SAN ANTONIO — Amegy Bank has signed a 44,207-square-foot office lease at 300 Convent, a 28-story, 545,426-square-foot building in downtown San Antonio. The space spans the entire 21st and 22nd floors and a portion of the first floor. Russell Noll of Transwestern represented Amegy Bank in the lease negotiations. Mark Krenger and Lisa Mittel of JLL, along with Dennis Tarro and Phillip Moore of Patrinely, which manages the building, represented the landlord, Affinius Capital.

Property Type

Driftwood Capital Provides $34.8M Mezzanine Loan for Marriott-Branded Hotel Complex in Miami

by John Nelson

MIAMI — Driftwood Capital has provided a $34.8 million mezzanine loan for the refinancing of Miami Airport Marriott Connection, a complex comprising three Marriott-branded hotels near Miami International Airport. Driftwood Capital provided a two-year loan with three one-year extension options on behalf of the borrowers, an affiliate of Cerberus Capital Management and Highgate, via its lending fund Driftwood Lending Partners LP. Located at 1201 N.W. LeJeune Road, Miami Airport Marriott Connection features a 371-room Marriott hotel, 301-room Courtyard by Marriott and a 164-room Residence Inn by Marriott.

MOUNT PLEASANT, S.C. — Trader Joe’s has signed a lease to open a new store at Sweetgrass Corner, a 90,000-square-foot shopping center located in Mount Pleasant, roughly five miles outside downtown Charleston. The grocer will occupy 14,000 square feet at the property, which is owned by Baltimore-based Continental Realty Corp. (CRC). Trader Joe’s, which operates more than 570 stores throughout the country, will be situated within a portion of the space left vacant by the closure of BI-LO in 2019. The new lease brings the center’s occupancy to 82 percent. CRC acquired Sweetgrass Corner in spring 2022. An opening date for the store was not disclosed.

HOUSTON — Restaurateur Mack McDonald will open a 15,858-square-foot restaurant in Uptown Houston. The restaurant will be located within 5POP, a 28-story, 566,773-square-foot office building, and will be operated under the Mack Allen’s upscale seafood brand. David Littwitz with Littwitz Investments represented the tenant in the lease negotiations. Crystal Allen with Transwestern represented the South Florida-based landlord, CP Group. The opening is slated for 2025.

HOUSTON — Locally based brokerage firm Oxford Partners has arranged the sale of an approximately 10,000-square-foot industrial property in northwest Houston. According to LoopNet Inc., the building at 13470 FM 529 totals 5,643 square feet, and the building at 13486 FM 529 totals 4,321 square feet. Nathan Buckhoff and Matt Rogers of Oxford Partners represented the seller, Mbella Properties, in the transaction, and Clay Pritchett of Partners Real Estate represented the buyer.

KILLEEN, TEXAS — California-based brokerage firm Hanley Investment Group has negotiated the sale of a 4,900-square-foot retail building in the Central Texas city of Killeen. The building was constructed in 2023 was net leased to Brakes Plus at the time of sale. Garrett Wood of Hanley represented the buyer, a Florida-based 1031 exchange investor, in the transaction. Matt Montagne, Maxwell Watson and Tyler Ellinger of Sands Investment Group represented the seller, a Los Angeles-based private investor.

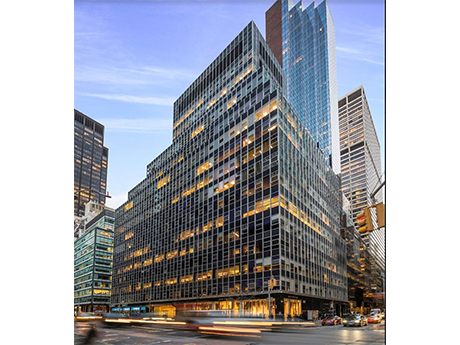

NEW YORK CITY — A partnership between locally based investment firm Waterman Interests and global asset manager HPS Investment Partners will redevelop 850 Third Avenue, a 605,000-square-foot office building in Midtown Manhattan. The 21-story building was originally constructed in 1961. According to the partnership, 850 Third Avenue offers the largest block of available space in Midtown East — more than 400,000 square feet — and will be repositioned to support build-to-suit headquarters deals. A construction timeline was not disclosed.

BOSTON — MassDevelopment has provided $21.8 million in tax-exempt bond financing for a 63-unit affordable housing project that will be located in Boston’s Hyde Park neighborhood. The property will consist entirely of one-bedroom units that will be reserved for households earning 30, 50 or 60 percent or less of the area median income. The borrower and developer is an affiliate of B’nai B’rith Housing of New England. Eastern Bank purchased the bond. The Massachusetts Executive Office of Housing & Livable Communities also provided $16.1 million in tax credit equity for the project.

BEACON FALLS, CONN. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Beacon Mill Village, a 185-unit multifamily property in Beacon Falls, located just northwest of New Haven. Built in 1988, the property offers one- and two-bedroom units with an average size of 809 square feet. Amenities include a pool, fitness center, sauna, tennis court and a dog park. Victor Nolletti, Eric Pentore and Wes Klockner of IPA represented the seller, Navarino Capital Management, in the transaction. The trio also procured the buyer, an entity doing business as Beacon Mill Holdings II LLC.

NORTH KINGSTOWN, R.I. — CBRE has brokered the sale of Mill Creek Townhomes, a 140-unit apartment complex located south of Providence in North Kingstown. Built in 1968 and expanded in 2006, the property offers two-, three- and four-bedroom units with an average size of 1,126 square feet on a 47-acre site. Simon Butler, Biria St. John, John McLaughlin and Brian Bowler of CBRE represented the seller, an affiliate of Massachusetts-based investment firm The Grossman Cos., in the transaction. The team also procured the buyer, Landings Real Estate Group, a private investment group based in Newport, R.I.