The Raleigh-Durham office market is poised for future growth as it exits the pandemic, however the question for us all is when. Re-occupancy of buildings by office users has been stubborn in the current post-pandemic environment. Despite the sluggish activity since the beginning of the year, there have been bright spots with companies becoming more strategic about their office space decisions as they return, especially in newer projects that offer best-in-class experiences. Moving forward, there will be economic and geopolitical headwinds that may interfere with the pace of recovery. However, investors and developers continue to the see the value in the market due to our highly educated workforce, favorable business climate and one of the fastest growing population centers in the country. The return of the workplace is the main driving factor for the activity in the office leasing market. As companies execute their re-occupancy plans, they are reevaluating their existing buildings, footprints and workspaces in a way that we have never seen before. Forward thinking organizations are making decisions to create unique spaces where their employees want to come to work, rather than a space where they have to come to work. We have quickly seen that one size …

Office

LOS ANGELES — Bolour Associates has purchased a two-story, mixed-use building located at 6432 Santa Monica Blvd. in the Hollywood neighborhood of Los Angeles for $13.7 million, or $421 per square foot. Totaling 32,500 square feet, the property features 17,500 square feet of ground-floor retail space and 15,000 square feet of second-story office space. At the time of sale, the property was 100 percent occupied by tenants ranging from creative management and casting to production equipment rentals and photography studios. Brandon Michaels, Matthew Luchs and Andrew Leff of Marcush & Millichap represented the buyer and undisclosed seller in the deal.

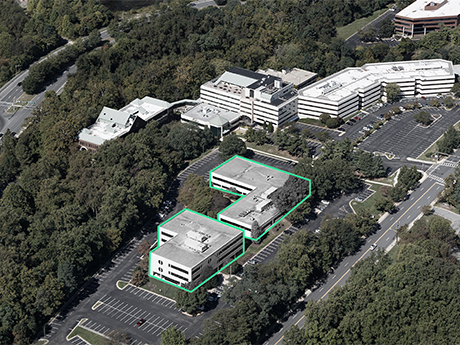

ROCKVILLE, MD. — CBRE has negotiated the $25.5 million sale of Research Square, a two-building office complex located at 1500 and 1550 Research Blvd. in Rockville, a suburb of Washington, D.C. The seller is Westat, an employee-owned research company based in Rockville. Tommy Cleaver, Dan Grimes and Stuart Kenny of CBRE represented Westat in the transaction. The buyer was not disclosed. CBRE says that the properties, which were fully vacated at the time of sale, represent a “premier life sciences conversion opportunity” as the Washington-Baltimore Corridor ranked No. 2 in CBRE’s Life Sciences Research Talent 2022 report.

HOFFMAN ESTATES, ILL. — Club Colors has signed a long-term lease for 52,056 square feet of office space at Bell Works Chicagoland in Hoffman Estates. The branding and marketing company will utilize the space for its national headquarters beginning in May 2023. Club Colors will occupy space on the third floor of the east building as well as a production facility on the first floor with access to a private outdoor patio. The tenant will bring its team of 125 employees from its current home in Schaumburg. Jon Springer of CBRE represented Club Colors, while Steve Kling of Colliers represented ownership, Inspired by Somerset Development. Bell Works Chicagoland is the redevelopment of the former AT&T campus. Club Colors is now the property’s largest tenant to date.

TEMPE, ARIZ. — Colliers has brokered the sale of Kyrene Corporate Center, an office property located at 9280 S. Kyrene Road in Tempe. Handwrytten Software Co. acquired the asset for an undisclosed price. The company, which provides software and hardware to mimic human handwriting for use in marketing materials, will use the 31,962-square-foot property as its headquarters. Situated on 2.6 acres, the asset was built in 1998. Michael Marsh of Colliers Arizona represented the buyer, while Michael Milic of Colliers Arizona represented the undisclosed seller in the deal.

NUTLEY, N.J. — Global investment firm Cantor Fitzgerald has acquired 200 Metro Boulevard, a 300,000-square-foot office building in the Northern New Jersey community of Nutley, for $131.7 million. The building is located within Prism Capital Partners’ 116-acre ON3 campus, which is a redevelopment of the former North American headquarters site of Swiss pharmaceutical company Hoffman-La Roche. The building also serves as the U.S headquarters of Japanese pharmaceutical giant Eisai Inc., which relocated some 1,200 employees to the ON3 campus in 2020. Eastdil Secured represented Prism Capital Partners in the sale. Other tenants at ON3 include Quest Diagnostics, Ralph Lauren Corp., the Hackensack-Meridian School of Medicine and Seton Hall University’s Graduate College of Nursing & School of Health & Medical Sciences.

NEW YORK CITY — JLL has negotiated a 60,000-square-foot office headquarters lease at 825 Seventh Ave. in Midtown Manhattan. Owned by a partnership between Edward J. Minskoff Equities and Vornado Realty Trust (NYSE: VNO), the building spans 196,616 square feet. Matthew Astrachan, Ellen Herman and Hale King of JLL represented the tenant, New Alternatives for Children, in the lease negotiations. Edward Riguardi of Vornado and Jeffrey Sussman of Edward J. Minskoff represented building ownership in conjunction with John Ryan III of Avison Young.

MIAMI — Helm Equities has announced plans for Parterre 42, a $300 million office building that will occupy a full city block between NE 42nd and 43rd streets in Miami’s Design District. The 500,000-square-foot development will offer 80,000 square feet of functional outdoor space dispersed across each floor of the building with communal work tables, outdoor power and charging stations, and flexible furniture groupings. COOKFOX Architects designed the project. Additional amenities at the property, which features unobstructed views of Biscayne Bay and the downtown Miami skyline, will include an indoor-outdoor cafe, multi-level fitness center, bike and scooter storage, and valet parking alongside retail space. The project was designed to achieve LEED Gold and WELL Gold certifications with a dedicated outdoor air system and an all-electric HVAC system. “We worked with COOKFOX to turn the typical office building inside-out, incorporating massive amounts of functional outdoor space on every floor so that occupants of Parterre 42 feel like they are truly working in nature,” says Ayal Horovits, principal at Helm Equities. Paul Amrich, Neil King, Gordon Messinger and Camron Tallon of CBRE have been tapped to lease the project’s 320,000 square feet of office space. A timeline for construction was not announced. …

By Richard Meder, Colliers While office markets across the country have experienced a slow climb back to normalcy following COVID-19-related restrictions, the Dayton office market has found its strength in the Wright-Patterson Air Force Base (WPAFB). Though the Dayton office market around WPAFB experienced similar ebbs and flows as that of the rest of the country during the pandemic, business never stopped. For some in other markets, the lasting effects of this disruption to the office market remain unknown. Business leaders must decide whether to implement a remote work lifestyle into their employee regimen or make a push to get back to normal office life — for some companies it is considered a hybrid approach. For the tenants in the WPAFB submarket, however, there was never question. While many office tenants vacated their spaces out of uncertainty, defense contractors cautiously occupying office spaces at the WPAFB submarket almost singlehandedly helped Dayton remain upright during the pandemic. With the submarket almost entirely consisting of defense contractors, this type of defense contracting work was not allowed to stop with the rest of the world. Having to adhere to both local and federal guidelines, decision-making among defense contractors certainly slowed, but it never …

DALLAS — The Swig Co., a San Francisco-based owner-operator, has sold a 536,000-square-foot office building located at 901 S. Central Expressway in North Dallas. The four-story building sits on 20 acres and serves as the headquarters of fashion design and manufacturing company Fossil Group. Andrew Levy of JLL represented Swig Co. in the transaction. The buyer and sales price were not disclosed.