EDISON, N.J. — Locally based developer Garden Communities is nearing completion of Millbrook Horizon, a 40-unit multifamily project located in the Central New Jersey community of Edison. Millbrook Horizon comprises three buildings that house one- and two-bedroom units. Two buildings are complete, and the third building will be complete later this summer. Rents start at $2,600 per month for a one-bedroom apartment.

Property Type

PHOENIX — ABI Multifamily has arranged the $2.6 million sale of 1011 Apartments, a multifamily community in Phoenix. The undisclosed buyer and seller are both based in Arizona. Carson Griesemer, Mitchell Drake and Dallin Hammond of ABI Multifamily represented the seller and buyer in the deal. Located at 6623, 6627 and 6631 South 10th St. and 6624 and 6632 South 11th St., 1011 Apartments features 20 two-bedroom/one-bath units each totaling 621 square feet. All units underwent interior upgrades, including new flooring, countertops, window coverings, paint, bathrooms and cabinets. Exterior upgrades include new roofing and air conditioning systems.

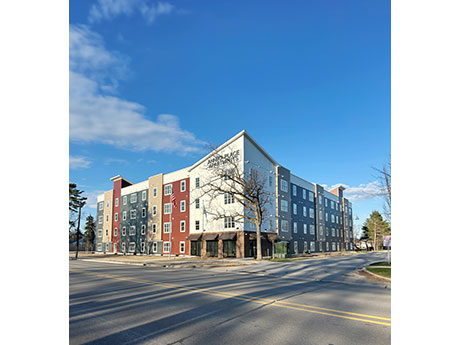

TRAVERSE CITY, MICH. — Woda Cooper Cos. Inc. has opened Annika Place, a 53-unit affordable housing community in Traverse City. The $14.7 million project offers 29 one-bedroom units and 24 two-bedroom units for residents who earn 30 to 80 percent of the area median income. Rental rates range from $377 to $1,125 per month, depending on the income restriction and size of unit. The Traverse City Housing Commission will provide rental assistance for eight units to be occupied by formerly homeless residents. The four-story development features amenities such as a community kitchen, fitness center, rooftop terrace, patio, picnic table, grill, park benches and playground. Annika Place is made possible with funding supported by Low-Income Housing Tax Credits allocated by the Michigan State Housing Development Authority. Affordable housing finance syndicator CREA LLC invested in the credits to provide equity financing. Huntington Bank provided a construction loan and permanent financing. The project honors the memory of U.S. Coast Guardsman Douglas Munro, who lost his life at the Guadalcanal on Sept. 27, 1942, because of heroic measures with his Higgins boat that shielded and saved the lives of 500 Marines. He is the only Coast Guard member to receive the Medal of Honor. …

Marcus & Millichap Brokers Sale of 2,867 SF Fifth & Penn Mixed-Use Property in San Diego

by Amy Works

SAN DIEGO — Marcus & Millichap has arranged the sale of Fifth & Penn, a mixed-use property in San Diego. Tom Fine of TJF 5th Ave LLC sold the asset to Daniel Heimler of DAH Penn LLC for $1.6 million. Located at 441-43 Pennsylvania Ave., the 2,867-square-foot property offers ground-floor restaurant space and an apartment and creative office space on the second floor. The buyer plans to occupy the apartment, while the restaurant and office tenants will remain at the building. Ross Sanchez and Nick Totah of The Totah Group in Marcus & Millichap represented the seller and procured the buyer in the deal.

NEW YORK CITY — Bernhardt Furniture has signed a 20,000-square-foot office lease renewal in Midtown Manhattan. The company’s flagship office and showroom are located at 136 Madison Avenue, a 17-story, 300,000-square-foot building. Mac Roos, Andrew Roos, Michael Cohen and Jessica Verdi of Colliers represented the landlord, Williams Equities, in the lease negotiations. Peter Sabesan and Matthew Feigen of Cresa represented the tenant.

SHEBOYGAN FALLS, WIS. — NAI Pfefferle has brokered the sale of a 50,000-square-foot manufacturing building located at 520 Forest Ave. in Sheboygan Falls, a city in eastern Wisconsin. The sales price was undisclosed, but the asking price was $3.9 million. John Roberts of NAI Pfefferle brokered the sale. Buyer and seller information was not provided.

