet upon completion, with flexibility to accommodate additional build-to-suit development. Construction on Phase I of the project is scheduled to begin immediately and will include five buildings totaling 1.2 million square feet. The initial phase of development is slated for completion in 2023. “This redevelopment project stands at the intersection of two significant and durable trends — work from home and e-commerce,” says Douglas Kiersey Jr., president of Dermody Properties. “The conversion of the office campus — with buildings dating back to the 1960s and 1970s — into modern logistics buildings offers many benefits to the community.” The site is located adjacent to Interstate 294 and southwest of the Willow Road interchange, which will allow for efficient access to O’Hare International Airport. The project benefits from …

Office

By Traci Kapsalis, JLL It’s no secret that the COVID-19 pandemic turned every office market across the globe upside down. In the process, quality of life, health and well-being have become top priorities for office workers, as well as a push for hybrid and flexible working models. To understand and support these evolving expectations, local governments, employers and landlords are working together to identify and shape their new future of work. In fact, new research from JLL reports that the next three years will be a critical phase for commercial real estate strategy, representing a crucial window of opportunity that will determine how successful companies (and cities) will be in adapting to rapid changes. At the crossroads of America, the Indianapolis market is well on its way to a reimagined office environment. Here are three demonstrable signs. 1. Flight to quality dominates the office market Leasing activity for Class A office properties is strong in Indianapolis. According to a recent report, activity in this sector is reaching new heights as it achieved 248,000 square feet of occupancy growth in the second quarter — the highest in a single quarter in over four years — and hit record-high rents of almost …

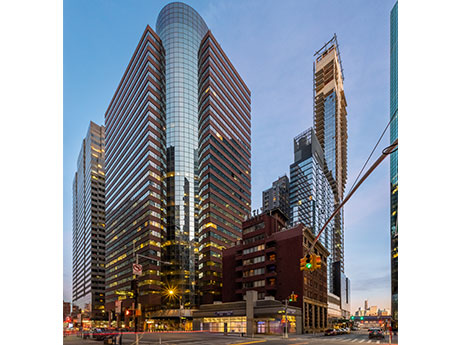

NEW YORK CITY — 1-800Accountant, which provides virtual accounting software for small businesses, has signed a 12,344-square-foot office lease at 260 Madison Avenue, a 570,000-square-foot building in Midtown Manhattan. Peter Turchin, Gregg Rothkin, Tim Freydberg, Hayden Pascal and Jared London of CBRE represented the landlord, The Sapir Organization, in the lease negotiations. The representative of the tenant was not disclosed.

TARZANA, CALIF. — Calabasas-based Agora Realty & Management has purchased Tarzana Medical Plaza, a three-story medical office building located at 5525 Etiwanda Ave. in Tarzana. An undisclosed seller sold the asset for $30 million in an off-market deal. At the time of sale, the 75,000-square-foot medical office building was 90 percent occupied. Current tenants include Providence Healthcare Systems, Cedars-Sinai Medical Care and Unilab Corp. Agora plans to complete an interior and exterior renovation on the property. Interior renovations will include upgraded elevator cabs, modern corridor finishes, lighting upgrades, and expanded and renovated lobby areas with enhanced wayfinding. The buyer also plans to add solar panels to reduce operating costs.

SANTA CLARITA, CALIF. — Spectrum Commercial Real Estate has brokered the sale of Santa Clarita Medical Center, a medical/dental building in Santa Clarita. Yair Haimoff, Randy Cude, Andrew Ghassemi and Matt Sreden of Spectrum handled the $11.3 million transaction. The names of the seller and buyer were not released. Located at 23206 Lyons Ave., the two-story property offers 37,759 square feet of medical and dental space. The building features a mix of 24 professional medical suites, floor-to-ceiling window lines and an abundance of parking.

NEW YORK CITY — MGM Studios has signed a 50,462-square-foot office lease at 260 Madison Avenue, a 570,000-square-foot building in Midtown Manhattan. Peter Turchin, Gregg Rothkin, Tim Freydberg, Hayden Pascal and Jared London of CBRE represented the landlord, The Sapir Organization, in the lease negotiations. The representative of the tenant was not disclosed.

SANTA CLARITA, CALIF. — Spectrum Commercial Real Estate has negotiated the off-market acquisition of an office property located at 25101 The Old Road in Santa Clarita. 360 Executive Suites SCV purchased the asset from an undisclosed seller for $7.1 million. The two-story building features 23,388 square feet of office space and comprises 90 private offices. Matt Sreden of Spectrum CRE represented the buyer in the deal.

MCKINNEY, TEXAS — Avison Young has arranged the sale of a 48,304-square-foot office building located in the northern Dallas suburb of McKinney. The property was built on 2.7 acres in 2006 and includes 152 surface parking spaces. Susan Gwin Burks, Bruce Butler, John Bowles and Philip Boren of Avison Young represented the seller, Dallas-based PAR Capital, in the transaction. Bill Cox of Carey Cox Co. represented the undisclosed, locally based buyer. The building was roughly 95 percent leased at the time of sale.

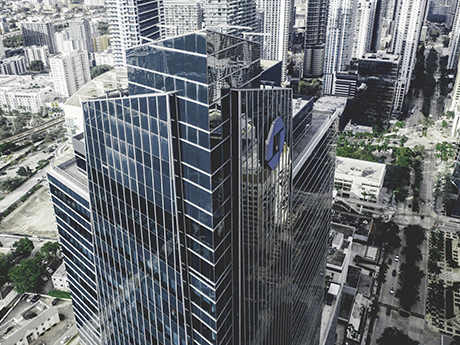

MIAMI — Law firm Bilzin Sumberg has renewed its office lease at 1450 Brickell office tower in Miami’s Brickell district. Barbara Black, Matthew Goodman and Jeff Gordon of JLL represented Bilzin Sumberg. The firm occupies 84,000 square feet of space at the 625,000-square-foot tower. Tere Blanca and Danet Linares of Blanca Commercial Real Estate represented the building owner, an entity doing business as 1450 Brickell LLC.

NEW YORK CITY — JLL has arranged the $252 million sale of the former AIG global headquarters to 99c LLC, a real estate firm specializing in adaptive reuse development in urban markets. The 31-story property is located at 175 Water St. in Lower Manhattan’s Seaport submarket and comprises 684,500 square feet of rentable space. Vanbarton Group was the seller. The purchase represents 99c’s entry into the New York market following a focus on London, where it acquired millions of square feet of commercial office space. The firm is currently one year into a four-year plan to do the same in New York. 175 Water St. features 12-foot ceilings, 24,000-square-foot floor plates, center-core configuration and an efficient design. The building’s flexibility also includes an unused ground floor, which is being primed for a reimagined lobby along with two usable rooftop terraces with amenities. The building is completely vacant, following AIG’s move to a new location in 2021. Andrew Scandalios, David Giancola, Vickram Jambu, Marion Jones, Steven Rutman and Alexander Riguardi led JLL’s capital markets investment sales advisory team representing the seller. “175 Water St. received a generous amount of investor interest given the nature of the building, which provided a blank canvas …