PLEASANT PRAIRIE, WIS. — Dermody Properties has broken ground on LogistiCenter at Pleasant Prairie, a rail-served logistics park in southeast Wisconsin. WestRock, a sustainable packaging company, has signed a build-to-suit lease to occupy more than 580,000 square feet within the park. The project site was previously home to a power plant and sits adjacent to substations that can deliver power capacity and provide freshwater service from Lake Michigan. LogistiCenter at Pleasant Prairie is expected to include three buildings totaling 2.4 million square feet with the flexibility to accommodate build-to-suits ranging from 250,000 to 1.8 million square feet.

Property Type

LAS VEGAS — Berkadia has arranged the sale of Prosper 89, a garden-style apartment community in Las Vegas. Nevada-based Turtle Bay 89 sold the asset to California-based Benedict Canyon Equities for $24.1 million, or $270,787 per unit. Located at 10750 El Camino Road, Prosper 89 features 89 units in a mix of one- and two-bedroom apartments with private garages. Community amenities include a pool, clubhouse, business center, fitness center and open grass areas. Jared Glover of Berkadia Las Vegas facilitated the transaction on behalf of the seller.

CHICAGO — General contractor Skender has completed a full interior and exterior revitalization of the Barbara Jean Wright Court Apartments in Chicago’s University Village neighborhood. The affordable housing property features 272 units across 27 buildings. Jonathan Rose Cos. purchased the asset from the Chicago Community Development Corp. in 2022 with the intent to preserve the property’s affordability status. In addition to Skender, the project team included architect Grund & Riesterer, mechanical engineer WT Group, civil engineer RTM Engineering and structural engineer Rockey Structures. Skender teamed up with Tandem Ventures to manage regulatory compliance, maximize community engagement and create local employment opportunities on the project. The 18-month project involved an occupied rehab where residents needed to be relocated during 27 phases of energy-efficiency and quality-of-life upgrades. Externally, the buildings received enhanced landscaping, energy-efficient windows, new roof shingles, brick masonry repairs and tuckpointing, new concrete sidewalks and asphalt parking lots, and new entry gates tied to a security and campus entry system. The renovated units provide dishwashers, updated bathrooms and new plumbing fixtures, new floor finishes, energy-efficient lighting fixtures and HVAC plant upgrades. The project also included the ground-up construction of a 5,000-square-foot clubhouse that features a leasing office, conference rooms, computer …

LONGMONT, COLO. — Capstone Apartment Partners has negotiated the sale of Eastglen Apartments, a 109,210-square-foot multifamily property in Longmont, approximately 35 miles north of Denver. Two Arrows Group acquired the asset for an undisclosed price. The seller was not disclosed. Located at 630 Lashley St., Eastglen Apartments features 102 units, with 20 percent designated as Low-Income Housing Tax Credit units. Sean Holamon, Adam Riddle and Jason Koch of Capstone Apartment Partners facilitated the transaction.

DOWNERS GROVE, ILL. — Inland Private Capital Corp. (IPC) has sold a 101,157-square-foot retail property occupied by Best Buy and Golf Galaxy in the southwest Chicago suburb of Downers Grove. IPC, through its subsidiary that serves as an asset manager, facilitated the sale of the property on behalf of Downers Grove Retail DST, one of IPC’s 1031 investment programs. The sale resulted in an equity multiple to investors of 1.75, according to IPC, which purchased the asset in 2013. Best Buy occupies 62,860 square feet, while Golf Galaxy leases 38,297 square feet. Chad Firsel and Daniel Waszak of Quantum Real Estate Advisors Inc. represented the seller. A Florida-based REIT purchased the asset for $14.6 million.

GARDEN CITY, KAN. — Burlington has opened a 22,547-square-foot store in Garden City, a city in western Kansas. The Woodmont Co. owns the property. Burlington occupies a portion of the space that formerly housed Sears. The expansion of the shopping center also included the entry of Kohl’s with an in-store Sephora. David Adams and Kendall Graff represented Woodmont on an internal basis in the lease with Burlington. Rickey Hayes of Retail Attractions LLC facilitated the identification of the project on behalf of the Finney County Economic Development Corp. he also helped facilitate the project’s development and obtained city approvals. Mike Clements of Embree Capital Markets Group Inc. arranged project financing through Dream First Bank, represented by Brandon Mumgaard. Good Neighbor Coffee, spearheaded by Andy Hooper of Hooper Hospitality, is proposed to be the latest addition to the shopping center.