Eli Lilly Plans $5.3B Expansion of Pharmaceutical Manufacturing Facility in Lebanon, Indiana

by Katie Sloan

LEBANON, IND. — Eli Lilly and Co. (NYSE: LLY) has released plans for a $5.3 billion expansion of its manufacturing facility in Lebanon, roughly 27 miles northwest of Indianapolis. The investment is the largest in U.S. history for active pharmaceutical ingredient manufacturing, according to the company. Lilly began developing the Lebanon site, located within the LEAP Research and Innovation District, in 2023. The expansion will enhance the company’s capacity to manufacture active pharmaceutical ingredients for its Zepbound and Mounjaro injectables, which are both diabetes and weight loss drugs. Lilly’s total investment in the site is now $9 billion. Upon full build-out, the facility will staff 900 full-time employees. The company expects to begin manufacturing at the property in 2026, with operations scaling up through 2028. The development will include the addition of a learning and training center built in conjunction with the State of Indiana, which will be utilized by the larger LEAP District. Lilly will also partner with the state on new infrastructural additions including roads, water, electricity and other utilities. Since 2020, Lilly has committed more than $16 billion to develop new manufacturing sites in the U.S. and Europe, with developments located in the Research Triangle of North …

— By Anthony Sanchez, design director and principal, Nadel Architecture + Planning — Consumers are heading back to the shopping mall, which is great news for retail owners, operators and tenants that rely on in-person sales and experiences as part of their respective business models. According to Placer.ai, February and March of this year saw a steady rise in foot traffic at malls nationally. Indoor malls sit just 5 percent below their pre-pandemic foot traffic levels, while open-air shopping malls surpassed 2019 levels for the first time since the pandemic. The trend marks an incredible resiliency for the retail space, especially as financing and inflationary issues loom over the economy. But with all these shoppers coming back to the mall, the question is: will they recognize it? Anchors Entering a New Era With news of some larger retailers like Macy’s and the Dollar Store closing locations en masse, developers are chomping at the bit to reimagine those spaces. There is exciting potential to recreate them within malls in ways that enhance the overall shopping experience for consumers and attract new foot traffic – all to the benefit of the existing retailers at the shopping center. The result might be a …

By Kirk Cypel, chief development officer, CBG Commercial Real Estate Misconceptions about the Rio Grande Valley’s (RGV) retail market abound, particularly among those who are unfamiliar with South Texas. But those who are entrenched in shopping center ownership and development in the area are baffled and frustrated by retailers allowing these misconceptions to deter them from actively exploring the RGV. Questions like whether McAllen is an eight- or 10-hour drive from San Antonio, whether there’s an airport, if it’s safe — these are inquiries that simply make local retail owners and operators shake their heads. The same applies to brokers who inquire about securing endcap, freeway-visible spaces for under $10 per square foot. The Valley Reality The RGV is less than a four-hour drive from San Antonio and is served by three commercial airports. It resembles a metropolitan area akin to California’s Inland Empire, where several interconnected cities form a cohesive economic unit. Yet many are surprised to learn of the RGV’s considerable size, spanning 422,107 square miles — 60 percent larger than the Inland Empire and more comparable to San Diego County in size. The Council for South Texas Economic Progress reports that the population is over 1.4 million, …

Aztec Group Arranges $55.6M Financing for Active Adult Community in Palm Beach Gardens, Florida

by John Nelson

PALM BEACH GARDENS, FLA. — Aztec Group has arranged $55.6 million in bridge financing for Arcadia Gardens, an active adult community located in Palm Beach Gardens. MetLife provided the loan to the borrowers, affiliates of the United Group of Cos. and Sina Cos. United Group also manages the property, which was developed in 2021. Situated on 10.6 acres, the age-restricted apartment community comprises 220 units reserved for residents age 55 and older. Amenities at Arcadia Gardens include a fitness center, salon, movie theater, swimming pool, spa, community garden, walking trail, onsite dining facilities and pickleball, bocce and croquet courts.