RENTON, WASH. — Innovatus Capital Partners has purchased Triton Towers, a trio of seven-story office buildings in Renton. Terms of the transaction were not disclosed. Triton Towers features more than 400,000 square feet of Class A office space. At the time of sale, Tower Three was fully occupied, Tower One had 24,413 rentable square feet available, and Tower Two had 48,650 rentable square feet available. The property offers two conference centers, an exercise facility with showers and lockers, outdoor picnic areas, a full-time day porter service, bike storage and free surface parking. LPC West, the West Coast arm of Lincoln Property Co., will provide property management services for the asset.

Office

WILMINGTON, MASS. — Boston-based mortgage banking firm EagleBridge Capital has arranged $38 million in debt and joint venture equity financing for a 210,945-square-foot office and lab complex in the northern Boston suburb of Wilmington. Located at 181 and 187 Ballardvale St., the two buildings sit on a combined 15.4 acres and each span approximately 105,000 square feet. Ted Sidel and Brian Walsh arranged the financing, specific terms of which were not disclosed, on behalf of an unnamed borrower.

HOLMDEL, N.J. — CentralReach, a provider of electronic medical record software, will open a 25,000-square-foot office at Bell Works, an office and retail campus owned by Somerset Development in the Northern New Jersey community of Holmdel. The company will relocate from its current office in Matawan late this summer. CentralReach employs about 400 people who work remotely on a full-time basis and views the new office as a “collaboration-focused space” that represents “the office of the future.” CentralReach is designing the space in collaboration with G3 Architects and NPZ Style & Décor.

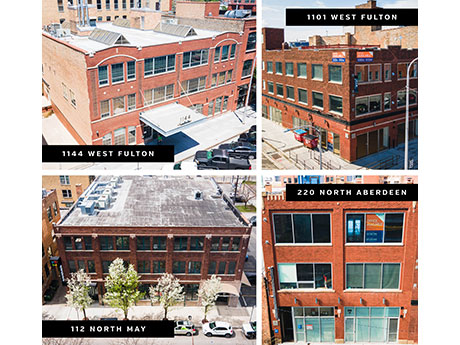

CHICAGO — SVN | Chicago Commercial has brokered the sale of a portfolio of office and retail buildings in Chicago’s Fulton Market district for $33.5 million. The portfolio comprises four buildings totaling more than 76,000 square feet as well as deeded parking spaces that can hold up to 58 cars. Scott Maesel, Drew Dillon, Chad Schroedl, Adam Thomas and Logan Parsons of SVN | Chicago Commercial’s Urban Team represented the seller. Buyer and seller information was not provided.

Content PartnerFeaturesIndustrialLeasing ActivityLee & AssociatesMarket ReportsMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ First-Quarter 2022 Economic Rundown by Sector

Lee & Associates’ newly released Q1 2022 North America Market Report scrutinizes first-quarter 2022 industrial, office, retail and multifamily outlooks throughout the United States. This class-by-class review of commercial real estate trends for the first quarter of the year focuses on how real estate is adjusting to long-term post-COVID attitudes. Lee & Associates has made the full market report available here (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city), but the overviews offered below provide sweeping looks at the overall health and obstacles for four major commercial real estate sectors. Industrial: Rents Pushed on Strong Demand Strong demand for industrial space throughout North America continued in the first quarter as vacancies fell to record lows and rent growth hit double digits. First quarter net absorption in the United States totaled 92.8 million square feet, which was up 25 percent year over year but down 35 percent from the 143-million-square feet average of the last three quarters of 2021. Annualized rents rose 10.1 percent in the U.S. and the average vacancy rate fell to 4.1 percent. Part of this trend was due to a pause in new construction starts early in the pandemic. However, …

