PHOENIX — Wespac Construction has completed work on three mixed-use buildings at Culdesac Tempe, a car-free, mixed-use development at 2025 E. Apache Blvd. in Tempe, just east of Phoenix. Situated on 17 acres, Culdesac Tempe will feature 44 apartments and 24,000 square feet of retail space. The site underwent extensive clearing, grading and utility installation. Additionally, a 2,500-square-foot restaurant shell and tenant improvement were constructed for Cocina Chiwas, a full-service restaurant. Key features include a 6,700-square-foot fitness facility and the 4,700-square-foot Market Building that spans three levels and features 16 apartments. DAVIS and Opticos designed the project, which Culdesac owns and developed.

Property Type

Marcus & Millichap Arranges $11.2M Refinancing for Joann-Occupied Building in Glendale, California

by Amy Works

GLENDALE, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has secured $11.2 million in refinancing for a single-tenant retail building, located at 1000 S. Central Ave. in the Los Angeles suburb of Glendale. Joann, a fabric and crafts retail chain that recently declared bankruptcy, occupies the property. Ron Bayls of Marcus & Millichap Capital Corp. arranged the 10-year loan, which includes a 5.97 percent interest rate with a 30-year amortization and 50 percent loan-to-value ratio.

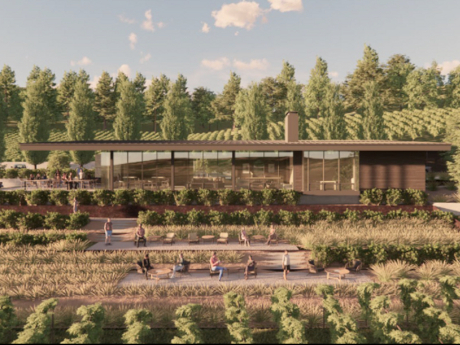

Gantry Secures $7.1M in Financing for Auteur Wines Facilities in Healdsburg, California

by Amy Works

HEALDSBURG, CALIF. — Gantry has arranged a $7.1 million construction-to-permanent loan for the build-to-suit development of dedicated facilities for Auteur Wines, a vintner-founded winery specializing in Pinot Noir and Chardonnay. Located at 10520 Wohler Road in the Sonoma County city of Healdsburg, the project will include a production winery, tasting room and vineyard on 8.2 acres. Jeff Wilcox and Andrew Ferguson of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The 20-year, construction-to-permanent, fixed-rate loan was provided through one of Gantry’s banking relationships and features an initial interest-only period transitioning to an 18-year amortization.

HOUSTON — Midway has opened The Laura, a 359-unit multifamily project that is part of the Houston-based developer’s initial phase of the 150-acre East River development in Houston’s Historic Fifth Ward. Designed by Munoz + Albin with EDI International as the architect of record, The Laura features studio, one- and two-bedroom apartments that range in size from 431 to 1,432 square feet. Amenities include a fitness center, dog park, pool, grilling stations, outdoor yoga space and a lawn for games and passive recreation. OHT Partners served as the general contractor for the project, construction of which began in late 2021. Rents started at $1,600 per month for a studio when leasing began last fall.

AUSTIN, TEXAS — Cleveland-based multifamily developer The NRP Group has completed The Markson, a mixed-income housing project in the Barton Springs area of Austin. Named after former company executive Dan Markson, the $60 million property comprises 330 units, more than half of which will be reserved for renters earning 80 percent or less of the area median income. Amenities include a pool, dog park, conference rooms, coworking lounge, coffee bar, fitness center, game room, outdoor kitchen, volleyball and bocce ball courts and access to surrounding nature trails. The NRP Group developed The Markson in partnership with the Housing Authority of the City of Austin. Amegy Bank and J.P. Morgan Asset Management provided financing for the project. According to the property website, monthly rents at The Markson’s essential worker living units start at $1,442 while market-rate units start at $1,790.

WEATHERFORD, TEXAS — Cushman & Wakefield has arranged the sale of Remington Ridge, a 257-unit multifamily property in the southern Dallas suburb of Weatherford. The initial 133-unit phase was completed in 2022, and construction is underway on the second and final 124-unit phase. The property offers one-, two- and three-bedroom units and amenities such as a pool, fitness center, business center, dog park, game room and an outdoor lounge. Asher Hall and Grant Raymond of Cushman & Wakefield represented the seller, Trinity Capital Group, in the transaction. The buyer was Juniper Investment Group.

HOUSTON — Partners Real Estate has brokered the sale of a 35,622-square-foot cold storage building located at 12634 East Freeway in Houston. The property, which was originally built in 1960 and expanded in the early 2000s, is located east of the downtown area and features 28-foot clear heights. Wyatt Huff and Hunter Stockard of Partners represented the seller, Mims Investment Inc., in the transaction. The buyer and sales price were not disclosed.

CYPRESS, TEXAS — Lone Star Downhole Products has signed a 10,000-square-foot industrial lease in the northwestern Houston metro of Cypress. The manufacturer of energy equipment parts is taking the entire building at 19615 Juergen Road, which according to LoopNet Inc. is under construction and will feature 20-foot clear heights. Georges Montes of Cypressbrook Co. represented the tenant in the lease negotiations. Nick Bergmann and Cape Bell of CBRE represented the landlord, Mesquite Realty & Investment Group.

CHARLOTTE, N.C. — General contractor Swinerton is underway on the development of Oxbow, a $97.8 million apartment community located within The Mill District in Charlotte. Swinerton is constructing the property on behalf of the developer, Space Craft. Upon completion, which is set for fall 2026, Oxbow will total 398 units across six floors and feature 14,300 square feet of ground-floor retail space. Apartments will range from studio to four-bedroom layouts. Amenities will include a gym, rooftop patio, bike storage and a resident courtyard. Swinerton is using cross laminated timber for Oxbow’s façade that was fabricated by affiliate firm Timberlab at its facility in Greenville, S.C.

ORLANDO, FLA. — Futura and Linkvest Capital have completed the construction of Nona Cove Self Storage, a 130,000-square-foot development featuring self-storage and retail space at 14800 Narcoossee Road in the Lake Nona neighborhood of Orlando. The facility — which comprises 122,000 square feet of self-storage space and 8,000 square feet of retail space — is part of the first phase of Futura at Nona Cove, a 17-acre mixed-use project anchored by a new 260-unit apartment community. Managed by Extra Space, Nona Cove Self Storage includes 1,046-square-foot bays with a gated drive-thru and is currently 57 percent leased.