NEW YORK CITY — Law firm Knobbe Martens has signed a 27,375-square-foot office sublease at 1745 Broadway in Midtown Manhattan. The space spans the entire 21st floor of the 26-story, 780,525-square-foot building. Richard Bernstein, Adam Ardise, Stephen Bellwood, Lei-Lani Keelan and Troy Elias of Cushman & Wakefield represented the sublandlord, Penguin Random House, in the negotiations. David Berke and Scott Gutnick of Newmark represented Knobbe Martens. Atlanta-based Invesco Real Estate owns 1745 Broadway.

Office

AUSTIN, TEXAS — Kane Russell Coleman Logan PC has signed an approximately 8,000-square-foot office lease at Frost Bank Tower in downtown Austin. The new office, which is scheduled to open in the coming weeks, will be staffed by six partner and associate attorneys and three business professionals. The Dallas-based law firm has also planned for future expansion at the 33-story building. An affiliate of Endeavor Real Estate Group owns the building.

AUSTIN, TEXAS — Industrious will open an 18,653-square-foot coworking space at Victory Plaza, a three-story building in North Austin. The space will be the sixth in Austin for the New York City-based company, which was recently acquired by Dallas-based CBRE Group Inc., and the opening is slated for this summer. Brent Powdrill, Bethany Perez and Colton McCasland of JLL represented the undisclosed landlord in the lease negotiations. Kristi Svec Simmons and Jon Wheless of CBRE represented Industrious.

KALAMAZOO, MICH. — BrainWise Psychotherapy has expanded its practice at One Crosstown Plaza in Kalamazoo. The practice opened its newly expanded space on March 1. After initially opening in a 1,250-square-foot space in 2024, BrainWise now occupies 4,353 square feet on the fourth floor of 555 Crosstown Parkway. The expansion enables the practice to onboard more therapists. BrainWise offers both in-person and online sessions for mental health support. Kara Schroer of NAI Wisinski of West Michigan represented the landlord in the lease with BrainWise.

CHELMSFORD, MASS. — DH Property Holdings (DHPH) has received a $19.2 million construction loan for an office-to-industrial conversion project in Chelmsford, located northwest of Boston. The regional developer plans to demolish a 102,786-square-foot office building at 270 Billerica Road and construct a 91,606-square-foot industrial facility with a clear height of 32 feet, 12 dock positions and parking for 181 cars and 11 trailers. Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Michael Ianno and Stanley Cayre of Walker & Dunlop arranged the loan through Voya Financial on behalf of DHPH.

Partnership to Open 808,000 SF First Phase of Aggie Square on UC Davis Health Campus in Sacramento

by Amy Works

SACRAMENTO, CALIF. — Baltimore-based Wexford Science + Technology, in partnership with The University of California, Davis and the City of Sacramento, has announced the groundbreaking of Aggie Square, a mixed-use development at UC Davis Health Campus in Sacramento. Located at the corner of Stockton Boulevard and 2nd Avenue, Aggie Square’s first phase will offer 808,000 square feet of upscale Class A life sciences research labs, technology and office space, plus housing and retail space. The ribbon-cutting ceremony is scheduled for May 2. Situated on 8.2 acres, Phase I consists of a 313,000-square-foot lab and life sciences building, a 255,000-square-foot Lifelong Learning office and classroom building, a 35,000-square-foot UC Veterinary Genetics Lab, and Anova Aggie Square, a 190-unit residential development with 15,000 square feet of retail space. The first phase also offers community serving uses, a parking structure and indoor/outdoor public spaces. Each building is anchored by UC Davis programs and configured to co-locate private industry investment and innovation infrastructure for startups, as well as community-based partnerships. The project team is also marketing another 313,000-square-foot lab and life sciences building with ground-floor retail located at 100 Aggie Square. The building offers flexible design, and construction will commence once preleasing thresholds are met. …

SAN DIEGO — Dollinger Properties has completed the sale of a two-story office building located at 8965 Balboa Ave. in San Diego’s Kearney Mesa neighborhood. Sharp HealthCare acquired the asset for $12.3 million. County of San Diego occupies the 27,761-square-foot property, which was built in 1985. The tenant has been onsite since 2002. Bob Prendergast, Lynn LaChapelle and Zac Saloff of JLL Capital Markets Investment Sales and Advisory team represented the seller, while Mike Labelle and Bridget Gossett of Cushman & Wakefield represented the buyer in the deal.

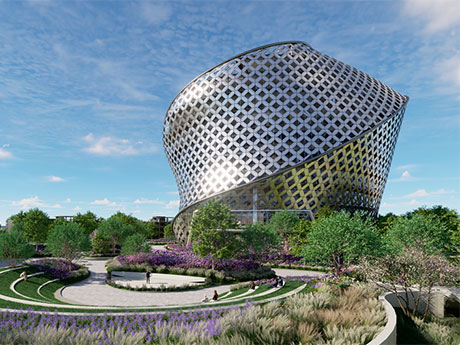

Port San Antonio Board of Directors Approves Next Step in Development of 300,000 SF Innovation Tower

SAN ANTONIO — The Port San Antonio Board of Directors has unanimously approved the next step in the development of Innovation Tower, an office project on the 1,900-acre Tech Port campus, located just southwest of downtown San Antonio. Port San Antonio is a public entity created to redevelop land formerly occupied by Kelly Air Force Base. Yesterday, the board approved $7.5 million to move the tower from its preliminary phase to the finalization of architectural plans, budget and schedule. The design phase is expected to last about one year, with groundbreaking slated for 2026 and completion by 2028. Project costs are estimated at roughly $275 million, according to the San Antonio Business Journal. The multi-story Innovation Tower, which will be located at the main entrance of the campus, will support growing demand by adding nearly 300,000 square feet of high-end office space. The tower will also include 27,000 square feet of amenity spaces such as a health and wellness center, sauna, locker rooms and a large conference room. Pelli Clarke & Partners designed the tower, with architect Bill Butler leading the project. The tower is a component of a broad innovation campus development strategy the organization unveiled in fall 2024. …

PARSIPPANY, N.J. — CBRE has negotiated the $10.2 million sale of a 79,766-square-foot office building in the Northern New Jersey community of Parsippany. According to LoopNet Inc., the building at 299 Cherry Hill Road was originally constructed in 1977 and renovated in 2021. Capital improvements included a redesign of the exterior façade; updated roadway signage, a new electronic tenant directory and LED lighting in the lobby and a new tenant amenity center with grab-n-go food service, conference room and a huddle room. Charles Berger and Thomas Mallaney of CBRE represented the seller and procured the buyer in the transaction.

NEW YORK CITY — NY E-Health Collaborative has signed a 15,000-square-foot office lease in Midtown Manhattan. The nonprofit networking organization for healthcare professionals is taking space at 5 Penn Plaza, which is located within Hudson Yards and was recently repositioned. Mitch Konsker, Christine Colley, Kristen Morgan, Greg Wang, Kate Roush and Dan Turkewitz of JLL represented the landlord in the lease negotiations. Joe Speck and Reid Longley of Colliers represented the tenant.