FAIRFIELD, N.J. — ConnectiveRX, a provider of various support services for the healthcare industry, has signed a 19,371-square-foot office lease renewal in the Northern New Jersey community of Fairfield. ConnectiveRX is re-committing to its space at Greenbrook Executive Center, a 203,028-square-foot building owned by locally based investment firm Accordia Realty Ventures, on a short-term basis. Fred Hyatt and Derek DeMartino of JLL brokered the lease on behalf of ownership. Law firm Dwyer, Connell & Lisbona LLP also recently committed to a five-year renewal for its 7,731-square-foot suite at Greenbrook Executive Center.

Property Type

NEW YORK CITY — JLL has negotiated a 15,202-square-foot office lease at 71 Fifth Ave. in the Union Square/Flatiron area of Manhattan. The tenant, AI-backed video game company Captions, will occupy the entire sixth floor of the 11-story building, which was originally constructed in 1907. Kyle Riker of JLL represented Captions in the lease negotiations. Mitchell Konsker, Ben Bass, Dan Turkewitz and Kyle Young, also with JLL, represented the landlord, a partnership between Madison Capital and Lubert Adler Partners, in conjunction with internal agents Jonathan Ratner and Cindy Chang.

MILWAUKEE — The Milwaukee office of Kraus-Anderson Construction will build the new corporate headquarters for Enerpac Tool Group in downtown Milwaukee. Currently located in Menomonee Falls, Enerpac will be relocating to the former ASQ Center at 648 N. Plankinton Ave. The building will be renamed Enerpac Center. The global manufacturer of industrial tools will occupy 50,000 square feet on the fourth floor. Approximately 130 employees will relocate downtown. American Society for Quality will continue to house its headquarters in the building. Creative Business Interiors provided full interior architectural design services. Enerpac’s space will feature a research and testing lab, open collaborative spaces, large conference rooms and offices. Plans also call for a fitness studio, eat-in café and updated restrooms. A full interior demolition of existing spaces will begin in early March and will combine the fourth floors of the existing north and south buildings, which are currently separate. Construction is slated to begin in late April and to be completed in late 2024 or early 2025.

BROWNSBURG, IND. — Sila Realty Trust Inc. has acquired an inpatient rehabilitation facility in Brownsburg, a northwest suburb of Indianapolis, for $39 million. Capital Growth Medvest was the seller. The property is fully leased to Community Health Network Rehabilitation Hospital West, a joint venture between Community Health Network (CHN) and Lifepoint Rehabilitation, a business unit of Lifepoint Health. CHN is a nonprofit health system with more than 200 sites of care and facilities throughout central Indiana, including six acute care hospitals totaling approximately 1,150 beds. Lifepoint is a national healthcare provider with 62 community hospitals and over 30 rehabilitation and behavioral health facilities across 29 states. The recently constructed facility in Brownsburg began accepting patients in May 2023, and serves as the third inpatient rehabilitation facility operated by the joint venture in the greater Indianapolis area. The property totals 56,000 square feet with 40 beds. The facility focuses on acute rehabilitation and recovery for patients who suffer from stroke, traumatic brain injury, spinal cord injury, complex neurological disorders, orthopedic conditions, multiple traumas, amputation and other injuries. The two-story building is situated on 12.2 acres.

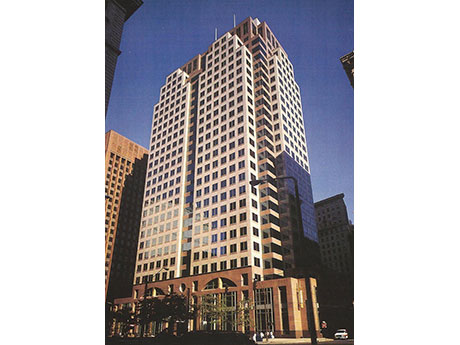

CLEVELAND — Farbman Group has taken over management of the 508,397-square-foot, 27-story Fifth Third Center in downtown Cleveland. The Class A office building is situated near the city’s historic Superior Avenue. Tenants include Fifth Third Bank, McDonald Hopkins, HWH Architects Engineers Planners, Brouse McDowell and more. Farbman manages more than 30 million square feet of office, retail, multifamily, student housing and industrial space throughout the Midwest.

DES MOINES, IOWA — NAS Investment Solutions has purchased Broadway Apartments in Des Moines for an undisclosed price. Built in 2015, the multifamily property rises three stories with 120 units averaging 875 square feet. Amenities include an updated clubhouse, fitness center, playground, dog park and theater room. Adventureland Amusement Park, Prairie Meadows Racetrack & Casino and Outlets of Des Moines are within two miles of the property.

Tower 16 Capital Partners Purchases Deco at Victorian Square Apartment Community in Reno, Nevada for $43M

by Amy Works

RENO, NEV. — San Diego-based Tower 16 Capital Partners has acquired The Deco at Victorian Square, an apartment property located at 955 Avenue of the Oaks in Reno, for $43 million. Built in 2021, The Deco features 209 apartments in a mix of studio, one- and two-bedroom layouts averaging 731 square feet. Tower 16 plans to implement nearly $1 million in upgrades, including modernized common areas, fitness center upgrades and landscaping enhancements. The company has also planned outdoor amenities, including barbecues, seating and game areas. Jonathan Merhaut of Eastdil Secured represented the undisclosed seller in the deal. Lee Redmond and Greg Stampley of Eastdil Secured arranged debt financing for the buyer.

StarPoint Properties Nears Completion of 157,473 SF Point Central Business Park in Denver

by Amy Works

DENVER — StarPoint Properties is nearing completion of Point Central Business Park, a speculative industrial project situated on more than 9.5 acres in Denver. Commencing construction last summer, the park is scheduled for completion in the second quarter of this year. Located at 1051 E. 73 Ave., the 157,473-square-foot park features a 74,618-square-foot building and an 82,855-square-foot building. The development can accommodate occupier sizes ranging from 13,000 square feet to 157,000 square feet. Each building offers 2,358 square feet of high-end speculative office space, 2,000A/480V electrical and 32-foot clear heights. The park features 225 parking spaces, 27 dock-high truck doors (with the ability to add an additional 23 doors) and eight drive-in doors. Drew McManus, Bryan Fry and Ryan Searle of Cushman & Wakefield are marketing the property for lease.

Marcus & Millichap Arranges $96M Refinancing for Three Shopping Centers in Southern California

by Amy Works

BAKERSFIELD, NORTH HOLLYWOOD AND VENTURA, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $96 million loan refinancing for three shopping centers in Southern California. Tenants at the properties — which are located in Bakersfield, North Hollywood and Ventura — include 24 Hour Fitness, Dollar Tree, Starbucks Coffee, Wells Fargo and Tractor Supply. Zack Metzner, Daizy Gomez and Linsey Farrahi of MMCC secured the five-year financing on behalf of the borrower, a private investor. The interest-only loan carries a fixed interest rate of 5.8 percent.

SAN DIEGO — Biotest Inc. has purchased a research and development (R&D) facility, located at 10140 Mesa Rim in the Sorrento Mesa neighborhood of San Diego, for $23 million. The China-based life sciences company plans to use the 42,547-square-foot property for product development and distribution. Todd Holley of Voit Real Estate Services represented the buyer in the transaction. The name of the seller was not released.