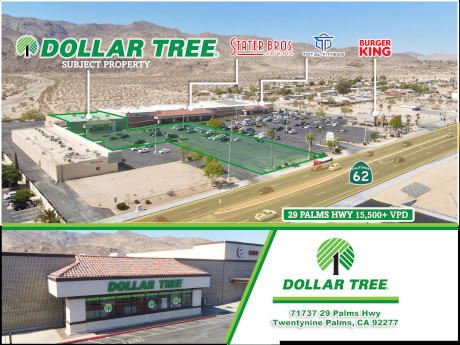

TWENTYNINE PALMS, CALIF. — Marcus & Millichap has arranged the sale of Dollar Tree, a net-leased retail property in Twentynine Palms, just north of Joshua Tree National Park in Southern California. An individual/personal trust sold the asset to an undisclosed buyer for $2.1 million. The 15,506-square-foot Dollar Tree is located at 71737 29 Palms Highway. Dollar Tree has committed to four and a half years on the lease, having recently exercised its five-year option period. There are two additional five-year extension options. The asset occupies a 1.5-acre lot within a 90,000-square-foot retail plaza featuring Stater Bros., Burger King and Total Fitness Gym. Michael Grandstaff and Christopher Hurd of Marcus & Millichap represented the seller, while Karl Markarian of JohnHart Corp. represented the buyer in the deal.

Property Type

By Taylor Williams Everybody loves a good underdog success story, but sometimes the Goliaths of the world just have too much going for them to get beat by the Davids. All retail owners worth their salt recognize the unique draws that boutique, original concepts bring to their shopping centers. But landlords’ fiduciary responsibilities often dictate that they bring in heavier proportions of national credit tenants that can afford top-dollar rents — all other factors being held equal. And in a market defined by (relatively) high costs of capital, low vacancy, healthy demand for space and rising operating expenses, established brands have the edge. “The market definitely favors national credit tenants that are well-financed and have hundreds if not thousands of locations,” says Will Majors, senior vice president in CBRE’s Austin market. “At minimum, it favors franchised locations with national corporate offices that support the franchisees.” According to data from CBRE, the direct availability rate for retail space in Dallas (not the metroplex as a whole) stood at 4.8 percent at the end of the first quarter, essentially unchanged from a year ago. In Austin, the availability rate currently clocks in at 3.4 percent, just 10 basis points higher on a …

Creation to Break Ground on $120M The Switchyard Mixed-Use Development in Suburban Phoenix

by Katie Sloan

QUEEN CREEK, ARIZ. — Development firm Creation is set to break ground on The Switchyard, a $120 million mixed-use development located at the northeast corner of Ellsworth and Ocotillo roads in the Phoenix suburb of Queen Creek. Plans for the 10-acre project include the development of 54,000 square feet of restaurant, retail, residential and office space. The retail portion of the development will include a 3,800-square-foot Postino wine café and an 11,900-square-food restaurant called The Porch, which will include an expansive outdoor patio. Creation plans to break ground on the multi-phase project later this year. Phase I is scheduled for completion in early 2026. The development team includes Dallas-based architect GFF Design and general contractor LGE Design Build. Creation is a real estate development firm with dual headquarters in Phoenix and Dallas. The company has a $4.5 billion pipeline of ground-up development currently underway across six states. — Katie Sloan

John Ramous, Nevada region partner at Dermody Properties, discusses how the southern part of the state’s various regions have evolved into industrial hubs — and what the firm is doing to capitalize on this. WREB: What is it about Las Vegas and its fundamentals that have made it an ideal place for industrial? Ramous: There are several key fundamentals driving Las Vegas’ — or Southern Nevada’s — growth as a comprehensive industrial and regional logistics hub. It’s strategically located near Southern California and other major West Coast markets, maintains a business and tax-friendly environment, has a supportive infrastructure, a streamlined permitting process, a focus on sustainability and a large, talented workforce with competitive labor costs. All these factors make this region an ideal place for industrial and logistics, as well as a very attractive location to work, live and conduct business. WREB: Can you tell me more about your Apex project? Ramous: Apex Industrial Park is becoming a primary center for larger and scalable logistics facilities, advanced manufacturing, technology and other distribution uses. Located in North Las Vegas off Interstate 15, it is luring major companies to the region, benefiting the entire Southern Nevada market. Trucks are arriving full …

FLOWER MOUND, TEXAS — Dallas-based Realty Capital will develop a 181-room hotel in Flower Mound, located in the northern-central part of the metroplex. The 12-story hotel will be located within the 160-acre Lakeside Village mixed-use development and will be operated under the Autograph by Marriott family of brands. The property will also include 21 for-sale residences across the top three floors. Amenities will include a pool, spa, ballrooms, fitness center, a lakefront wedding chapel, an outdoor music amphitheater and several lakefront restaurants.

HOUSTON — Locally based developer Griffin Partners has broken ground on Carter Crossing, a 137,171-square-foot speculative industrial project in North Houston. Carter Crossing will be situated on a nine-acre site near Beltway 8 and I-45 and feature 3,707 square feet of prefinished office space, 32-foot clear heights and 28 dock-high loading doors. Transwestern is the leasing agent for the project, which is expected to be complete before the end of the year.

HOUSTON — Clay Development has completed Kennedy Greens Distribution Center III, a 110,250-square-foot industrial project in Houston. The 7.7-acre site is located at 13520 JFK Boulevard on the city’s north side and is part of a larger, 145-acre development. Building features include 32-foot clear heights, 2,600 square feet of office space and parking for 186 cars. The site can also support parking for up to 32 trailers.

HOUSTON — Elite Pickleball Club will open a 40,000-square-foot indoor facility at Bay Pointe Shopping Center in southeast Houston. According to LoopNet Inc., the property was built on nine acres in 1993 and totals 103,385 square feet. Lesley Rice, Andy Parrish and Audrey Schulz of Partners Real Estate represented the landlord in the lease negotiations on an internal basis. Huntley Grichor of Red Key Houston represented the tenant, which is backfilling part of a former grocery store space.

GEORGETOWN, TEXAS — Clopay has signed a 23,140-square-foot industrial lease in the northern Austin suburb of Georgetown. The manufacturer of overhead and garage doors will occupy space within Building 3 at CrossPoint Business District, the first phase of which will feature 488,758 square feet of space across three buildings and 61.7 acres. The company expects to take occupancy this summer. Darryl Dadon and Olivia Reed of CBRE represented the landlord, a partnership between Jackson-Shaw and Diamond Realty Investments, in the lease negotiations.

BEDFORD, MASS. — Persimmon Technologies has signed a 142,224-square-foot life sciences lease in the northeastern Boston suburb of Bedford. The property at 35 Crosby Drive, which is a redevelopment of a former industrial flex property, will serve as the robotics and electric motor manufacturer’s new North American headquarters. Richard Ruggiero, Torin Taylor, Matthew Adams and Rory Walsh of Newmark represented the landlord, New York City-based REIT, W. P. Carey, in the lease negotiations. Colliers represented the tenant. The redevelopment is expected to be complete late next year.