BOTHELL, WASH. — Colliers has arranged the sale of the Wright Group Building, an office and flex property located at 19201 120th Ave. NE in Bothell’s North Creek business park. RH Wright LLC sold the asset to Gravestone Partners for $10.2 million. Totaling 59,830 square feet, the building offers 25,000 square feet office space supported by flex and warehouse elements. The property features at least 20-foot clear heights, two dock-high doors, eight grade-level doors and 1,000 amps of power. At the time of sale, the building was partially occupied by a mix of office and service-oriented tenants, including Trane Technologies, Element Materials Technologies, ISEC Construction, Taekwondo Way, Biogenesis and Barry Glenn State Farm. David Gunther of Colliers represented the seller in the deal.

Office

CHICAGO — Skender has completed the 230,000-square-foot build-out of Invenergy’s One South Wacker Drive headquarters in Chicago. The developer, owner and operator of power infrastructure originally occupied floors 18, 19 and 20. Skender completed upgrades to those floors in addition to the demolition and full construction of five additional floors (14-17). The project team included Lumen Workplace as owner’s representative, Partners by Design as architect and Syska Hennessy as engineer. Skender completed the build-out and renovation in three phases over the course of 12 months. The open-office concept features a three-floor atrium stair, two roof decks, a large café and an 8,000-square-foot control center for managing global power markets and operations. Floor 15 now serves as the heart of the workplace with a new reception area and boardroom.

DALLAS — UBS has signed a 26,537-square-foot office lease at 23Springs, a newly constructed office building in Uptown Dallas. The global wealth manager will occupy the entire 20th floor of the 26-story building and plans to take occupancy this summer. Robert Jimenez, Burson Holman and Elizabeth Fortado represented the landlord, Dallas-based Granite Properties, in the lease negotiations on an internal basis. Robby Baty and Bill McClung of Cushman & Wakefield represented UBS.

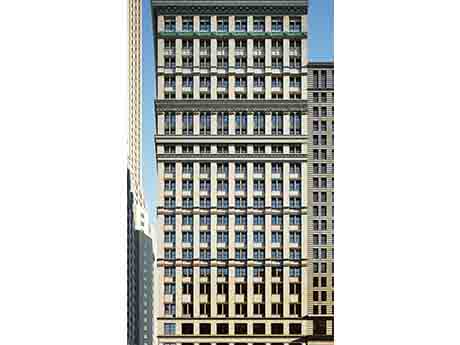

NEW YORK CITY — GFP Real Estate has received $191.5 million in financing for the office-to-residential conversion of 40 Exchange Place, a historic 300,000-square-foot building in Lower Manhattan’s Financial District. Upon completion, the 20-story converted building will include 382 affordable and market-rate apartments, as well as ground-floor retail space. In addition to the loan, the project will be backed by federal and state historic rehabilitation tax credits as well as a 35-year 457-m tax abatement, a New York City incentive designed to support office-to-residential conversions. Jordan Roeschlaub, Chris Kramer and Tim Polglase of Newmark arranged the financing through Derby Lane. A construction timeline was not announced.

NEWARK, DEL. — NAI Emory Hill has brokered the sale of a 27,000-square-foot office building in Newark, located near the Delaware-Pennsylvania border. The building at 254 Chapman Road sits on a 1.9-acre site within the University Office Plaza development and was 93 percent leased at the time of sale. Jim O’Hara Jr. of NAI Emory Hill represented the seller, BRB Realty, in the transaction. EXP Realty represented the buyer, Life Reign International LLC.

NEW YORK CITY — Cushman & Wakefield and Greystone Capital Advisors have co-arranged an $800 million loan for the refinancing of 550 Madison Avenue, a 41-story, roughly 685,000-square-foot office building in Midtown Manhattan. The borrower is The Olayan Group, a family-owned international investment firm. A consortium of lenders led by Rothesay, a pension insurance company based in the United Kingdom, and ING Capital provided the debt. Several other lending institutions and insurance companies, including Crédit Agricole CIB, BBVA, BNP Paribas, Société Générale and Chubb, also participated in the financing. John Alascio, Gideon Gil, Alexander Hernandez, Alex Lapidus, Zach Kraft, Meredith Donovan and Cecelia Galligan led the transaction for Cushman & Wakefield. The team collaborated with Greystone’s Drew Fletcher, Bryan Grover and Jesse Kopecky to place the debt on behalf of ownership. According to Wikipedia, the building was originally constructed in 1984 as the headquarters of AT&T Corp. and would later house the headquarters of Sony. Olayan Group acquired 550 Madison Avenue in 2016 and subsequently implemented a $300 million capital improvement program. Designed by Norwegian architecture firm Snøhetta, the renovation repositioned the former single-tenant headquarters building into a multi-tenant workplace destination. Building features include a triple-height lobby, a half-acre public …

STAMFORD, CONN. — Newmark has arranged a $51.8 million acquisition loan for Metro Center, a 282,589-square-foot office building in the southern coastal Connecticut city of Stamford. Metro Center was originally built in 1987 and has undergone more than $12 million in recent capital improvements. Tenants include law firm Robinson + Cole and Roth Capital. Christopher Kramer, Chris Lozinak and Jordan Roeschlaub of Newmark arranged the loan through Knighthead Funding on behalf of the new owner, local investment firm HB Nitkin Group. Newmark also represented the undisclosed seller in the disposition of the building and has been retained as the leasing agent.

NORWALK, CONN. — CBRE has brokered the sale of a four-building, 945,000-square-foot office park in the southern coastal Connecticut city of Norwalk. The buildings are part of a larger, six-building development known as Merritt 7, which houses the headquarters of companies such as Xerox, Terex, Emcor, Hearst Connecticut Media Group, Common Fund, Datto/Kaseya, MBI and LBB Specialties. Jeff Dunne, Steven Bardsley and Travis Langer of CBRE represented the seller, an entity doing business as Merritt 7 Venture LLC, in the transaction. The duo also procured the buyer, New York-based Argent Ventures.

Marcus & Millichap Brokers Sale of 33,055 SF Mixed-Use Property in San Diego’s La Jolla Neighborhood

by Amy Works

SAN DIEGO — Marcus & Millichap has arranged the sale of Prospect Square at La Jolla Village, a mixed-use property located in San Diego’s La Jolla submarket. 1025 Prospect LLC sold the asset to 1025 Associates LLC & Wedge 3.0 LLC for $10.3 million. Nick Totah of Marcus & Millichap represented the seller, while Ross Sanchez of Marcus & Millichap represented the buyers in the deal. Located at 1025 Prospect St., Prospect Square at La Jolla Village features 33,055 square feet of ground-floor and second-floor retail and restaurant space, third-floor office space and a three-story subterranean parking garage. Current tenants include Cody’s Restaurant, Beeside Balcony, The Agency, Arjang Fine Art, Blueprint Equity and Patient Partner. Originally built in 1984, the property was renovated in 2022 and 2024.

FRISCO, TEXAS — Sports and comedy entertainment group Dude Perfect has opened an 80,000-square-foot headquarters and entertainment facility in Frisco. Known as DPHQ3 and designed by Alliance Architects in conjunction with Tangram Interiors and Studio Other, the space features private offices, open desking areas, a café, lounges, phone booths and communal hubs. In addition, the facility doubles as an athletic playground via an NBA-sized basketball court, 45-yard turf field and a golf simulator. Founded in 2009 by five Texas A&M University graduates, Dude Perfect first began exploring plans for such a facility in North Texas in 2022.