SANTA TERESA, N.M. — Sonny Brown Associates has arranged the sale of an industrial building located at 465 Industrial Ave. in Santa Teresa, a suburb of El Paso, Texas. Dallas-based Hunt Southwest acquired the asset from Easton, Pa.-based MCS Industries for an undisclosed price. The 215,256-square-foot warehouse, distribution and manufacturing facility features 60-foot and 45-foot column spacing with staging bays at 40-foot deep, 32-foot clear heights, CTPAT capacity, 20 dock-high doors and one ramp door. The building features a 5,843-square-foot office space, 5,686-square-foot QC Lab space and 880-square-foot shipping/receiving office space. Additionally, the building is expandable by 45,900 square feet. Adin Brown of El Paso, Texas-based Sonny Brown Associates represented the seller and buyer in the deal.

Property Type

SAN DIEGO — Drawbridge Realty has completed 16705 Via Del Campo Court, a speculative office and R&D property in Rancho Bernardo, a master-planned community in northern San Diego. The three-story, Class A building is the first speculative office building to be constructed in the Rancho Bernardo market in more than a decade. The three-story, 80,720-square-foot building features large, efficient floor plates with 15-foot floor-to-floor ceiling heights, expansive window lines, outdoor patios on the ground level and third floor, and surface parking for more than 300 vehicles. Netherlands-based semiconductor manufacturer ASML (NASDAQ: ASML) has leased the top two floors, totaling 55,227 square feet. The first floor, totaling 25,493 square feet, is currently available for lease and being marketed by Jay Alexander and Tim Olson of JLL.

SAN DIEGO — Lee & Associates has arranged the sale of 5052 Wightman Street, an apartment building in San Diego. The asset traded for $7.1 million. Built in 1963, the building features 44 apartments. The property was held by the same owners for multiple decades, but had deferred maintenance issues. The community features an affordable component for residents earning 50 to 60 percent of the area median income. Eric von Bluecher and Ivan Del Muro-Garcia of The Von Bluecher Group — the multifamily brokerage team of Lee & Associates North San Diego County — represented the undisclosed buyer and undisclosed seller in the deal.

SAN RAMON, CALIF. — PSRS has arranged $3.7 million in permanent financing for Pointe West Plaza, a retail property in San Ramon, east of the Bay Area. The firm previously arranged bridge acquisition financing for the property. Pointe West Plaza is a 16,921-square-foot building with a mix of tenants including a billiards venue, salon, bistro and Chinese restaurant. The property also features underground and surface parking, totaling 82 spaces. Jonny Soleimani and Matthew Farzinpour of PSRS secured the five-year loan with a 25-year amortization schedule through a correspondent life insurance company.

CHICAGO — Chicago-based Habitat has begun pre-leasing efforts for Cassidy on Canal, a 33-story luxury apartment tower in Chicago’s Fulton River District. The property at 350 N. Canal St. features 343 units in a variety of layouts ranging from studios to penthouses. Additional features of the project include 1,313 square feet of ground-floor retail space, parking for 123 vehicles and an outdoor dog run just northwest of the building. Amenities include a 10,000-square-foot outdoor deck off the building’s fifth floor with landscaped grounds, a pool, lounge seating, fire pits, grilling areas, heaters and dining areas. Inside, residents will have access to a fitness center with practice studios, a game room, clubrooms, a coworking center and a spa with sauna, steam and whirlpool rooms. The first resident move-ins are expected in May. Rents will range from $2,550 to $5,660 per month. Penthouse units will go for up to $10,810 per month. The project site was formerly home to the Cassidy Tire building. Architecture firm Solomon Cordwell Buenz designed the new glass tower. The joint venture partner on the project is Diversified Real Estate Capital LLC, with James McHugh Construction Co. serving as general contractor.

CLEVELAND — Cleveland-based BWE has arranged $150 million in financing through a Freddie Mac transitional line of credit (TLOC) for a collection of over 2,500 manufactured housing community sites in the Midwest, Southeast and Rocky Mountain regions. MJ Vukovich, Ghazy Grijalva and Andrew Capra of BWE arranged the TLOC through Freddie Mac’s Optigo channel on behalf of a long-term client. The team also sourced a $14 million traditional bank loan for the borrower from a lender specializing in manufactured housing. The TLOC provides a convenient solution for manufactured housing communities that require more repairs and renovations before securing permanent financing terms or more flexibility in their hold period, according to BWE. By only initially using $100 million of the $150 million TLOC, the borrower has the ability to shape its portfolio more thoroughly by adding new properties in the future. BWE structured the TLOC as a floating-rate loan with interest-only payments for the full term. Additionally, the terms included interest rate caps to hedge against the risk of increasing rates, while also positioning the client to take advantage of a declining rate environment later this year and provide flexibility for asset exit.

GROVEPORT, OHIO — Green Jobs Properties LLC has acquired a 640,640-square-foot industrial facility located at 3755 Hayes Road in Groveport, a southern suburb of Columbus. The purchase price was $56 million. The seller was Groveport Venture LLC.

WEST CHICAGO, ILL. — Brown Commercial Group has brokered the sale of a 31,379-square-foot industrial building in West Chicago for an undisclosed price. Matt Hanson of Brown represented the buyer, Krishiv Foods, a distributor of Indian food products. The buyer is more than tripling its space and will be relocating from Elk Grove Village. Mike Antonelli of Brown represented the seller, Spare Tire Enterprises LLC, which purchased the building in 2018.

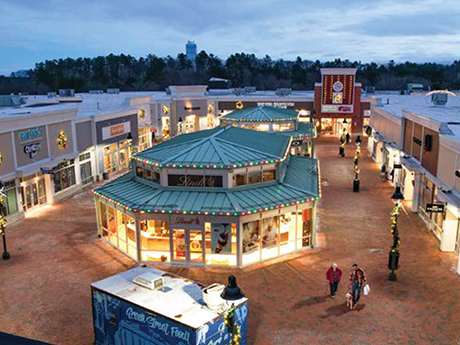

FREEPORT, MAINE — Boston-based retail owner-operator Wilder Cos. has acquired Freeport Village Station, a 122,121-square-foot shopping center located near Portland, Maine. The center is situated across from L.L. Bean’s flagship campus, and the outdoor equipment and apparel retailer’s outlet store anchors the 3.6-acre property. Other tenants include Brooks Brothers, Old Navy, Coach, Famous Footwear, Lindt, Oakley, OshKosh B’gosh and Carter’s, Sunglasses Hut, Talbots, Sketchers and Francesca’s. The seller and sales price were not disclosed.

ALBANY, N.Y. — KeyBank has provided an $11.1 million Freddie Mac loan for the refinancing of Astro Apartments, a student housing complex located across the street from the primary campus of State University of New York in Albany. Built in 1998, Astro Apartments consists of two three-story buildings on a 2.4-acre site. According to Apartments.com, the property totals 100 units and offers amenities such as a fitness center, business center, package handling service and onsite laundry facilities. Residences come in studio, one- and two-bedroom floor plans. Dirk Falardeau and Mark Flanders of KeyBank structured the financing on behalf of the borrower, Redburn Development Partners.