Omaha’s office market saw more total lease transactions in 2021 for more total space than in any year since our firm has tracked it — 281 transactions for nearly 1.8 million square feet. In a typical year, Omaha usually sees approximately 200 transactions for 1 million square feet. In addition to leasing activity, net absorption was positive at 310,391 square feet, and Omaha’s overall vacancy rate contracted slightly over the year. In turn, year-over-year market rent growth reached its highest point since pre-COVID-19. “Though slow-moving compared with other major U.S. metros, Omaha’s office market is showing early signs of a recovery thanks to its diversified employment base,” states CoStar. It seems fair to describe the market as stable as we are not seeing large swings in space availability and pricing, but it feels tenuous, just as corporate office space decision-makers are dealing with uncertainty. We continue to see office users choosing to wait and see on decisions affecting demands for office space. Most of the numbers are trending the right way, albeit slowly, but Omaha’s vacancy rate is more than 300 basis points higher than seen in many years before the pandemic, and we finished 2021 with 324,398 square feet …

Mirae Asset Global Purchases Academy Sports Headquarters Campus in Metro Houston for $190M

by John Nelson

KATY, TEXAS — Mirae Asset Global Investments, a global investment firm based in Seoul, South Korea, has purchased the headquarters campus of sporting goods retail giant Academy Sports + Outdoors (Nasdaq: ASO) in the west Houston suburb of Katy. Phoenix-based Tratt Properties sold the 1.5 million-square-foot campus, which is triple-net leased to Academy Sports on a long-term lease, for $190 million. The 93-acre campus includes a little over 1.2 million square feet of warehouse space, 250,000 square feet of flexible office space and mezzanine space totaling approximately 800,000 square feet. Located at 1800 N. Mason Road, the site has immediate access to Interstate 10 and Texas Highway 99, which circles Houston. “From a logistics perspective, this property is exceptionally well-located, with access to highways in all directions,” says Ken Hedrick, executive managing director of Newmark. “The scarcity and increasing value of land in the west Houston area further enhance the property’s value.” Hedrick, along with Newmark colleagues Jerry Hopkins, Andrew Ragsdale, Alex Foshay and Kristian Nielsen, represented Tratt Properties in the sale. Dustin Stolly, Jordan Roeschlaub and Nick Scribani, also with Newmark, arranged acquisition financing on behalf of Mirae Asset Global. Tratt Properties is an active logistics real estate investor …

Drawbridge Realty Buys Arrow Electronics Headquarters Property in Englewood, Colorado for $106M

by Amy Works

ENGLEWOOD, COLO. — Drawbridge Realty has purchased one of the Arrow Buildings at Dry Creek Station in Englewood for $106 million. The acquisition is Drawbridge’s first since completing a $1.7 billion recapitalization of its national portfolio in February with institutional investors KKR and General Atlantic. Arrow Electronics (NYSE: ARW) fully occupies the 223,177-square-foot, Class A headquarters building, located at 9151 E. Panorama, on a long-term basis. Constructed in 2017, the property enabled Arrow to consolidate its more than 1,600 local employees spread across nine buildings into one campus-style location. The seven-story building offers parking for more than 1,300 cars and is adjacent to Interstate 25 and near the Dry Creek light rail station. The acquired building is adjacent to Arrow’s other worldwide headquarters building. Terms of the transaction were not released.

COLORADO SPRINGS, COLO. — Cushman & Wakefield has arranged the sale of Interquest I-IV, a four-building flex, office and healthcare portfolio located at 9925, 9945, 9950 and 9960 Federal Drive in Colorado Springs. An undisclosed seller sold the asset to a Denver-based private partnership for an undisclosed price. Aaron Johnson and Jon Hendrickson of Cushman & Wakefield represented the seller. Constructed in phases in 2001 and 2008/2009, the buildings offer a total of 241,232 square feet of flex, office and healthcare space. At the time of sale, the portfolio was 76 percent leased to a healthcare and technology tenants. Interquest I (9945 Federal Drive) and Interquest II (9925 Federal Drive) have LEED Silver certification.

PHOENIX — Meridian has completed the sale of Grunow Memorial Medical Center, a medical office property located in Phoenix. A private Canadian investor acquired the asset for $17.9 million. Located at 925 E. McDowell, Grunow Memorial Medical Center features 53,000 square feet of medical office space. At the time of sale, the building was 90 percent leased to 12 tenants, including DaVita Dialysis. Lester A. Bryon designed the property, which was constructed in 1931. Mindy Berman of JLL represented Meridian in the transaction.