NEW YORK CITY — JTC Group has signed a 15,926-square-foot office lease in Midtown Manhattan. The global fund administration services company will relocate from Rockefeller Center to the entire 20th floor of 575 Madison Avenue, a 25-story, 385,347-square-foot building. David Hollander, Gregg Rothkin, Brad Auerbach, Maxwell Tarter and William Hooks of CBRE represented the landlord, Steinberg and Pokoik Management Co., in the lease negotiations. John Nugent and Joe D’Apice, also with CBRE, represented the tenant.

Office

HOUSTON — JLL has arranged an undisclosed amount of acquisition financing for 3555 Timmons, a 227,064-square-foot office building located in the Greenway Plaza area of Houston. Built in 1982 and renovated in both 2017 and 2024, the building was 95 percent leased at the time of sale, with the Houston-Galveston Area Council serving as the anchor tenant. Michael Johnson, Michael King, Scot Sarlin and James Lovell of JLL arranged the fixed-rate debt through an undisclosed insurance company on behalf of the borrower, DML Capital.

PHOENIX, CHANDLER, TEMPE AND SCOTTSDALE, ARIZ. — City Office REIT has completed the disposition of six office buildings totaling 1.2 million square feet in the Phoenix area to Southwest Value Partners for $266 million. Ben Geelan, Will Mast and Charlie von Arenstschildt of JLL Capital Markets represented the seller. Sher Hafeez, Michael Leggett, Dan Freeze and Josh Lieberman of JLL provided advisory services. The portfolio includes:– Block 23, a 307,000-square-foot property at 101 E. Washington St. in downtown Phoenix;– 5090 N. 40th Street, a 173,000-square-foot asset at 5090 N. 40th St. in Phoenix’s Camelback corridor;– SanTan, a 267,000-square-foot asset in Chandler;– Papago Tech, a 163,000-square-foot property at 1600-1700 N. Desert Drive in Tempe;– The Quad, a 163,000-square-foot building at 6200-6390 E. Thomas Road in Scottsdale;– Camelback Square, a 174,000-square-foot building at 6991 E. Camelback Road in Scottsdale.

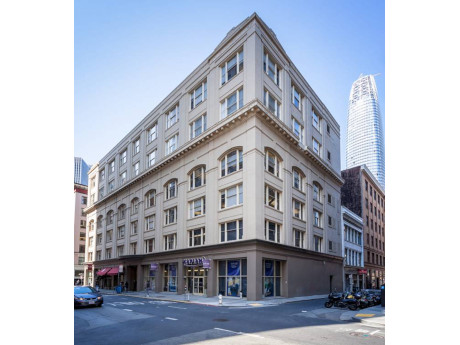

SAN FRANCISCO — TMG Partners and Bridges Capital have purchased 149 New Montgomery Street, an office building in San Francisco’s South Financial District. The partnership acquired the mortgage loan from U.S. Bank as trustee in August and has now acquired the property through a deed in lieu of foreclosure. Originally built in 1907, the property offers 80,000 square feet of office and ground-floor retail space, including Café Madeleine. The new owners plan to renovate the building.

NASHVILLE, TENN. — Avison Young has negotiated the $4.5 million sale of a 7,203-square-foot boutique office building located at 107 Kenner Ave. in Nashville. Mike Jacobs, Lisa Maki and Jordan Powell of Avison Young represented the seller, Jim Jacobs of SilverPine Investments and Chapman Capital, in the transaction. Crews Johnson of Cushman & Wakefield represented the buyer, an accounting firm that will occupy the office building. The two-story property features two conferences rooms, three work rooms, collaborative spaces, a break room, reception area and 23 parking spaces. The freestanding property was built in 1979, according to LoopNet Inc.

NAPERVILLE, ILL. — Greenstone Partners has arranged the $6.1 million sale of 1952 McDowell Road, a 55,000-square-foot medical and office building in the Chicago suburb of Naperville. The anchor tenant is Advanced Behavioral Health Services, which occupies the entire third floor and recently extended its lease through 2029. The asset was 86 percent leased at the time of sale. Jason St. John and AJ Patel of Greenstone represented the seller, a Naperville-based office operator. An outside broker represented the buyer, a local investor.

PLYMOUTH TOWNSHIP, MICH. — Bernard Financial Group (BFG) has secured a $1.5 million loan for the refinancing of a 53,314-square-foot office property in Plymouth Township. Adam Ferguson of BFG arranged the loan on behalf of the borrower, Plymouth Commerce Center LP. A life insurance company provided the loan.

NEW YORK CITY — WeWork has signed a 55,000-square-foot office lease at 245 Fifth Avenue, a 24-story, 316,495-square-foot building in Midtown Manhattan. The space spans four floors, and the lease term is 10 years. Aaron Ellison and Travis Milone of Newmark, along with internal agents Peter Greenspan and Melissa Visoky, represented WeWork in the lease negotiations. Scott Klau, Erik Harris, Zach Weil, Cole Gendels and Ben Klau, also with Newmark, represented the landlord, The Moinian Group.

NEW YORK CITY — Norges Bank Investment Management, the world’s largest sovereign wealth fund, has agreed to acquire a 95 percent interest stake in Manhattan’s 1177 Avenue of the Americas for $542.6 million. The deal values the 1 million-square-foot office property at $571.1 million. Boston-based Beacon Capital Partners will acquire a 5 percent interest in the building and will perform the asset management duties for the property on behalf of the new ownership. Eastdil Secured served as exclusive advisor to the seller, a joint venture between California State Teachers’ Retirement System (CalSTRS) and New York City-based Silverstein Properties. The transaction is expected to close this quarter. The sellers acquired the Sixth Avenue building at the end of 2007 for more than $1 billion. The 47-story property was completed in 1992. Notable tenants include law firm Kramer Levin, private equity firm Mill Point Capital, nonprofit Practising Law Institute and global insurance and investment organization Starr. The asset features a recently renovated lobby with 60-foot-high ceilings and a new outpost of Naya, a fast-casual Middle Eastern restaurant. Norges Bank Investment Management is an investment fund created to manage revenue from Norway’s oil-and-gas resources. The fund invests in equities, fixed-income investments, real estate …

— By Sebastian Bernt of Avison Young — The San Diego office market is beginning to stabilize in 2025. However, recovery remains uneven amid elevated vacancy, rising sublease availability and evolving workplace strategies. While quarterly leasing activity has improved modestly— up roughly 7 percent year over year through the second quarter — overall fundamentals remain challenged. San Diego’s total office availability rate stands at 18.2 percent as of the second quarter. This is flat from the previous quarter but still up more than 500 basis points from pre-pandemic norms. Sublease availability exceeds 2.2 million square feet, a lingering effect of corporate downsizing and the continued shift toward hybrid work models. Sublease inventory is most concentrated in suburban nodes such as UTC and Sorrento Mesa, as well as Downtown San Diego. Demand remains strongest for Class A assets in suburban submarkets like UTC, Del Mar Heights and Sorrento Valley where tenants prioritize modern, amenity-rich properties. Even within these markets, average deal sizes have declined by 20 percent to 30 percent compared to 2019 levels, with users often consolidating space and seeking shorter lease terms. Downtown San Diego continues to face pronounced headwinds, with vacancy topping 25 percent in several Class B …