PUEBLO SPRINGS, COLO. — BWE, on behalf of ESH Development, has secured a $39.5 million HUD 221(d)(4) loan to finance the development of Pueblo Springs, a Class A market-rate apartment project in Pueblo, approximately 45 miles south of Colorado Springs. James Swanson of BWE’s Phoenix office originated the financing. The HUD-insured loan provides for a combined construction and permanent financing for market-rate multifamily projects. The non-recourse, fully assumable loan features a 40-year, fully amortizing term that will qualify for HUD’s reduced rates for eco-friendly developments upon final construction and delivery of units. Pueblo Springs will feature 199 units with nine-foot ceilings in select units, walk-in closets, ceiling fans, private balconies or patios, soaking tubs, breakfast bars, pantries, granite or quartz countertops, and stainless steel and Energy Star appliances, including in-unit washers/dryers. Community amenities will include a clubhouse with Wi-Fi, a fitness center, business center/e-lounge, community room with gourmet kitchen, bike storage, heated pool and spa, barbecue and picnic areas, walking paths, extensive landscaping, 24-hour emergency staff and gated entry. Colorado Structures is serving as general contractor for the project, which will be built to a high standard of energy efficiency.

Property Type

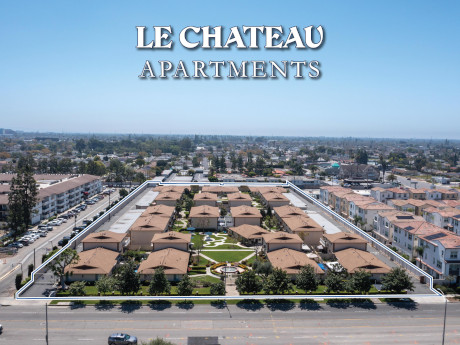

Marcus & Millichap Negotiates $27M Sale of La Chateau Apartments in Anaheim, California

by Amy Works

ANAHEIM, CALIF. — Marcus & Millichap has arranged the sale of La Chateau Apartments, a multifamily community in Anaheim. The asset traded for $27.4 million, or $361,184 per unit. Tyler Leeson, Matt Kipp and Nicholas Kazemi of Marcus & Millichap represented the undisclosed seller, while Drew Holden of Marcus & Millichap represented the undisclosed buyer in the deal. Built in 1964, Le Chateau offers 76 apartments in single-floor and townhome unit styles, all with two bedrooms. Each unit features a private patio and carport with an overhead storage bin. Community amenities include four on-site laundry facilities, a clubhouse and gated garage.

RAVENNA, OHIO — Geis Cos. has completed a 248,000-square-foot manufacturing facility for LG America in Ravenna, about 15 miles east of Akron. The two-building property consists of a three-story, 100,000-square-foot Customer Solutions Building and a single-story, 148,000-square-foot Acrylonitrile Butadiene Styrene (ABS) Compounding Building. The latter building features a fitness room, employee cafeteria and multiple labs for testing, inspection and weighing ABS compounds. Geis and First Energy worked together to engineer a transmission line and substation that is now owned by LG and will power the facility. The project involved significant coordination with the LG design team in South Korea. Geis Construction provided design-build services.

EAGAN, MINN. — Net Lease Office Properties (NLOP) has sold two office assets in the Minneapolis suburb of Eagan for gross proceeds totaling $60.7 million. The properties, which are leased to Blue Cross Blue Shield Inc., are located at 1800 and 3400 Yankee Doodle Road and total 347,472 square feet. Net proceeds after closing costs were used to repay approximately $48 million of JPMorgan’s senior secured mortgage and approximately $8 million on its mezzanine loan. Following the sale, NLOP owns 47 office properties, three of which are leased to Blue Cross Blue Shield.

PORTLAND, ORE. — Gantry has arranged a $16.2 million permanent loan for the acquisition of a warehouse facility located at 6447 N. Cutter Circle in Portland. FedEx Ground fully occupies the 212,000-square-foot building, which was redeveloped in 2015. The 126-door, cross-docked facility offers ready access to the Port of Portland, Interstate 5, Union Pacific Railroad and Portland International Airport. Tony Kaufmann and Joe Foley of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The long-term, fixed-rate loan was secured from one of Gantry’s correspondent life company lenders and structured with a term that exceeds the tenant’s firm lease term. The loan features interest-only payments for half the term, followed by a 30-year amortization period.

FARGO, N.D. — Gindi Equities has acquired Osgood Townsite Apartments, a 243-unit multifamily community built in 2004 in Fargo. Property Resources Group sold the asset for an undisclosed price. The acquisition marks Gindi’s entry into the Fargo market. Gindi plans to invest in a renovation program to modernize and enhance the Class B property. Planned improvements include redesigned kitchens and bathrooms and upgraded building exteriors and grounds. Gindi will also implement sustainable elements and energy savings fixtures to increase efficiency and reduce utility costs. Property Resources Group will continue to manage and service the asset. With this acquisition, Gindi’s multifamily portfolio is valued at over $250 million and includes 2,000 units across the country.

ST. PETERS, MO. — SVN Chicago Commercial has arranged the $3.8 million sale of the Mercy Health medical office building in St. Peters, a northwest suburb of St. Louis. The 17,296-square-foot property is located at 107 Piper Hill Drive. Mercy Health occupies the building on a net-lease basis and recently executed a lease extension with substantial improvements to the site. Tim Franz of SVN represented the undisclosed seller. The asset sold to a West Coast-based REIT.

Tova Capital Acquires 18,600 SF East Willow Village Retail Center in Signal Hill, California

by Amy Works

SIGNAL HILL, CALIF. — Tova Capital has purchased East Willow Village, an inline shop and pad space in Signal Hill, for $6.7 million in an off-market transaction. Signal Hill is approximately 20 miles south of Los Angeles. Located at 2201 E. Willow St., East Willow Village features 18,600 square feet of retail space. Turner’s Outdoorsman anchors the center on a 5,600-square-foot pad. Additional tenants include food, health, wellness and community-serving retail users. Kelly Hawkshaw, Luc Hawkshaw and Eric Mandell of Ally Commercial Real Estate represented Tova Capital in the deal. The seller was not disclosed.

BEACH PARK, ILL. — Marcus & Millichap has brokered the sale of Self Storage of Beach Park, a 57,050-square-foot self-storage property in Beach Park, a city in northeast Illinois. The sales price was undisclosed. Completed in 2021, the asset features 197 non-climate-controlled units and 250 climate-controlled units within three single-story buildings. Sean Delaney of Marcus & Millichap represented the seller, a limited liability company, and procured the buyer, Extra Space Storage. The property will be rebranded as Storage Express.

LAS VEGAS — Evans Senior Investments (ESI) has arranged the sale of a 45-bed post-acute rehab community in Las Vegas. The seller was a regional owner-operator. A national owner-operator with a presence in Nevada acquired the asset for $8.5 million, or $188,888 per bed. The community, exclusively licensed to accept Medicare only, has provided skilled nursing care since its inception in 2015. At the time of marketing, the facility was 73 percent occupied and had struggled to maintain healthy occupancy levels in previous months. Despite these challenges, ESI noted the facility’s growth potential and the anticipated Medicare rate increase set to take effect this year. The previous owner-operator made the strategic decision to divest this asset to better concentrate on its regional portfolio. This was the seller’s only asset outside of the state of Michigan.