PLYMOUTH, MINN. — CBRE has arranged the sale of Creekside Apartments, a 204-unit multifamily property in the western Minneapolis suburb of Plymouth. Heartland Realty Investors Inc. purchased the community from Creekside Apartment Homes LLP for an undisclosed amount. CBRE’s Keith Collins, Ted Abramson and Abe Appert represented the seller. Built in 2000, Creekside Apartments underwent significant unit and common area improvements over the past four years. Units average 986 square feet. Amenities include a community room, mezzanine workspaces, a fitness center, virtual bike studio, outdoor grilling areas and underground parking.

Property Type

CHICAGO AND NILES, ILL. — Cannabis Facility Construction (CFC) has completed two Bud & Rita’s-branded dispensaries in metro Chicago. Nature’s Grace and Wellness, a family-owned and operated Illinois cannabis firm, pursued an operational partnership approach for both locations. The company partnered with Illinois Cannabis Co. for the property at 5960 W. Touhy Ave. in Niles and Green & Randle for the dispensary at 3425 W. Belmont Ave. in Chicago’s Avondale neighborhood. The design of both facilities draws inspiration from 1950s diners. Half of the 6,000-square-foot Avondale location is designated as open space for hosting community event. The Niles location is larger at 7,600 square feet. In addition to Eastlake Architects, the project team included Boulder for engineering work, Quick Electric for security and IT, Bataglia and Parkside for electrical installations, Dunaway for carpentry, Tim’s Glass for the installation of storefront glass and Right Way Signs for the exterior and interior signage as well as painted murals.

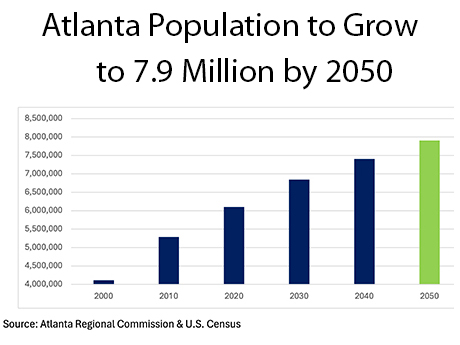

By Will Mathews and Mike Kidd of Colliers What is the reason behind Atlanta’s explosive growth over the last 20 to 30 years? Simply put, it’s been the exponential increase in population driven by an influx of new residents from the Northeast, Midwest and Mid-Atlantic. Atlanta is home to 17 Fortune 500 companies (the third-largest market in the nation), numerous high-paying jobs, a culturally diverse population and multiple prestigious universities, laying a strong foundation for incredible net migration. Multifamily investors are drawn to Atlanta, evidenced by the region’s high volume of multifamily transactions. According to MSCI Real Capital Analytics, Atlanta is currently ranked No. 4 in the country behind New York City, Dallas and Los Angeles in transactions. Despite challenges related to new supply and systematic traffic problems, the future of Atlanta’s multifamily market is very bright for a number of reasons. 7.9 Million by 2050 According to the Atlanta Regional Commission, the population of Atlanta will grow to 7.9 million, or an increase of 1.8 million people from 2020 to 2050. One of the direct beneficiaries of population growth is multifamily rent growth. Reflecting recent population trends, rent growth is forecasted to peak in the suburban counties east of …

By John Nelson Lending activity in the multifamily divisions of Fannie Mae and Freddie Mac is in the midst of a prolonged slump. The 2023 multifamily loan volumes for the government-sponsored enterprises (GSEs) were down significantly year-over-year, with Fannie Mae at $52 billion last year (compared to $69 billion in 2022) and Freddie Mac at $48 billion (compared to $73.8 billion in 2022). And it doesn’t appear that deal volume will return to the frothy levels achieved in 2022 this year. Fannie Mae executed $10.1 billion in loans during the first quarter of 2024, which is almost identical to its first-quarter 2023 production. Freddie Mac generated $9 billion in multifamily loans in the first quarter — up significantly from $6 billion in first-quarter 2023 — but down nearly 45 percent from fourth-quarter 2023. While the GSEs freely acknowledge the slowdown in business, they are more than holding their own when it comes to serving borrowers. The Mortgage Bankers Association (MBA) reports that multifamily loan originations totaled $264 billion in 2023, with the agencies accounting for 38 percent of all multifamily originations. By comparison, the share of overall multifamily originations was closer to 29 percent for Fannie Mae and Freddie Mac …

