OKEMOS, MICH. — Bernard Financial Group (BFG) has arranged a $6.7 million loan for the refinancing of a 254-unit multifamily property in Okemos near Lansing. Dennis Bernard and Joshua Bernard of BFG arranged the loan through Minnesota Life Insurance Co. The borrower was an entity doing business as Cedar Creek MS LLC.

Property Type

NEW YORK CITY — Locally based brokerage firm Stav Equities has arranged the $5.7 million sale of two multifamily redevelopment sites in Brooklyn. The buildings at 21 Montauk Ave. and 22 Milford St. were previously used as storage facilities for a local furniture business. The buyer, Moses Rabinowitz, plans to redevelop the sites into apartment buildings totaling 96 units. Jacob Stavksy of Stav Equities represented Rabinowitz and the undisclosed seller in the off-market transaction.

BRIDGEVIEW, ILL. — Entre Commercial Realty has brokered the sale of a 43,750-square-foot industrial building in the Chicago suburb of Bridgeview for an undisclosed price. The multi-tenant property is located at 9700 Industrial Drive immediately off the four-way interchange of I-294 and 95th Street. Jeffrey Locascio and Chris Wilbur of Entre brokered the transaction. The buyer was a joint venture between Clear Height Properties and Harbert US Real Estate, an investment strategy sponsored by Harbert Management Corp. Entre has been retained to market the property for lease. The seller was undisclosed.

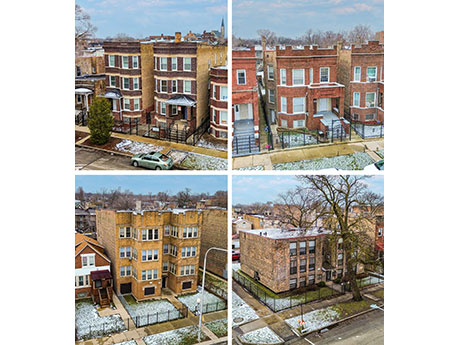

CHICAGO — Kiser Group has negotiated the $2.1 million sale of a portfolio of multifamily properties in Chicago’s West Garfield Park neighborhood. The newly renovated units were fully occupied at the time of sale. Jack Petrando and Noah Clark of Kiser brokered the transaction. Buyer and seller information was not provided.

CLAWSON, MICH. — Dominion Real Estate Advisors has brokered the sale of a 14,350-square-foot industrial building located at 850 N. Rochester Road in Clawson, a northern suburb of Detroit. The sales price was undisclosed. Barry Landau of Dominion represented the seller, LT Property Holdings LLC. Ernie Dearman of CLG Realty Advisory represented the buyer, OM3 LLC.

EVANSTON, ILL. — Mosaic Construction LLC has completed a renovation of FEW Distillery, a craft distillery located at 918 Chicago Ave. in Evanston — the birthplace of Prohibition. Mosaic conducted a structural renovation to the 3,000-square-foot whiskey production facility. According to Mosaic, FEW became the first maker of whiskey and gin in Evanston since the U.S. Congress ended Prohibition nearly 100 years ago. The company opened at a former automotive shop in 2011 with its entrance hidden in an alley. The renovation included new steel columns, support beams, a concrete floor and electrical work. The project team consisted of Moshe Calamaro and Associates (engineering), Battaglia Electric (electric), Twin Bros. Paving (concrete flooring) and GCS Roman Steel Work (steel).

CHICAGO AND LOS ANGELES — A joint venture between Remedy Medical Properties and Kayne Anderson Real Estate has acquired a portfolio of 37 healthcare properties from Broadstone Net Lease (NYSE: BNL), a diversified real estate investment trust with an industrial focus. The properties traded hands for $252 million. JLL served as the broker for the transaction. The 37 properties were selected from a larger collection of healthcare assets designated for sale by Broadstone Net Lease. The properties are being sold as part of the REIT’s plan to focus on core net lease assets in the industrial, retail and restaurant sectors. As of March 31, industrial properties comprised 54.2 percent of the REIT’s portfolio. The portfolio totals more than 708,000 square feet across 13 states. Each property is fully leased. The assets are situated in prominent markets that include: Chicago; Houston; Charlotte, North Carolina; Indianapolis; Seattle; Milwaukee; Tampa, Florida; and Arlington, Texas. The properties are leased by health systems and physician groups such as Advocate, Emerge Ortho, Froedert Health, IU Health, Tampa General, TGH Imaging and USPI. The largest facility included in the portfolio is Ridgeway Medical Campus in Greece, New York, near Rochester. The multi-specialty outpatient medical center comprises 120,000 …

— By Edward F. Del Beccaro, Executive Vice President, TRI Commercial — The major Northern California industrial markets contain a total of more than 860 million square feet of industrial buildings. The San Francisco Bay Area, North Bay, Silicon Valley, Sacramento and Central Valley have all experienced a falloff in tenant demand from 2021 to 2022 pandemic highs. Most markets experienced negative absorption in fourth-quarter 2023, including sublease space coming on the market that resulted in rents either plateauing or decreasing. Nevertheless, the outlook is still positive based on the various economic drivers pushing the market. For instance, manufacturers are benefitting from onshoring, with a projected 40 percent reduction in sourced material from China, per a recent report from Alix Partners. In addition, declining interest rates and continuing inflation will cause institutional money to flow into the industrial sector versus the office sector, according to a March 2024 ProLogis report. Below are various industrial submarket reviews: In the Oakland/East Bay Industrial I-80/880 Corridor, year-end 2023 experienced a slowdown in demand due to new construction and existing space becoming available. More than 10.2 million square feet is available, reflecting negative absorption of more than 778,000 square feet last year. The Port …

AUSTIN, TEXAS — It’s no secret that today’s commercial real estate market can be challenging, whether you’re looking to break ground on a new project or close a transaction. But there’s plenty to be optimistic about in the student housing sector moving forward, according to Peter Katz, executive managing director of Institutional Property Advisors. Katz moderated this year’s “Power Panel,” which kicked off the first full day of the 16th annual InterFace Student Housing conference, held at the JW Marriott in Austin. The panel brought together a consortium of high-level executives to provide their thoughts on the current dynamics in the sector and their outlook for the year ahead. “I always feel the energy and the excitement in the student housing sector,” began Katz. “And while we feel a sense of tempered exuberance this year, the investment community is still extremely enthusiastic. Consumer strength is coming in hotter than expected and inflationary readings are pushing out the timing of proposed interest rate cuts from The Fed.” Two years into the cycle of tightening from The Fed, investors are recognizing that the price adjustments that have already occurred have now become an acquisition opportunity, Katz continued. “And while there’s still pain …

NASHVILLE, TENN. — Host Hotels & Resorts Inc. has purchased the fee simple interest in a two-hotel complex in downtown Nashville. The properties in the $530 million acquisition include 1 Hotel Nashville, a 215-room hotel, and the 506-room Embassy Suites by Hilton Nashville Downtown. Affiliates of Starwood Capital Group, Crescent Real Estate LLC and High Street Real Estate Partners sold the hotels, which they built in 2022. Situated adjacent to Bridgestone Arena and across from the Music City Convention Center, the hotels feature a combined 721 rooms averaging approximately 500 square feet in size, as well as seven food-and-beverage options, including Harriott’s Rooftop. Amenities include a spa with six treatment rooms, two fitness centers, a yoga studio and 33,000 square feet of shared meeting space, including a 9,400-square-foot ballroom and 9,300 square feet of pre-function space.