DALLAS — Colliers has brokered the sale of Meadow Park Tower, a 260,000-square-foot office building located along the North Central Expressway corridor in Dallas. Dallas-based owner-operator Bradford Cos. purchased the property from an undisclosed seller and plans to invest about $8 million in capital improvements. Construction of that project will start during the current quarter. The sales price was not disclosed. Creighton Stark and Chris Boyd of Colliers brokered the deal along with Richmond Collinsworth of Bradford Cos.

Office

PEARLAND, TEXAS — Partners Capital, the investment management platform and development arm of Partners Real Estate Co., has purchased Silverlake Business Park, a five-building, 90,000-square-foot office and industrial complex located in the southern Houston suburb of Pearland. Wes Cole of Cantera Real Estate Group represented Partners Capital in the off-market transaction in conjunction with internal agents Andrew Pappas and Adam Hawkins. The seller and developer, WC Properties Ltd., was self-represented. Veritex Bank provided acquisition financing for the transaction.

NEW YORK CITY — Bank of America has provided a $123 million loan for the refinancing of 767 Third Avenue, a 40-story office tower in Manhattan. Designed by FXFowle, the building spans 310,000 square feet and features an amenity center with games, a movie screen, lounge with TVs and a boardroom. James Millon, Tom Traynor and P.J. Finley of CBRE arranged the debt. The borrower was Sage Realty, the leasing and management division of the William Kaufman Organization. A portion of the proceeds will be used to fund capital improvements and leasing costs.

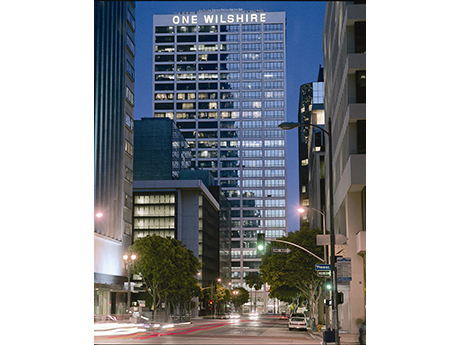

LOS ANGELES — JLL has arranged the $389.2 million refinancing of One Wilshire, a multi-tenant data center located at 624 S. Grand Ave. in downtown Los Angeles. The borrower is GI Partners, an alternative investment firm based in San Francisco. The 30-story, 661,553-square-foot data center features five separate utility power risers and 13 onsite generators with fuel storage for 24 hours of operation, along with separate and redundant data risers. The property also features office space, a multi-tower antenna array and fiber connectivity to the rooftop. Kevin MacKenzie, Brian Torp, Jake Wagner, Samuel Godfrey and Darren Eades of JLL arranged the 10-year, fixed-rate, non-recourse, interest-only loan through Goldman Sachs. “As one of the largest internet exchanges in the world, One Wilshire is truly a best-in-class asset recognized as the premier telecommunications hub of the Western United States,” says MacKenzie. “GI Partners has done an excellent job managing the asset to maximize utilization and creating significant value.” The demand for fast, secure and reliable data storage and delivery is at an all-time high and will continue to escalate for the foreseeable future thanks to the widespread appeal of content streaming services, social media and virtual connectivity. As a data center market, …

AUSTIN, TEXAS — Shorenstein Properties, an investment firm headquartered in San Francisco and New York City, has sold the Alpha Building, a 210,000-square-foot office property located within the 750-acre Mueller District in Austin. The Teacher Retirement System of Texas (TRS) purchased the six-story building, which was designed by Page Sutherland Page, for an undisclosed price. Troy Holme and Peter Jansen of CBRE represented TRS in the transaction. Shorenstein is developing two more office buildings at Mueller that will contain approximately 350,000 square feet and are slated for a 2024 delivery.

NEW YORK CITY — Locally based firm ABS Partners Real Estate has completed the redevelopment of LX57, a 110,000-square-foot office building located at 695 Lexington Ave. in Manhattan’s Plaza District. The project included a lobby upgrade, renovated elevator cabs that feature touchless technology, a façade restoration and new furnishings of office suites. The 20-story building now also houses interior finishes that are designed for ease of cleaning and disinfection, and each floor now includes a dedicated air filtration system.

EWING, N.J. — CBRE has negotiated the sale of a 310,000-square-foot office and warehouse building in the Trenton suburb of Ewing for $18.7 million. The property was originally built in 1995 as a build-to-suit for the seller and occupant, Educational Testing Service (ETS). Jeffrey Dunne, Jeremy Neuer, Steve Bardsley, David Gavin, Rich Gatto, Fahri Ozturk, Travis Langer, Zach McHale, Matthew Saker and Alec Monaghan of CBRE represented ETS in the transaction. The team also procured the undisclosed buyer, which will temporarily lease the space back to ETS.

SAN ANTONIO — Northmarq has arranged a $12.3 million loan for the refinancing of Teralta Corporate Park, a two-building, 58,389-square-foot office property in San Antonio. The single-story property was built in 2017 and fronts Loop 1604 near the junction of Interstate 10. Aetna provided the three-year, interest-only loan to the borrower, San Antonio-based Sirell Properties. Bryan Leonard of Northmarq arranged the debt.

JERICHO, N.Y. — New Jersey-based investment firm The Birch Group has acquired 1 and 2 Jericho Plaza, a 665,592-square-foot office complex on Long Island, for $212 million. The property was 95 percent leased at the time of sale to tenants such as AIG, Deloitte, Morgan Stanley, Ernst & Young, Valley Bank, Sterling National Bank and UBS. The seller was a partnership between New York City-based private equity firm DRA Advisors and New Jersey-based Onyx Equities.

SAN FRANCISCO — PRP has completed the sale of 350 Rhode Island Street, an office property in San Francisco. PRP bifurcated the land and improvements, selling the fee simple position to Safehold (NYSE: SAFE) for $64.5 million and selling the leasehold to a venture of Lincoln Property Co. and Korea Asset Investment Management for $118 million, for a total consideration of $182.5 million, or $1,436 per square foot. The transactions occurred simultaneously. The City and County of San Francisco occupy the 127,100-square-foot building under a lease that goes through 2033. Originally built in 2002, the building was redeveloped in 2019 for the city’s tenancy. Adam Lasoff, Rob Hielscher, Michael Leggett, Miyeon Lee and Erik Hanson of JLL Capital Markets handled the transaction.