By Anné Erickson, JLL Kansas City’s appeal is catching the attention of companies looking for more than just square footage. From corporate relocations like Fiserv and expansions by Propio Language Services, to a deep talent pool, business-friendly environment and central location, the metro is emerging as a strategic choice for growth. These factors are fueling activity in a market already defined by stable fundamentals, headline lease transactions and a strong flight-to-quality trend. While the overall vacancy rate remained at 20.2 percent according to JLL’s Q2 2025 Kansas City Office Market Dynamics report, the quarter delivered 192,000 square feet of positive net absorption, reversing early-year declines. Average asking rents held steady at $22.98 per square foot, signaling stability despite the competitive environment. For tenants seeking to secure best-in-class space, and investors targeting properties with long-term upside, Kansas City is increasingly worth a closer look. Flight to quality One of the clearest shifts in recent quarters has been the move toward high-quality, well-located buildings that can support hybrid work, collaboration and tenant amenities. After several years of shorter lease terms and cautious decision-making, companies are now committing to space that reflects their long-term workplace strategies. This was evident in several major second-quarter …

Office

DALLAS — Accounting giant EY has signed an office lease renewal at One Victory Park, a 17-story, 435,606-square-foot building in Uptown Dallas. The square footage and term of the lease were not disclosed. Matt Schendle and Carrie Halbrooks of Cushman & Wakefield represented the landlord, Clarion Partners, in the lease negotiations. Glenn Dyke, Phil Puckett and Harlan Davis of CBRE represented EY.

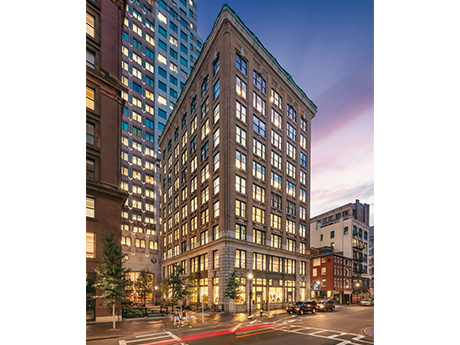

BOSTON — JLL has arranged $8 million in financing for a 75,000-square-foot office building located at 15 Broad St. in downtown Boston. The 10-story building was originally constructed in 1910. Amy Lousararian and Hugh Doherty of JLL arranged the five-year, fixed-rate loan through MountainOne Bank. The borrower, local owner-operator Broder, plans to use proceeds to fund capital improvements, including a redesign of the lobby, upgrading of common areas and the introduction of a new amenity package.

SAN FRANCISCO — A joint venture between Lincoln Property Co. and New York Life Real Estate Investors (NYLREI) has acquired two Class A office buildings totaling 494,552 square feet in San Francisco. The properties, 353 Sacramento Street and 600 Townsend Street, are located in the heart of the Financial District and Design District submarkets, respectively. Located between Jackson Square and the North Financial District, 353 Sacramento is a 23-story, 284,751-square-foot office tower. The building has undergone extensive renovations since 2016, including a new lobby, upgraded elevator systems and modernized elevator lobbies and restroom renovations. Building amenities include lockers, showers and a bike room. Lincoln and NYLREI will build out a full-floor amenity center with two outdoor terraces, a fitness center, conferencing facilities and a tenant lounge in addition to move-in ready tenant speculative suites. Current tenants include Wells Fargo, Ramp, Merge and Even-up Law. Situated in the Showplace Square submarket, the five-story 600 Townsend offers 209,801 square feet of creative office space. The property features high-end creative improvements, a significant solar project overhaul, a modernized lobby and an outdoor patio/lounge. The building is nearly fully leased by SS&C Advent and PagerDuty. Onsite amenities include a lobby, outdoor common area and secure …

ROLLING MEADOWS, ILL. — Verizon has renewed its 128,894-square-foot office lease at Continental Towers, an office campus located at 1701 Golf Road in the Chicago suburbs of Rolling Meadows. Joe Stevens and Steve Degodny of Transwestern Real Estate Services represented ownership, while Jon Springer and Andrew Kaplan of CBRE represented Verizon, which has been a tenant at Continental Towers since 2016. The lease marks one of the largest office deals completed in Chicago’s Northwest suburban submarket in 2025, according to Transwestern. Continental Towers comprises 910,000 square feet in four buildings: three 12-story office buildings and an amenity-driven property known as the Hub, plus 1 acre of outdoor space. Tenants have access to a fitness center, conference center, tenant lounge, game room, underground parking and delicatessen. A pickleball court, golf simulator room and two basketball courts will soon be available for tenant use.

