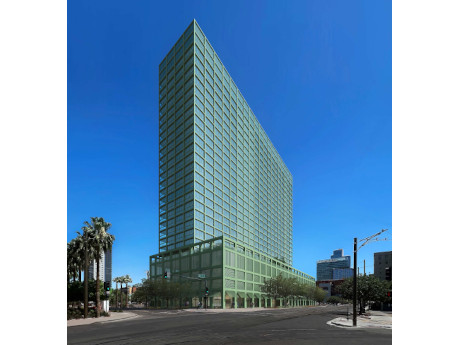

PHOENIX — JLL Capital Markets has arranged $120 million in construction financing for the development of Ray Phoenix, a 26-story residential building in downtown Phoenix. Michael Gigliotti, Brad Miner and Frank Choumas of JLL Capital Markets Debt Advisory secured the financing for the borrower, VeLa Development Partners and Ray, through an affiliate of RXR Realty Investments LLC. Located at 777 N. Central Ave., Ray Phoenix will offer 401 studio, one- and two-bedroom apartments, including duplex and penthouse units with floor-to-ceiling windows, custom cabinetry and luxury flooring and bathroom tiles. The property will feature 20,000 square feet of amenity space, including a large fitness center, yoga studio, resort-style pool, communal kitchen, fireplace lounge, sunken lounge with theater experience, dog wash stations, indoor and outdoor gardens, and workspaces. Situated within an Opportunity Zone, Ray Phoenix will be located on the Phoenix light-rail line and less than a mile north of the Footprint Center and Chase Field.

Property Type

Formation Interests, Crescent Real Estate Break Ground on 427,000 SF Formation Park Industrial Project in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — Dallas-based Formation Interests and Crescent Real Estate has broken ground on the first phase of Formation Park 10, an industrial development at the corner of Bullard Avenue and Celebrate Life Way in Goodyear, a suburb west of Phoenix. Willmeng Construction is serving as general contractor for the project. The first phase of Formation Park 10 will consist of 427,000 square feet spread across two buildings and includes a large, first-of-its-kind park to serve as an amenity for future tenants and the surrounding community.

Davis Property & Investment Buys Central Commerce Center Industrial Campus in Kent, Washington

by Amy Works

KENT, WASH. — Davis Property & Investment has acquired Central Commerce Center, an industrial campus located at the intersection of Central Avenue South and 259th Street in Kent, a suburb south of Seattle. Constructed between 2000 and 2001, Central Commerce Center comprises four fully leased industrial buildings with freeway access, ample parking and proximity to numerous walkable amenities. The buildings offer 12- to 16-foot clear heights, on-grade loading facilities and an infrastructure that includes a total of 1400 amps 3-phase 480v power. Brian Bruininks and Shane Mahvi of Andover Co. represented the undisclosed seller in the deal. The price was not disclosed.

SRS Negotiates $6.1M Ground Lease Sale of Chick-fil-A-Occupied Property in Murrieta, California

by Amy Works

MURRIETA, CALIF. — SRS Real Estate Partners has arranged the $6.1 million ground lease sale of a restaurant property at 27960 Clinton Keith Road in the Inland Empire city of Murrieta. Chick-fil-A occupies the 5,000-square-foot property, which opened for business in March and has a 15-year ground lease in place. Winston Guest, Matthew Mousavi and Patrick Luther of SRS Capital Markets represented the seller and developer, Newport Beach-based Sage Investco, and the buyer, a California-based private family trust, in the all-cash transaction. The Chick-fil-A property sale is part of a break-up strategy valued in excess of $20 million for the Class A pads at The Vineyard Shopping Center, a 26.3-acre retail project anchored by Costco and ALDI.

Progressive Real Estate Partners Brokers $2.4M Sale of Value-Add Retail Strip Center in West Covina, California

by Amy Works

WEST COVINA, CALIF. — Progressive Real Estate Partners has arranged the sale of a multi-tenant retail strip center in West Covina, approximately 20 miles east of Los Angeles. A San Bernardino County-based private investor sold the asset to a West Covina-based investor for $2.4 million in an all-cash transaction. Located at 532-540 N. Azusa Ave., the 7,760-square-foot property was fully occupied at the time of sale by five service-oriented tenants ranging in size from 1,300 square feet to 2,000 square feet. Current tenants include a nail salon, hair salon, martial arts school, massage studio and Friar Tux. Greg Bedell and Roxanne Klein of Progressive Real Estate Partners represented the seller in the deal.