NEW YORK CITY — New York City-based investment firm KKR has acquired a portfolio of multifamily properties for roughly $2.1 billion. Development and operating company Quarterra Multifamily was the seller. Situated throughout the United States, the portfolio comprises more than 5,200 multifamily units. The properties include a mix of mid- and high-rise buildings, with a concentration in the states of California, Washington, Florida, Texas, Georgia, North Carolina, Colorado and New Jersey. The number of individual properties was not disclosed. According to Daniel Rudin, KKR managing director, the portfolio “serves high-growth metropolitan areas across the country, where new supply will slow down significantly looking out beyond the next couple years.” “We believe this is a great moment to invest in real estate, as transaction activity starts to pick up on the heels of two years of dislocation in commercial real estate markets,” adds Justin Pattner, partner and head of real estate equity in the Americas with KKR. Gibson Dunn & Crutcher LLP advised KKR in the transaction, and Troutman Pepper Hamilton Sanders LLP and Jones Lang LaSalle advised the seller. Carter-Haston, MG Properties and Dalan Real Estate will work with KKR to operate the properties moving forward. — Hayden Spiess

LITTLE ELM, TEXAS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of The District in Little Elm, a 324-unit apartment community located on the northern outskirts of Dallas. The property was built on 10 acres in 2023 and includes 19 townhomes and 10,000 square feet of retail and restaurant space. Units come in one-, two- and three-bedroom floor plans. The amenity package comprises a pool, fitness center, dog park and spa, clubhouse, package lockers, private work pods, a coffee bar and grilling stations. Drew Kile, Taylor Hill, Michael Ware and Cameron Purse of IPA represented the seller, Palladium USA, in the transaction and procured the buyer, Quarry Capital.

LIVE OAK, TEXAS — Dick’s Sporting Goods will open a 100,000-square-foot “House of Sport” store at Live Oak Town Center, a shopping center development located on the northeastern outskirts of San Antonio. The space will feature a climbing wall, outdoor field, multiple golf bays and a multi-sport cage that can be used for baseball, softball, lacrosse and soccer. IKEA (300,000 square feet) and Floor & Décor (79,681 square feet) anchor Live Oak Town Center, which is being developed in phases and will ultimately feature more than 800,000 square feet of shopping, dining and entertainment space. A tentative opening date was not announced. Weitzman owns Live Oak Town Center.

HOUSTON — Credit union Wellby Financial has purchased 9.5 acres in southeast Houston for its new headquarters facility. The site is located near Baybrook Mall and about three miles from Wellby’s current headquarters office at 1330 Gemini St. The square footage of the new complex was not disclosed, but the project will be developed in phases, with construction scheduled to begin next year. Kelly Hutchinson of Colliers represented Wellby Financial in the land purchase. The seller and sales price were not disclosed.

SAN ANTONIO — Partners Real Estate has brokered the sale of an apartment building in San Antonio’s Oak Park/Northwood neighborhood. According to Apartments.com, Riviera Apartments totals 20 units in studio, one- and two-bedroom floor plans and was built in 1965. Steve Garza and Justin Ventura of Partners represented the buyer, an entity doing business as SP 2118 Edgehill LLC, in the transaction. Diego Guevara of Core Commercial represented the undisclosed seller.

HOUSTON — Cima Cash Handling America Inc., which provides computer hardware to count and track money, has signed a 3,400-square-foot lease at an industrial flex facility located at 15720 Park Row Drive in West Houston. According to LoopNet Inc., the building spans 28,800 square feet and was originally constructed in 1998. Jason Gibbons of the Finial Group represented the tenant in the lease negotiations. The name and representative of the landlord were not disclosed.