Town Lane, Trinity Capital Purchase 440 South Church Office Building in Uptown Charlotte for $75.8M

by John Nelson

CHARLOTTE, N.C. — A partnership between New York-based Town Lane and locally based Trinity Capital Advisors has purchased 440 South Church, a 15-story office building located in Uptown Charlotte. The seller and purchase price were not disclosed, but Charlotte Business Journal reported that New York-based Epic Investment Partners sold the building for $75.8 million. Patrick Gildea and Matt Smith of CBRE represented the seller in the transaction. J.P. Cordeiro, Mike Ryan and Brian Linnihan of CBRE’s Debt & Structured Finance team arranged acquisition financing. Built in 2009 and lightly renovated in 2022, 440 South Church’s occupancy rate was 47 percent at the time of the sale. Town Lane and Trinity Capital, which is also the 388,657-square-foot tower’s original developer, plan to invest $20 million in capital improvements and renovations, including an overhauled lobby, new lounges, new street-level retail space, updated building systems and upgrades to the amenity level on the second floor. Tenants at 440 South Church include Driven Brands and HDR Engineering.

DURHAM, N.C. — Accesso has purchased 555 Mangum, a 251,464-square-foot office building located in downtown Durham. The developer and previous owner, Northwood Ravin, sold the Class A office building to Accesso for $72 million. Ryan Clutter, Mike McDonald, Daniel Flynn and C.J. Liuzzo of JLL brokered the sale. Built in 2020 adjacent to the Durham Bulls Athletic Stadium, 555 Mangum features an onsite parking garage comprising 812 spaces, a newly opened rooftop bar and restaurant called The Lenny, a fitness center with locker rooms, conference center and an outdoor courtyard. Tanium, a global cybersecurity firm, recently renewed and expanded its lease to 48,000 square feet at the building.

RUSTON, LA. — KDC has delivered a 50,000-square-foot call center and operations hub for JPMorgan Chase in Ruston, a north Louisiana city located about 68 miles east of Shreveport via I-20. The $31 million Chase Operations Center is an extension of an existing customer support center in Monroe, which is about 32 miles east of Ruston. Situated on 5 acres along Woodward Avenue, the facility opened with 50 employees and has the capacity to grow to 200. The design-build team includes architect HKS and general contractor Lincoln Builders Inc.

Cushman & Wakefield Brokers $16.2M Sale of 1840 Gateway Office Building in San Mateo, California

by Amy Works

SAN MATEO, CALIF. — Cushman & Wakefield has arranged the sale of 1840 Gateway, a Class A office property in San Mateo. Monday Properties sold the asset to SC Properties for $16.2 million. Gary Boitano, Ryan Venezia, Steve Herman, Jack Depuy, Seth Siegel, Scott Prosser and Courtney Trunnell of Cushman & Wakefield represented the seller and the buyer in partnership with Clarke Funkhouser of JLL. The four-story property offers 70,098 square feet of office space, as well as a recently renovated gym facility with showers. Approximately 75 percent of the building’s square footage is finished as high-end creative space, including renovated restrooms and polished concrete floors. The property also offers a multi-story glass-enclosed lobby and flexible zoning that allows for potential redevelopment to residential use.

DALLAS — Locally based brokerage firm Younger Partners has arranged the sale of Bent Tree Plaza, an 82,144-square-foot office and healthcare complex in North Dallas. Located along the Dallas North Tollway, the property comprises two parcels and and was 72 percent leased at the time of sale. Tom Strohbehn and Scot Farber of Younger Partners represented the undisclosed seller in the transaction. Younger Partners has also been retained as the leasing agent by the new owner, which similarly requested anonymity.