CAMAS, WASH. — Portland, Oregon-based WDC Properties has completed the disposition of Clara Flats, a mixed-use multifamily property in Camas, just across the Columbia River from Portland. An undisclosed, out-of-state buyer acquired the asset for $11.9 million. Located at 608 NE Birch St., the two-building Clara Flats features 30 apartments and two fully leased retail spaces. Completed in 2020, the property features mountain and river views. Jordan Carter, Clay Newton and Tyler Linn of Kidder Mathews represented the seller in the deal.

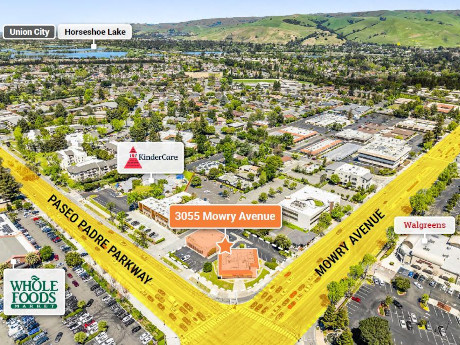

Marcus & Millichap Brokers Sale of 7,200 SF Western Dental-Occupied Properties in Fremont, California

by Amy Works

FREMONT, CALIF. — Marcus & Millichap has arranged the sale of two buildings with a combined size of 7,200 square feet in the Bay Area city of Fremont. A private investor sold the medical office assets to an undisclosed buyer for $3.7 million. Western Dental occupies the assets, located at 3055 Mowry Ave. and 38780 Paseo Padre Parkway, on a net-lease basis. Yuri Sergunin, J.J. Taughinbaugh and Eric Carrillo of Marcus & Millichap’s Palo Alto office represented the seller in the deal.

CONSHOHOCKEN, PA. — Morgan Properties, a development and investment firm based in metro Philadelphia, has acquired a portfolio of 11 multifamily properties totaling 3,434 units in Pennsylvania. Morgan purchased the properties from their original developer, DePaul Management Co. The price was not disclosed. Matt Stefanski and Zachary Pierce of Berkadia brokered the transaction. The portfolio consists of: The new ownership plans to invest more than $80 million in capital improvements to the portfolio. Renovations will feature upgrades to units’ kitchens and bathrooms, as well as the installation of in-unit washers and dryers. Morgan will update lighting, landscaping, roofing and parking areas at all properties and install high-efficiency heating systems. Amenity and common area enhancements will also be undertaken throughout the portfolio. These initiatives will include fitness center upgrades and expansions; construction of exterior dog parks and pet wash stations; and additions of new amenities like Amazon package hubs, playgrounds, pickleball courts and outdoor grilling and dining stations. “The DePaul acquisition directly supports our strategic goal of acquiring large multifamily portfolios with high barriers to entry where our market concentration will enable us to achieve operational efficiencies and capitalize on economies of scale,” says Jonathan Morgan, president of Morgan Properties. — …

By Charlie Adams and Walker Adams of NAI Brannen Goddard Industrial real estate in Atlanta is in limbo as of the second quarter of 2024. Certain submarkets in Atlanta have been overbuilt and tenant demand with historically active users (third-party logistics, wholesale, e-commerce, etc.) has decreased in comparison to what was seen over the last four years. As a result of the space grab during COVID-19, many logistics tenants are sitting on excess inventory within their buildings. Consumer demand has cooled, increased interest rates have dampened the economy as a whole and rents have risen 14.5 percent year-over-year, according to CBRE’s most recent report. The impact of these headwinds for traditional industrial (warehouse and distribution) real estate is positive. Developers haven’t had the fundamentals allowing overbuilding to a point of hyper-supply. Industrial construction starts have been few and far between over the past 12 months, and we believe this lack of new supply will keep Atlanta’s fundamentals healthy through this limbo we’re currently experiencing. With 4 million square feet of net absorption in first-quarter 2024 and 15.9 million square feet under construction, we should see 2025 vacancy in line with current vacancy, assuming absorption continues at a similar pace. Therefore, …