By Chris Cordes, real estate portfolio manager, PPR Capital Management When seeking a sponsor for multifamily partnerships, it’s critical to consider one that offers worthy qualities for the joint venture, since this individual or company will be in charge of managing the property on behalf of the partnership. Worthiness is measured by the ability to be resourceful and versatile. When determining the worthiness of a sponsor, there’s an old expression that can be helpful to keep in mind: “You’re only worth as much as the pocketknife that you carry.” The pocketknife is a simple tool that offers incredible assistance when utilized for daily tasks. While this device is particularly useful when completing common tasks, it’s important to select the right type of pocketknife. Often, a knife with a single blade will not always get the job done, and you’ll need something else to finish a task. The iconic Swiss Army Knife solves that issue. The historic and versatile multi-use device is known for including varying types of pivoting tools that offer a secured level of preparedness in a compact way. During the sponsor screening process, the main equity partner should examine the qualities a sponsor presents and determine whether the …

Ozempic Manufacturer Novo Nordisk Breaks Ground on $4.1B Production Facility Near Raleigh

by John Nelson

CLAYTON, N.C. — Novo Nordisk, a Danish pharmaceutical giant, has broken ground on a 1.4 million-square-foot manufacturing facility in the Raleigh suburb of Clayton. The drugmaker plans to invest $4.1 billion in the development in order to boost the production of diabetes treatment Ozempic, weight loss drug Wegovy and other injectable therapies. Operations at the 56-acre site will include filling and packaging syringes and injection pens. According to CNBC, the demand for Wegovy and Ozempic has outstripped supply in the United States over the past year. The disparity has led to “intermittent shortages,” reports the national news outlet. In 2024 alone, Novo Nordisk is investing $6.8 billion into pharmaceutical production, up from approximately $4 billion last year. “It took us a century to reach 40 million patients, but through this expansion and continued investment in our global production, we’re building Novo Nordisk’s ability to serve millions more people living with serious chronic diseases in the future,” says Lars Fruergaard Jørgensen, president and CEO of Novo Nordisk. “This is yet another real signal of our efforts to scale up our production to meet the growing global need for our life-changing medicines and the patients of tomorrow.” The expansion project will double …

AUSTIN, TEXAS — A partnership between Atlanta-based developer Wood Partners and ParkProperty Capital has opened The Albright, a 261-unit apartment complex in Austin’s Burnet neighborhood. The Albright offers studio, one-, two- and three-bedroom units with smart technology features, stainless steel appliances, granite countertops, walk-in closets and full-size washers and dryers. Amenities include a pool, fitness center, coworking lounge, clubroom, gaming area, pet park and a rooftop lounge. Rents start at $1,475 per month for a studio apartment, according to the property website.

Atlanta BeltLine, Invest Atlanta Approve $172M Budget for Affordable Housing and Trail Construction

by John Nelson

ATLANTA — The board of directors of Atlanta BeltLine Inc. and Invest Atlanta have approved the Atlanta BeltLine budget for the 2025 fiscal year. Totaling $172 million and marking a 12 percent increase over the 2024 budget, the funding will be directed toward the goal set in 2005 of developing 5,600 units of affordable housing by 2030, as well as acquiring land for the completion of trail construction on the planned 22-mile corridor by the end of 2030. Funding sources for the budget include $69 million from the tax-allocation district (TAD); $49 million from donations; $32 million from the BeltLine special service district (SSD); and $20 million from federal grants. “This is a historic and exciting time for Atlanta BeltLine as we get closer to completing the trail while meeting important goals,” says Clyde Higgs, president and CEO of Atlanta BeltLine Inc. “Supported by our new budget, we will exceed our goals for affordable housing, accelerate the pace for trail work and invest in more economic opportunities for all.” The new funding will help The BeltLine to develop more affordable housing than originally set out by the 2005 BeltLine Redevelopment Plan, which is notable since development costs have risen significantly …

LAREDO, TEXAS — Dallas-based Kobalt Investment Co. has purchased the 222,291-square-foot Rio Norte Shopping Center in the Rio Grande Valley city of Laredo. Ross Dress for Less anchors the center, which is also home to tenants such as Michael’s, Petco, Dollar Tree, Shoe Carnival and Five Below. Adam Howells and Matthew Barge of JLL represented the undisclosed seller in the transaction. Kobalt purchased the property in partnership with Dallas-based Stonefield Investment Advisors and San Antonio-based Espada Real Estate.